About Focus Universal

Focus Universal Inc. (Focus), a universal smart instrument developer and manufacturer, engages in the development and commercialization of novel and proprietary universal smart technologies and instruments.

Focus is also a provider of patented hardware and software design technologies for Internet of Things (IoT) and 5G. The company has developed five disruptive patented technology platforms with 26 patents and patents pending in various phases and 8 trademarks pending in various phases to solve the major problems facing hardware and software design and production within the industry.

The company has developed five proprietary platform technologies that solve the most fundamental problems plaguing the internet of things (IoT) industry by increasing the overall degree of chip integration capabilities by shifting integration from the component level directly to the device level; creating a faster 5G cellular technology by using ultra-narrowband technology; leveraging ultra-narrowband power line communication (PLC) technology; developing a natural integrated programming language (NIPL) applied to software development, which generates a user interface through machine auto generation technology; and developing a universal smart instrumentation platform (USIP).

The company has developed an innovative and proprietary device on a chip (DoC) technology, which combines the required electronic circuits of various integrated circuit components onto a single, integrated chip (IC) and pushes beyond the limits of current integrated chips. The company’s DoC technology works as a single component but is capable of handling entire IoT device functions (excluding sensors and architecture-specific components). The company’s DoC technology includes both the hardware and software, uses less power compared to traditional IoT devices, with better performance, includes smaller overall devices, and offers greater reliability despite decreasing the number of interconnections between components. The company’s DoC technology into its product offering, will simplify the manufacturing process. The company’s planned DoC technology allows devices to achieve interoperability with one another and are interchangeable, both features where traditional IoT devices fall short.

The company’s research and development suggest that the existing IC integration in IoT devices is mainly focused on hardware-to-hardware integration, not incorporating software solutions. This lack of incorporating software under a common operating system, application software, and extra interface into ICs, limits IC integration to the component level. Software is a critical component in electronics, and the more tightly integrated the software, the better the power and performance. Software also adds an element of flexibility and allows multiple discrete ICs, which in the past were unable to be further integrated into a single IC.

The Universal Smart Instrumentation Platform (USIP) the company developed is a standardized, universal hardware and software integration platform that provides a universal common foundation for what it anticipates will be used by thousands of IoT and standalone devices. The company’s USIP also eliminates redundant hardware and software and results in significant cost savings and production efficiency. The electronic design and production start from a 90% completed common foundation, the company’s USIP, instead of the individual components that necessitate the current method of building each standalone instrument from scratch. USIP allows ICs to be integrated from the component level up to the device level, which pushes the frontier of semiconductor technology beyond Moore’s Law.

The company’s ultra-narrowband wireless communication 5G+ technology aims to achieve both low band 5G coverage and 1 Gbps high-band speed because it employs an ultra-narrow spectrum channel (<1KHz) to establish an ultra-long-distance link between the 5G base station and the receiver.

The company developed an ultra-narrowband technology that offers a potential alternative and/or complementary solution to the broadband technology used in 5G networks and meets the challenging 5G demands.

5G+

The company is developing 5G+, which is a promising alternative wireless technology that uses its innovative ultra-arrowband (UNB) wireless technology. UNB technology employs an ultra-narrow spectrum channel (<1 kHz) to establish an ultra-long-distance link between transmitter and receiver. The company’s internal testing suggests that a single 5G+ subcarrier wave has the potential to provide speeds of 64 to 256 Mbps. Moreover, multiple UNB subcarriers may be combined, which effectively increases bandwidth. Given anticipated data rates of 64 Mbps.

The company’s internal testing suggests that to achieve speeds of 1 Gbps, its 5G+ technology would only require bandwidths of 4 to 16 kHz, which is narrow enough to be operated in lower frequency spectrums. This would mean that 5G+ providers would not need to purchase the higher frequency spectrums required by 5G technology.

