About Mitsubishi UFJ Financial Group

Mitsubishi UFJ Financial Group, Inc. (MUFG), through its subsidiaries (MUFG Group), engages in a range of financial businesses.

The company includes MUFG Bank, Mitsubishi UFJ Trust and Banking, Mitsubishi UFJ Morgan Stanley Securities (through Mitsubishi UFJ Securities Holdings), Mitsubishi UFJ NICOS and other subsidiaries and affiliates, for which it is the holding company. As a bank holding company, the company is regulated under the Banking Act of Japan.

The company’s services include commercial banking, trust banking, securities, credit cards, consumer finance, asset management, leasing and many more fields of financial services. As of March 31, 2023, the company had the largest overseas network among Japanese banks, consisting of approximately 2,400 business locations in more than 50 countries, including Krungsri in Thailand and Bank Danamon in Indonesia. MUFG’s role as the holding company is to strategically manage and coordinate the activities of its business groups.

On December 1, 2022, the company completed the sale of the shares in MUFG Union Bank to U.S. Bancorp.

Business Groups

Under the Medium-term Business Plan, the company’s business groups have been reorganized as follows in an effort to further integrate the expertise and capabilities of its subsidiaries to respond to the needs of its customers more effectively and efficiently.

Digital Service Business Group

The Digital Service Business Group focuses on providing digital-based financial services to mass-segment customers (i.e., retail customers and small and medium–sized enterprise customers) and on introducing digital technologies into MUFG. This business group was established on April 1, 2021 mainly by separating the mass-segment businesses that previously belonged to the Retail & Commercial Banking Business Group.

The digital transformation is one of the company’s most important strategies. Particularly in the mass-segment customers market, user interface and user experience (UI/UX) enhancement and cost structure reform are quite significant.

Retail & Commercial Banking Business Group

The Retail & Commercial Banking Business Group integrates the domestic retail and commercial banking businesses of MUFG Bank, Mitsubishi UFJ Trust and Banking, Mitsubishi UFJ Securities Holdings and other group companies of MUFG. This business group offers retail customers (with a strategic focus on high net-worth individuals) and small and medium–sized enterprise customers in Japan an extensive array of commercial banking, trust banking and securities products and services.

Business Strategy

In the domestic market in which the company operates, demographic changes, including Japan’s aging population with a declining birthrate, further acceleration of digital transformation and promotion of work style reforms continue to diversify customer expectations for financial institutions.

In the wealth management (WM) business, which is one of the company’s key strategic focus areas, it is accelerating utilization of tools to offer wealth management solutions, including asset management, asset and business succession transfer, and real estate services. For example, the company has begun operating the WM Digital Platform, a digital tool for understanding customers’ assets and needs across the MUFG Group, at all of its business locations. Through this tool, the company has established a system designed to provide comprehensive solutions on a group-wide basis to the various challenges its customers face.

Japanese Corporate & Investment Banking Business Group

The Japanese Corporate & Investment Banking Business Group provides services to help large Japanese corporate customers seeking global expansion achieve growth in their corporate value. The company engages in the lending, fund settlement, and foreign exchange businesses and also provides comprehensive solutions for M&As and real estate-related services, fully employing the expertise of each group entity.

The company seeks to increase its lending spreads by reducing low-profitability loans and improving risk-taking for projects with high profitability potential. In addition, the company is working to accelerate the reduction of its equity holdings and have made significant progress towards achieving the reduction target under the Medium-Term Business Plan.

The company also intends to expand and deepen its engagement with customers to resolve environmental and social issues, as well as management issues of its customers which are becoming more complex and diverse. The company has also made investments with customers in multiple businesses that are expected to contribute to solving social issues.

Asset Management & Investor Services Business Group

The Asset Management & Investor Services Business Group covers the asset management and asset administration businesses of Mitsubishi UFJ Trust and Banking and MUFG Bank. By integrating the trust banking expertise of Mitsubishi UFJ Trust and Banking and the global strengths of MUFG Bank, the business group offers a full range of asset management and administration services for corporations and pension funds, including pension fund management and administration, advice on pension structures, and payments to beneficiaries, and also offers investment trusts for retail customers.

