About OrthoPediatrics

OrthoPediatrics Corp. operates as a medical device company.

The company engages in designing, developing, and marketing anatomically appropriate implants, instruments, and specialized braces for children with orthopedic conditions, giving pediatric orthopedic surgeons and caregivers the ability to treat children with technologies specifically designed to meet their needs.

The company sells its specialized products, including PediLoc, PediPlates, Cannulated Screws, PediFlex nail, PediNail, PediLoc Tibia, ACL Reconstruction System, Locking Cannulated Blade, Locking Proximal Femur, Spica Tables, RESPONSE Spine, BandLoc, Pediatric Nailing Platform | Femur, Devise Rail, Orthex, The Fassier-Duval Telescopic Intramedullary System, ApiFix Mid-C System and Mitchell Ponseti specialized bracing products to various hospitals and medical facilities throughout the United States and various international markets. The company uses a contract manufacturing model for the manufacturing of implants and related surgical instrumentation while its clubfoot orthopedic products are manufactured in house.

In 2017, the company expanded operations and established legal entities in the United Kingdom (U.K.), Australia and New Zealand, permitting the company to sell under an agency model directly to local hospitals in these countries. The company began selling direct to Canada in September 2018, Belgium and the Netherlands in January 2019, Italy in March 2020, and Germany, Switzerland and Austria in January 2021. In order to further enhance the company’s operations in Europe, the company established operating companies in the Netherlands and Germany in March 2019 and April 2022, respectively.

The company routinely explores opportunities to acquire or invest in complementary products, technologies or businesses. For example, in 2020, the company acquired Telos, a boutique regulatory consulting firm formed in Colorado; and ApiFix, Ltd., the developer of a minimally invasive deformity correction system for patients with adolescent idiopathic scoliosis (‘ApiFix System’). In 2022, the company acquired MD Ortho, a manufacturer of orthopedic clubfoot products; and Pega Medical, a medical device company, which sells a portfolio of trauma and deformity correction devices for children, including the Fassier-Duval Telescopic Intramedullary System designed to treat osteogenesis imperfecta.

In 2020, the company also acquired the intellectual property assets from Band-Lok, LLC, related to its Tether Clamp and Implementation System which the company uses in connection with its Bandloc 5.5/6.0 System. The company was previously the sole licensee of the purchased asset under a license agreement with Band-Lok. Also, the company purchased certain intellectual assets and product inventory from Devise Ortho, Inc., related to its Drive Rail external fixation system, which compliments the company’s existing external fixation products.

In addition to acquisitions, the company looks for partnerships, which can provide it with complementary enabling technologies. For example, in 2021, the company extended its license agreement for its exclusive distribution rights of the FIREFLY Technology. Also in 2021, the company entered into a license agreement resulting in exclusive distribution rights of the 7D Surgical FLASH Navigation platform for pediatric applications. These partnerships allow for exclusive distribution in children's hospitals across the United States and serve as supporting avenues for the company to focus on high-volume children's hospitals.

The company’s largest investor is Squadron, a private investment firm based in Granby, Connecticut.

The company designs, develops and commercializes innovative orthopedic implants and instruments to meet the specialized needs of pediatric surgeons and their patients, who have been largely neglected by the orthopedic industry. The company serves three of the largest categories in this market.

The company addresses this unmet market need and sells the broadest product offering specifically designed for children with orthopedic conditions. The company markets 46 surgical and bracing systems that serve three of the largest categories within the pediatric orthopedic market: trauma and deformity correction, scoliosis, and sports medicine procedures.

The company’s global sales organization focuses exclusively on pediatric orthopedics. As of December 31, 2022, the company’s U.S. sales organization consisted of 41 independent sales agencies employing more than 197 focused sales representatives. Outside of the United States, the company’s sales organization consisted of more than 70 independent stocking distributors and 14 independent sales agencies in over 70 countries.

The company collaborates with pediatric orthopedic surgeons in developing new surgical systems that improve the quality of care. The company has an efficient product development process that relies upon teams of engineers, commercial personnel and surgeon advisors.

Strategy

The company has implemented a strategy that has five pillars: continuing the company’s laser focus on high-volume children’s hospitals that treat the majority of pediatric patients; providing a broad product portfolio uniquely designed to treat children by surrounding pediatric orthopedic surgeons with all the products they need; deploying instrument sets and providing unparalleled sales support; expanding addressable market through aggressive investment in research and development, and select acquisition opportunities; and training the next generation of pediatric orthopedic surgeons.