The company’s patented PLC is an innovative communication technology that enables sending data over existing power cables in the electric grid. The company has successfully developed ultra-narrowband PLC technology that can transfer data through the power grid. According to its internal testing, the company’s ultra-narrowband PLC technology can send and receive data without the customary interference that occurs in standard office and residential environments, achieving speeds of 4 Mbps at a bandwidth of less than 1000 Hz. To test noise interference and disturbance, the company utilized six industrial blowers simultaneously when testing, and no significant interference was found. The company has completed the development of its 4Mbps PLC modules and the printed circuit board layout. These modules will be used for IoT systems involving over 1,000 sensors.

The company’s ultra-narrowband PLC technology is a considerably more effective way to transfer data than current in-home and commercial network systems, such as Zigbee and Z-Wave. While Zigbee and Z-Wave will need new infrastructure to be installed, the company’s PLC technology could operate by itself or complement existing wideband communication tools like Wi-Fi, Zigbee, or Z-Wave. Penetrating physical barriers like walls within a single floor or reaching out to different floors in a single building is a challenge for the wireless technology that IoT systems are using. The company’s technology converts virtually every standard wall socket into an access point, in many ways incorporating the best of wired and wireless communication, making it a more consistent and reliable system for crucial and sensitive operations. The company’s ultra-narrowband PLC technology’s ability to reach long distances via power lines becomes especially useful in commercial networks that require the ability to avoid physical barriers like walls, underground structures, and hills, such as those networks used in industrial facilities, underground structures, golf course irrigation systems, and campuses. Moreover, the company’s technology can be an integral part of any smart city, community, or campus.

The company has developed a proprietary and patented user interface machine auto generation platform (UIMAGP) to replace the manual software designs that are used. This platform is used to build the IoT user interface. The natural integrated programming language the company has developed is like the language humans use to communicate with each other, which makes it is easy for humans to learn, while still being understood by a machine. The UIMAGP simplifies the process of software programming by saving hundreds of lines of code into a micro code that can be saved to a sensor module. When that sensor module is plugged into a USIP, the user interface specification codes saved to the sensor module is sent to the platform and a universal display, such as a smartphone, a computer, or a display unit. The UIMAGP saved on the universal display automatically generates the user interface within milliseconds instead of requiring months or years of software development work. An embedded coding hardware engineer can design sensor module hardware and provide the user interface specification code. Thus, the hardware-defining software is achieved.

The company has been dedicated to solving instrumentation interoperability for over a decade. The company subdivides instruments into a reusable foundation component to the maximum extent possible, architecture-specific components, and sensor modules, which perform traditional instruments’ functions at a fraction of their cost. For most instruments, 90% of the design, parts, and firmware are the same. These parts can be replaced by USIP.

The company operates in the scientific instruments industry and the smart home installations industry and plan to apply several of its new technologies to the IoT marketplace.

The company’s ultra-narrowband PLC technology has achieved data transfer speeds of 4 megabits per second (Mbps), with a bandwidth of less than 1000 hertz (Hz). These results are 15 times faster than the Zigbee short-range wireless technology mesh networks and 100-400 times faster than Z-Wave’s low-energy wave short-range wireless technology. The 4Mbps PLC modules will be used for IoT applications involving thousands of sensors. The company is developing even higher communication speeds through its PLC. The ultra-narrowband PLC module will be integrated into ICs. This division will focus on ultra-narrowband PLC research and development, promoting and marketing ultra-narrowband PLC, ICs and finished products. The company also intends to promote and market ICs, licensing, and contract designing.

The company’s research and development efforts are focused on an operating frequency of 64 megahertz (MHz), which is about 100 times lower than 4G networks (6 gigahertz (GHz)) and 5,000 times lower than 5G networks (up to 300 GHz). The company’s technology’s 1,000 Hz bandwidth is approximately 20,000 times narrower than 4G networks and 100,000 times narrower than 5G networks. The narrower the bandwidth, the less energy consumption. By maintaining the 1,000 Hz bandwidth, the company’s ultra-narrowband wireless technology can save electricity usage by a factor of up to 100,000 times when compared with a 5G network. The company’s ultra-narrowband wireless technology has the potential to push the wireless frontier well beyond 5G. The company finalized its ultra-narrowband technology research with data transfer speeds of 64-256 Mbps in the fourth quarter of 2022. The company needs to build testing equipment. This requires the company to design and build a digital device that can perform the digital speed testing. The company has designed the devices and it should receive the finished circuit boards in the next few weeks and hope that such device will be completed by the end of 2023.