The company aims to expand its asset management and asset administration services business by enhancing the quality of its products and services, effectively utilizing the broad customer base of the MUFG Group and improving its operational efficiency through IT technology.

Global Corporate & Investment Banking Business Group

The Global Corporate & Investment Banking Business Group covers the corporate, investment and transaction banking businesses of MUFG Bank and Mitsubishi UFJ Securities Holdings. Through a global network of offices and branches, the company provides non-Japanese large corporate and financial institution customers with a comprehensive set of solutions that meet their increasingly diverse and sophisticated financing needs.

Through the integrated business management structure between the Global Corporate & Investment Banking Business Group and the Global Markets Business Group, the company aims to offer a wide range of financial services to meet the diverse needs of both corporate and institutional investor customers.

The expansion of the global corporate and investment banking and global markets businesses has been an important pillar of the MUFG Group’s growth strategy. The company continues to work to strengthen the strategic alignment and collaboration among its group companies and across global geographies in order to best deploy its comprehensive expertise to provide its customers with value-added solutions and services.

Corporate Banking

Through its global network of offices and branches, the company provides a full range of corporate banking solutions, such as project finance, export credit agency finance, and financing through asset-backed commercial paper. The company’s primary customers include large corporations, financial institutions, sovereign and multinational organizations, and institutional investors that are headquartered outside of Japan.

Investment Banking

The company provides investment banking services, such as debt and equity issuance and M&A-related services to help its customers develop their financial strategies and realize their business goals. In order to meet customers’ various financing needs, the company has established a customer-oriented coverage model through which its product experts coordinate with one another to offer innovative financing services globally. The company has further integrated the management of the operations of its commercial banking and securities subsidiaries to enhance collaboration. The company is one of the world’s top provider of project finance, one of the core businesses of the Global Corporate & Investment Banking Business Group. The company provides sophisticated professional services in arranging limited-recourse finance and secured finance, and offering financial advice in various sectors, including natural resources, power, and infrastructure, backed by its experience, expertise, knowledge, and global network.

Transaction Banking

The company provides commercial banking products and services for large corporations and financial institutions in managing and processing domestic and cross-border payments, mitigating risks in international trade, and providing working capital optimization. The company provides customers with support for their domestic, regional and global trade finance and cash management programs through its extensive global network.

Global Commercial Banking Business Group

The Global Commercial Banking Business Group provides a comprehensive array of financial products and services, such as loans, deposits, fund transfers, investments and asset management services for local retail, small and medium-sized enterprise, and corporate customers across the Asia-Pacific region through the company’s major local commercial banking subsidiaries and affiliates outside of Japan referred to as Partner Banks. The company’s Partner Banks include Krungsri in Thailand, Bank Danamon in Indonesia, VietinBank in Vietnam and Security Bank in the Philippines. MUFG Union Bank, a Partner Bank in the United States, was sold to U.S. Bancorp on December 1, 2022.

The network among the Partner Banks covers a vast market, consisting of four countries with population totaling approximately 557 million. The company’s network, which combines the global reach of the MUFG Group companies with strong regional presence of the Partner Banks each carrying an established brand, provides it with unique competitive advantages. Through sharing and integration of the expertise and capabilities of the Partner Banks, the company seeks to achieve synergy effects and capture the business opportunities arising from the economic growth of the region.

Bank of Ayudhya Public Company Limited (Krungsri)

Krungsri is a strategic subsidiary of MUFG Bank in Thailand. Krungsri provides a comprehensive range of banking, consumer finance, investment, asset management, and other financial products and services to retail consumers, small and medium-sized enterprises, and large corporations mainly in Thailand through 614 branches (consisting of 575 banking branches, 40 automobile finance business branches and one overseas branch) and other service outlets nationwide. In addition, Krungsri’s consolidated subsidiaries include the largest credit card issuer in Thailand with a market share of 15%, sales finance and personal loan accounts in its portfolio, a major auto finance provider, a fast growing asset management company and a leading microfinance service provider in Thailand.

MUFG owns a 76.88% ownership interest in Krungsri through MUFG Bank as of March 31, 2023. By combining Krungsri’s local franchise with competitive presence in the retail and small and medium-sized enterprise banking markets in Thailand with MUFG Bank’s global financial expertise, it seeks to offer a wider range of high-value financial products and services to a more diverse and larger customer base.