Product Portfolio

The company has developed a comprehensive portfolio of implants and instruments specifically designed to treat children with orthopedic conditions within the three categories of the pediatric orthopedic market that the company serves. The company markets 46 surgical and specialized bracing systems that address pediatric trauma and deformity correction, scoliosis and sports medicine/other procedures. Many of the company’s products are available in a variety of sizes and configurations to address a wide range of patient conditions and surgical requirements. These surgical systems are summarized below.

Trauma and Deformity Correction

The company’s trauma and deformity correction product line includes more than 7,900 implants, external fixation, specialized braces and bone graft substitutes for the femur, tibia, upper and lower extremities.

Scoliosis

The company’s scoliosis product category includes the company’s RESPONSE systems for treating spinal deformity in children, the BandLoc 5.5mm/6.0mm sub-laminar banding system, FIREFLY Pedicle Screw Navigation Guides, 7D Flash Naviation image guidance system and ApiFix Mid-C System.

In addition to the company’s direct product offering, the company invests in complementary enabling technologies that allow the company to better serve the children's hospitals in which the company sells. Enabling technologies in the company’s scoliosis space include the FIREFLY Technology, a 3D printed and patient-specific Pedicle Screw Navigation Guide, as well as the 7D FLASH Navigation image guidance system. The company has exclusive distribution rights to both of these complementary technologies, allowing for exclusive distribution in children's hospitals across the United States.

Sports Medicine/Other

The company’s sports medicine/other product category primarily includes its ACL, MPFL Reconstruction system and Telos.

The company’s revenue is typically higher in the summer months and holiday periods, driven by higher sales of the company’s trauma and deformity and scoliosis products, which is influenced by the higher incidence of pediatric surgeries during these periods due to recovery time provided by breaks in the school year.

Product Pipeline

The company has a large number of new product ideas under development within the areas of spinal implants, active growing smart implants, trauma implant systems, limb deformity implant systems, and non-surgical devices. The company aspires to launch at least one new system and/or line extension/product improvement every quarter across the company.

The company has a deep pipeline of new systems that are under development, including the following projects:

Pediatric Nailing Platform | Tibia

In the first half of 2023, the company plans to submit a 510(k) for an innovative Pediatric Nailing Platform | Tibia, that will use a similar instrument platform to the Pediatric Nailing Platform | Femur system, which was introduced in 2018. This new to the market system will treat deformities and traumatic injuries of the tibia. The company expects the beta launch to occur in 2023 and a full-scale launch to occur in 2024.

Active Growing Implants

The company is developing a new generation of smart implants, which the company refers to as its Active Growing Implants. The company’s Active Growing Implants will utilize a power source of significantly greater strength and control than current magnetic technology and will be adjustable at the time of implantation and non-invasively over the course of treatment to accommodate the changing clinical needs of patients as they heal, grow and age. The company made significant development progress on this in 2022. This new technology will be available for early onset scoliosis and potentially limb deformity.

RESPONSE Rib and Pelvic System

The company’s RESPONSE Rib and Pelvic System is designed to aid surgeons in the treatment of early onset scoliosis, a debilitating form of scoliosis that affects very young children. The company expects to beta launch the system in 2023.

Growth Guidance for Scoliosis

The company is developing a next-generation growth guidance technology for treating certain forms of early onset scoliosis. This procedure uses rods and pedicle screws attached to specific points in the spine and configured similar to a ‘track and trolley’ system, which allows the spine to grow naturally while correcting a spinal curve.

Development of Operative Planning Software

The company has a number of initiatives underway involving the development of both pre-operative planning and intraoperative use software to assist surgeons in the treatment of spinal, trauma and deformity correction conditions, as well as the utilization of the company’s product solutions for these conditions. These projects encompass both educational and software as a medical device type offering.

External Fixation Systems

The company plans to continue development to support the strengthening of the company’s external fixation product portfolio. Throughout 2022, the company launched the Drive Rail system that complements the Mini Rail and Orthex product offering. In addition to a suite of innovative features, this system is compatible for use with the Orthex frame. Further development will focus on hardware and software upgrades, as well as a completely new system for emergency fracture management.

Sales and Marketing

The company is the only orthopedic company with a robust pediatric-focused infrastructure, including a dedicated global commercial organization. As of December 31, 2022, the company’s U.S. sales organization consisted of 41 independent sales agencies employing 197 focused sales representatives.