Products

The company is a wholesaler of various digital, analog, and quantum light meters and filtration products, including fan speed adjusters, carbon filters, and HEPA filtration systems. The company sources these products from manufacturers in China and then sell them to a major U.S. distributor, Hydrofarm, who resells its products directly to consumers through retail distribution channels and, in some cases, places its branding on its products.

Fan Speed Adjuster Device: The company provides a fan speed adjuster device to its client Hydrofarm. Designed specifically for centrifugal fans with brushless motors, the company’s adjuster device helps ensure longer life by preventing damage to fan motors by adjusting the speed of centrifugal fans without causing the motor to hum. These devices are rated for 350 watts max, have 120VAC voltage capacity, and feature an internal, electronic auto-resetting circuit breaker.

Carbon Filter Devices: The company sells two types of carbon filter devices to its client Hydrofarm. These carbon filter devices are professional-grade filters specifically designed and used to filter the air in greenhouses that might be polluted by fermenting organics. One of these filters can be attached to a centrifugal fan to scrub the air in a constant circle or can be attached to an exhaust line as a single pass filter, which moves air out of the growing area, filters unwanted odors, and removes pollen, dust, and other debris in the air. The other filter is designed to be used with fans from 0-6000 C.F.M.

HEPA Filtration Device: The company provides a high-efficiency particulate arrestance (HEPA) filtration device at wholesale prices to its client Hydrofarm. Manufactured, tested, certified, and labeled in accordance with current HEPA filter standards, this device is targeted towards greenhouses and grow rooms and designed to keep insects, bacteria, and mold out of grow rooms. The company sells these devices in various sizes.

Digital Light Meter: The company provides a handheld digital light meter to measure luminance in FC units or foot-candles.

Quantum Par Meter: The company provides a handheld quantum PAR meter to measure photosynthetically active radiation (PAR). This fully portable handheld PAR meter measures PAR flux in wavelengths ranging from 400 to 700 nm. It is designed to measure up to 10,000 µmol.

Smart Home Installation

Through AVX Design and Integration, Inc. (AVX), an IoT installation and management company based in southern California, and a subsidiary of the company, offers residential customers an entire smart home product line. The company has finished designing smart devices for lighting control, air conditioner control, sprinkler control, garden light control, garage door control, and heating control. The company is developing a swimming pool control device, smoke detector, and carbon monoxide monitor.

Smart installation based on the USIP, and the company’s Ubiquitor together will include more functionalities than the systems offered by its competitors. Once successfully integrated, the Ubiquitor will be central to every smart installation with the company’s IoT Installation Services segment. The Ubiquitor’s connectivity capabilities will allow that system to be expanded and customized in the future. The company also plans to offer zero down payment options for installation of its smart systems and charge a monthly subscription fee instead.

Strategy and Marketing Plan

The company plans to market the USIP to the industrial sector first, including key growth industries such as indoor agriculture. Once the technology is established there, the core technologies of universality and interoperability through a readily available device, such as a mobile device or smartphone, may be ported to products specifically intended for the consumer and residential markets.

While industrial markets are large, the consumer and residential markets are even more significant. This two-phase approach will allow for continuous and increasing revenue growth. Moreover, during the industrial phase of development, the company will test and refine its products to ensure that they are ready for the consumer and residential markets.

Once the company has successfully entered the industrial sector, it intends to roll out additional technologies that are under development. These technologies will advance and support the core technologies marketed in phases one and two to the industrial and consumer markets.

The company will continue to design, manufacture, market, and distribute its electronic measurement devices, such as temperature humidity meters, digital meters, quantum PAR meters, pH meters, TDS meters, and CO2 monitors. Over the years, Hydrofarm has developed a broad and loyal customer base that buys its existing products on a repeat basis. The universal smart technology has been applied to its existing traditional devices and demonstrated significant functional improvement and hardware cost savings.