PT Bank Danamon Indonesia, Tbk. (Bank Danamon)

Bank Danamon is a strategic subsidiary of MUFG Bank in Indonesia. Bank Danamon provides a comprehensive range of banking and other financial products and services to retail consumers, small and medium-sized enterprises, and large corporations in Indonesia. It operates an extensive distribution network spread out from Aceh to Papua, with more than 879 branches and service outlets. In addition, Bank Danamon provides financing for automotive and consumer goods through PT Adira Dinamika Multi Finance Tbk, a subsidiary of Bank Danamon.

MUFG made an initial investment in December 2017 and owns a 92.47% ownership interest in Bank Danamon through MUFG Bank as of March 31, 2023. This investment in Bank Danamon represents another milestone for the company’s growth strategy in Indonesia and Southeast Asia. The company aims to offer a unique and unparalleled retail and small and medium-sized enterprise banking business model based on the established local networks of its Partner Banks and MUFG’s global network to provide holistic financial services to a wider range of customers.

Other Activities in Southeast Asia

The company has been expanding its operations in Southeast Asia with an effort to further develop its businesses abroad. In addition to Krungsri and Bank Danamon, the company has strategic business and capital alliances with other banks in Southeast Asia, including VietinBank in Vietnam and Security Bank in the Philippines, as its Partner Banks.

VietinBank provides a wide range of financial services to consumers, small businesses, middle-market and large companies through its branch network predominantly in Vietnam. The company owns a 19.73% equity interest in VietinBank.

Security Bank provides a wide range of financial services to consumers, small businesses, middle-market and large companies through its branch network in the Philippines. The company owns a 20% equity interest in Security Bank.

In November 2022, the company agreed to acquire 100.0% of the shares of HC Consumer Finance Philippines, Inc. and 85.0% of the shares of PT Home Credit Indonesia, both of which are subsidiaries of Home Credit B.V., a Dutch consumer finance company.

Global Markets Business Group

The Global Markets Business Group covers the customer business and the treasury operations of MUFG Bank, Mitsubishi UFJ Trust and Banking and Mitsubishi UFJ Securities Holdings. The customer business includes sales and trading in fixed income instruments, currencies and equities, as well as other investment products, and origination and distribution of financial products. The treasury operations include asset and liability management, as well as global investments for the MUFG Group. In the fiscal year ended March 31, 2022, the company started a new investment business in the Global Markets Business Group involving long-term diversified investments as a new sustainable revenue source.

Customer Business

Sales and Trading in Fixed Income Instruments, Currencies and Equities: The company provides financing, hedging, and investment solutions to its retail, corporate, institutional, and governmental customers through sales and trading in financial market products, such as fixed income instruments, currencies, and equities.

Investment Products for Non-Institutional Customers in Japan: The company provides investment products, such as mutual funds, and structured bonds, notes and deposits to non-institutional customers in Japan. The company offers solutions using these investment products to help customers better manage their assets and liabilities. This business is conducted through the integrated operations management structure among the Global Markets Business Group, the Asset Management & Investor Service Business Group, the Retail & Commercial Banking Business Group, and the Japanese Corporate and Investment Banking Business Group.

Origination and Distribution: The company provides financing solutions to institutional customers through origination and distribution of financial products, such as syndicated loans and securities issuances. This business is conducted through the integrated operations management structure between the Global Markets Business Group and the Global Corporate and Investment Banking Business Group.

Treasury Operations

Asset and Liability Management: The company seeks to manage interest rate and liquidity risks residing in its balance sheets through, among other things, transactions designed to manage the profit and loss impact attributable to market movements based on its balance sheet analyses and forecasts. Such transactions include investments in high quality liquid securities, such as Japanese government bonds and the U.S. Treasury bonds and trading in other financial products, such as interest rate swaps and cross currency swaps.

Global Investment: Through its treasury operations, the company also seeks to enhance its profitability by diversifying its portfolio and strategically investing in financial products, including corporate bonds and funds.

Global Strategic Alliance with Morgan Stanley

As of March 31, 2023, the company held approximately 377 million shares of Morgan Stanley’s common stock representing approximately 22.6% of the voting rights in Morgan Stanley.

In conjunction with Morgan Stanley, the company formed two securities joint venture companies in 2010 to integrate its respective Japanese securities companies. The company converted the wholesale and retail securities businesses conducted in Japan by Mitsubishi UFJ Securities into Mitsubishi UFJ Morgan Stanley Securities. Morgan Stanley contributed the investment banking operations conducted in Japan by its former wholly-owned subsidiary, Morgan Stanley Japan, to Mitsubishi UFJ Morgan Stanley Securities, and converted the sales and trading and capital markets businesses conducted in Japan by Morgan Stanley Japan into an entity called Morgan Stanley MUFG Securities, Co., Ltd. The company holds a 60% economic interest in Mitsubishi UFJ Morgan Stanley Securities and Morgan Stanley MUFG Securities, and Morgan Stanley holds a 40% economic interest in Mitsubishi UFJ Morgan Stanley Securities and Morgan Stanley MUFG Securities. The company holds a 60% voting interest and Morgan Stanley holds a 40% voting interest in Mitsubishi UFJ Morgan Stanley Securities, and it holds a 49% voting interest and Morgan Stanley holds a 51% voting interest in Morgan Stanley MUFG Securities. Morgan Stanley’s and its economic and voting interests in the securities joint venture companies are held through intermediate holding companies. The company has retained control of Mitsubishi UFJ Morgan Stanley Securities and it accounts for its interest in Morgan Stanley MUFG Securities under the equity method due to its significant influence over Morgan Stanley MUFG Securities.

The company has also expanded the scope of its global strategic alliance with Morgan Stanley into other geographies and businesses, including a loan marketing joint venture that provides clients in the United States with access to the world-class lending and capital markets services from both companies; business referral arrangements in Asia, Europe, the Middle East and Africa, covering capital markets, loans, fixed income sales and other businesses; global commodities referral arrangements whereby MUFG Bank and its affiliates refer clients in need of commodities-related hedging solutions to certain affiliates of Morgan Stanley; and an employee secondment program to share best practices and expertise in a wide range of business areas.

In July 2023, the company jointly announced with Morgan Stanley the launch of Alliance 2.0, an enhanced Global Strategic Alliance for further collaboration between both companies for the next decade and beyond.

Competition

The company’s major competitors in Japan include:

Japan’s other major banking groups: Mizuho Financial Group and Sumitomo Mitsui Financial Group;

Government financial institutions: Japan Finance Corporation, Japan Post Bank, Development Bank of Japan and Japan Bank for International Cooperation;

Other commercial banking institutions: Resona Bank, Shinsei Bank, regional banks, and credit associations (shinkin banks); and

Securities companies and investment banks: Nomura group and Daiwa group.

Regulation

In addition to the Companies Act, Japanese banks, including MUFG Bank and Mitsubishi UFJ Trust and Banking, are required to comply with the Banking Law of Japan (the Banking Law). As a bank holding company, the company is regulated under the Banking Act of Japan.

The company is subject to supervision, regulation and examination with respect to its U.S. operations by the Federal Reserve Board pursuant to the U.S. Bank Holding Company Act of 1956, as amended the BHCA, and the International Banking Act of 1978, as amended (the IBA), as the company and MUFG Bank are bank holding companies and foreign banking organizations, as defined pursuant to those statutes. The FRB functions as the company’s umbrella supervisor under amendments to the BHCA effected by the Gramm-Leach-Bliley Act of 1999, which among other things:

Under the authority of the IBA, as amended, the company’s banking subsidiaries, MUFG Bank and Mitsubishi UFJ Trust and Banking, operates five branches, two agencies and 17 representative offices in the United States. MUFG Bank operates branches in Los Angeles, California; Chicago, Illinois; and two branches in New York, New York; agencies in Houston and Dallas, Texas; and representative offices in Washington, D.C.; Tempe, Arizona; Los Angeles, Menlo Park, Monterey Park, Redwood City, San Diego and San Francisco, California; Danbury, Connecticut; Atlanta, Georgia; Florence, Kentucky; Boston, Massachusetts; Edina, Minnesota; Jersey City, New Jersey; Charlotte, North Carolina; Irving, Texas; and Seattle, Washington. Mitsubishi UFJ Trust and Banking operates a branch in New York, New York. The company has developed internal procedures and processes that address the regulatory requirements under the Foreign Account Tax Compliance Act (FATCA).