The company divided its customers into a few segments to determine what specific marketing technique will reach each targeted group and its needs.

Existing Customer, Hydrofarm

The company’s universal smart instruments’ design, development, and manufacture are targeted to increase current sales to Hydrofarm, its existing customer.

The company’s current customer, Hydrofarm, is the largest distributor in the horticulture industry, with roughly 50% of the market share in the U.S. horticulture industry.

All the company’s current universal smart devices, including sensors and controllers, will be distributed to Hydrofarm. Smartphones can be used to display and control all the sensors and controllers in the horticulture industry. By the end of 2020, the company completed the development of several sensors that are used in the gardening industry, including a light control node, temperature sensor, humidity sensor, digital light sensor, quantum PAR sensor, pH sensor, TDS sensor and carbon dioxide sensor; and it finished the circuit layouts for the pilot IoT system for the gardening industry (consisting of approximately 1,000 sensor nodes and controllers). The company has received the circuit boards and are trying to launch the pilot production. The company is designing the injection molding tooling so that it can create the casing. The company will be able to launch the pilot production once the casing tooling is fixed. In 2023, the company intend to extend its product line to Hydrofarm, who in turn will resell and market its systems and devices to its customers in the horticulture industry.

Online Customers

The company intends to use traditional and specialized e-commerce outlets to help with online brand awareness. By analyzing Amazon’s data, the company plans to determine which traditional instruments have the highest selling volumes and at what price point. Future research and development will focus on integrating the sensors used in these instruments into the universal smart instruments to leverage on their existing markets.

Traditional Controller and Remote-Control Customers

Traditional controllers monitor and control their sensors through bi-directional communication implemented by hardware. The sensors or probes in controllers not only measure the physical environment but also give feedback to the input actuators that can make necessary corrections. They are expensive and require a corresponding monitor in which unidirectional communication is needed.

Special Customers

For customers who consider an instrument’s compatibility, interoperability, interchangeability, universality, upgradeability, expandability, scalability, and remote access ability as crucial, universal smart technology has several fundamental advantages over traditional instruments in terms of hardware cost and functionality.

Traditional Instruments Manufacturers

The company may consider selling the Ubiquitor directly to instrument manufacturers and allowing them to distribute it through their established platforms. The company is putting together an internal sales team in order to establish the marketing campaign for its sensor devices, including the Ubiquitor. The company is also expanding the sales team for AVX because the Ubiquitor device will be integral to smart home installations.

Growth Strategy

Mergers and acquisitions (M&A) represent a significant part of the company’s growth strategy because M&A can fill business gaps or add key business operations without requiring it to wait years for marketing and sales cycles to materialize. The company has used this growth strategy in its acquisition of AVX, and in the future intend to continue to use M&A to find and secure opportunities that will either achieve the objective of growth in its market segments; or provide an area of expansion that will add to the company’s products and/or service lines in markets that it is not serving, but could serve if it had the appropriate expertise.

One of the company’s key strategies to grow through M&A is to acquire smaller businesses that focus on IoT installation technology (industrial or residential) and in the USIP or PLC industries.

One way to promote the company’s universal smart technology is to provide direct OEM engineering design consulting services to potential industrial customers. Direct, on-site consulting will educate the company’s industrial consumers on the many ways its technology can be implemented in a variety of industrial applications. Through its engineering consulting services strategy, the company intends to become its customers’ engineering partner at all stages of the design cycle so that it may effectively assist them in transforming ideas into production-ready products and accelerate time to market for its universal smart technology product segment.

Distribution Method

The company intends to engage in relationships predominantly with standard the U.S. component manufacturers and similar electronics providers for the manufacturing of unassembled parts of the Ubiquitor and its sensor nodes, and to then ship such parts to its Ontario, California facility where it will assemble the Ubiquitor devices and sensor nodes. Afterwards, the company would distribute its Ubiquitor devices to distributors and retailers directly and also ship directly to traditional industrial instrument manufacturers. The company has a sales department operating out of its Ontario, California office and eventually plan to open a second sales department in China dedicated to promoting its technologies to local instrument manufacturers who can utilize its Ubiquitor devices in their manufacturing and other processes. The company intends to market the Ubiquitor to industrial end-users through Hydrofarm, through direct business-to-business sales channels and also directly to consumers via e-commerce internet platforms. For its quantum light meters, and air filtration products, while it still continues to anticipate orders from Hydrofarm in 2023, the company has begun to diversify away from one single dominant distributor into more diversified distribution channels, such as direct wholesale into retail outlets and direct distribution to end-users. The company also intends to implement a direct sales method via Amazon.com and other online retailers.