History

Mitsubishi UFJ Financial Group, Inc. was founded in 1880. The company was incorporated in 2001.

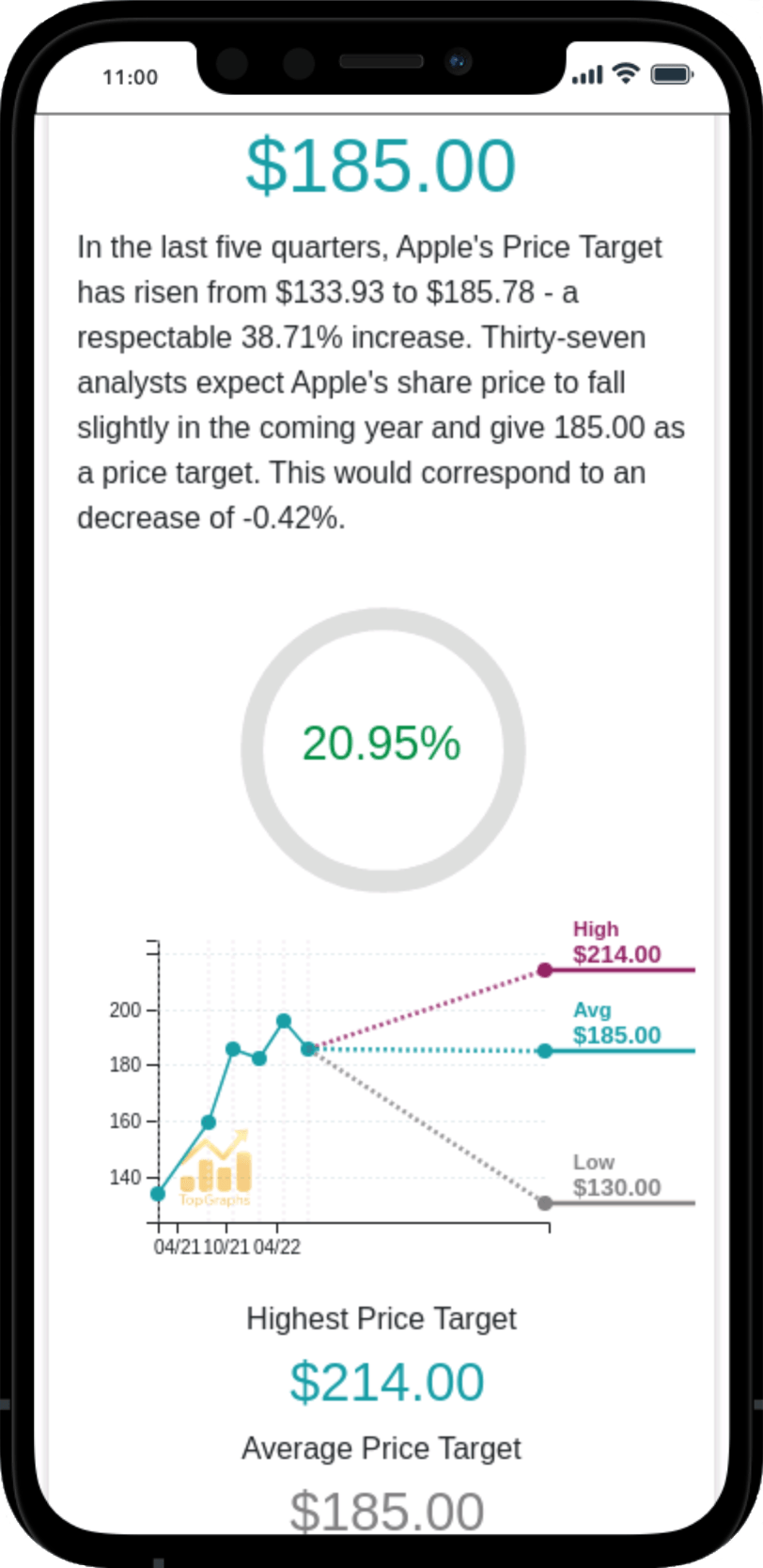

Stock Value

Stock Value