Raw Materials

The company predominantly uses large-scale manufacturers in the United States, such as Texas Instruments and Intel for the major components. Other key suppliers the company could consider include Analog Devices, Skyworks Solutions, Infineon, STMicroelectronics, NXP Semiconductors, Maxim Integrated, On Semiconductor, and Microchip Technology.

Intellectual Property Protection

On November 4, 2016, the company filed a U.S. patent application number 15/344,041 with the USPTO. On March 5, 2018, the company issued a press release announcing that the USPTO published an Issue Notification for U.S. Patent Application No. 9924295 entitled Universal Smart Device, which covers a patent application regarding the company’s Universal Smart Device. The patent was issued on March 20, 2018.

Subsequent to its internal research and development efforts, the company filed with the USPTO on June 2, 2017, a patent application regarding a process for improving the spectral response curve of a photo sensor. The patent was issued on February 26, 2019.

On November 29, 2019, the company filed an international utility patent application filed through the patent cooperation treaty as application PCT/US2019/63880. In April 2020, the company was notified that it received a favorable international search report from the International Searching Authority regarding this patent application, which patents the company’s PLC technology. The World International Property Organization report cited only three category A documents, indicating that the company’s application met both the novelty and non-obviousness patentability requirements. Consequently, the company is optimistic that the patent covering the claims for its PLC technology will be issued in due course and will allow the company to implement strong protections on the PLC technology worldwide.

On May 19, 2021, the company filed thirteen provisional patent applications with the USPTO that it had been researching and developing for years encompassing a broad spectrum of technology areas including sensor technology, wired and wireless communications, power line communications, computer security, software solutions, interconnected technological communications, smart home systems and methods for both home and hydroponic areas, dynamic password cipher, local file security, payment card security, infrared sensor, and a method and apparatus for high data rate transmission.

In the fourth quarter of 2021, the company hired the law firm of Knobbe Martens, Olson & Bear, LLP based in Orange County, CA to serve as outside intellectual property counsel for the company. The firm is working on transferring the Company’s provisional patent applications to formal patent applications in addition to filing new provisional patents. In 2021, the company filed 14 patents. The company filed 18 domestic patents in 2022 (plus two international patents in 2022), and so far have filed 3 patents in 2023.

In addition, the company’s patent number 11,488,468 was allowed and subsequently issued on November 1, 2022. The patent, titled Sensor for Detecting the Proximity of an IEEE 802.11 Protocol Connectable Device.

Research and Development Activities

For the year ended December 31, 2022, the company spent a total of $1,060,385on research and development activities.

Competition

There are several companies that compete with AVX in smart home installations, including Vivint Smart Home, Crestron, and Control4.

History

Focus Universal Inc. was founded in 2012. The company was incorporated in Nevada in 2012.

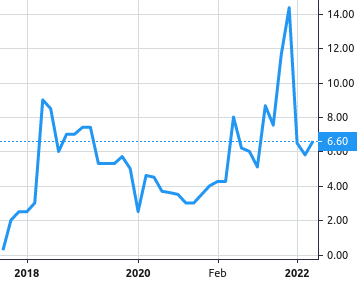

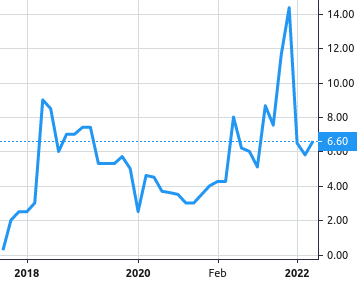

Stock Value

Stock Value