Outside of the United States, the company’s sales organization consisted of over 70 independent stocking distributors and 14 independent sales agencies in over 70 countries, including the largest markets in the European Union, Latin America, and the Middle East, as well as South Africa, Australia, and Japan. The company’s distributors are well regarded by pediatric orthopedic surgeons in their respective markets. To support the company’s international distribution organization, the company has hired a number of regional market managers, whose product and clinical expertise deepens the company’s relationships with both surgeons and the company’s distributors. In the near term, the company expects to selectively expand the number of international markets the company serves, as well as to deepen the company’s penetration of important existing markets, such as Brazil and Germany.

The company has developed intensive training programs for its global sales organization. The company expects its sales agencies and distributors to continue to deepen their knowledge of pediatric clinical conditions, surgical procedures and the company’s products. The company’s domestic and international sales representatives are usually present in the operating room during surgeries in which the company’s products are used.

Manufacturing and Suppliers

The company’s products are primarily manufactured to its specifications by third-party suppliers who meet the company’s manufacturer qualification standards. MD Orthopaedics, Inc.’s specialized bracing products are manufactured on-site in the company’s Iowa facility. The company’s third-party manufacturers meet FDA and other country-specific quality standards, supported by its internal specifications and procedures. All of the company’s device contract manufacturers are required to be ISO 13485 certified and are registered establishments with the FDA.

Intellectual Property

As of December 31, 2022, the company owned 61 issued U.S. patents and 115 issued foreign patents and the company had 33 pending U.S. patent applications and 166 foreign patent applications. As of December 31, 2022, 11 of the company’s U.S. issued patents had pending continuation or divisional applications in process, which may provide additional intellectual property protection if issued as the U.S. patents. The company’s issued U.S. patents expire between 2024 and 2039, subject to payment of required maintenance fees, annuities and other charges. As of December 31, 2022, the company owned 31 U.S. trademark registrations and 7 pending U.S. trademark applications, as well as 77 registrations in other jurisdictions worldwide.

Government Regulation

The company’s products and its operations are subject to extensive regulation by the FDA and other federal and state authorities in the United States, as well as comparable authorities in foreign jurisdictions. The company’s products are subject to regulation as medical devices under the Federal Food, Drug, and Cosmetic Act (‘FDCA’), as implemented and enforced by the FDA.

In addition to the U.S. regulations, the company is subject to a variety of regulations in other jurisdictions governing clinical trials and commercial sales and distribution of the company’s products. Whether or not the company obtains FDA clearance or approval for a product, the company must obtain authorization before commencing clinical trials or obtain marketing authorization or approval of the company’s products under the comparable regulatory authorities of countries outside of the United States.

The company’s marketed products are Class I and exempted from premarket notification, or Class II devices subject to 510(k) clearance with the exception of the ApiFix Mid-C System, which is an unclassified, approved device under the Humanitarian Device Exemption (‘HDE’) regulation.

The company’s Class II products are subject to 510(k) clearance under the FDCA. To obtain 510(k) clearance, the company must submit to the FDA a 510k submission demonstrating that the proposed device is ‘substantially equivalent’ to a predicate device already on the market.

The company’s manufacturing processes are required to comply with the applicable portions of the QSR, which cover the methods, facilities and controls for the design, manufacture, testing, production, processes, controls, quality assurance, labeling, packaging, distribution, installation and servicing of finished devices intended for human use.

In order to comply with the new regulations and continue selling medical devices in the U.K. following the transition period, the company must appoint a U.K. Responsible Person and register the medical devices with the U.K.'s Medicines and Healthcare product Regulatory Agency, or MHRA. A new conformity assessment must be completed by a U.K. Approved Body, or UKAB.

In addition to FDA restrictions on marketing and promotion of drugs and devices, other federal and state laws restrict the company’s business practices. These laws include, without limitation, foreign, federal, and state anti-kickback and false claims laws, as well as transparency laws regarding payments or other items of value provided to healthcare providers.

The advertising and promotion of the company’s products is subject to EU Directives concerning misleading and comparative advertising and unfair commercial practices, as well as other EEA Member State legislation governing the advertising and promotion of medical devices.

The company’s U.S. operations are subject to the U.S. Foreign Corrupt Practices Act of 1977 or FCPA. The company is also subject to similar anticorruption legislation implemented in Europe under the Organization for Economic Co-operation and Development’s Convention on Combating Bribery of Foreign Public Officials in International Business Transactions.

Research and Development

The company’s research and development expenses were $8.0 million for the year ended December 31, 2022.

Competition

The company has competitors in each of its three product categories, including the DePuy Synthes Companies (a subsidiary of Johnson & Johnson), Medtronic plc, Smith & Nephew plc and Orthofix.

History

OrthoPediatrics Corp., a Delaware corporation, was founded in 2006. The company was incorporated in 2007.

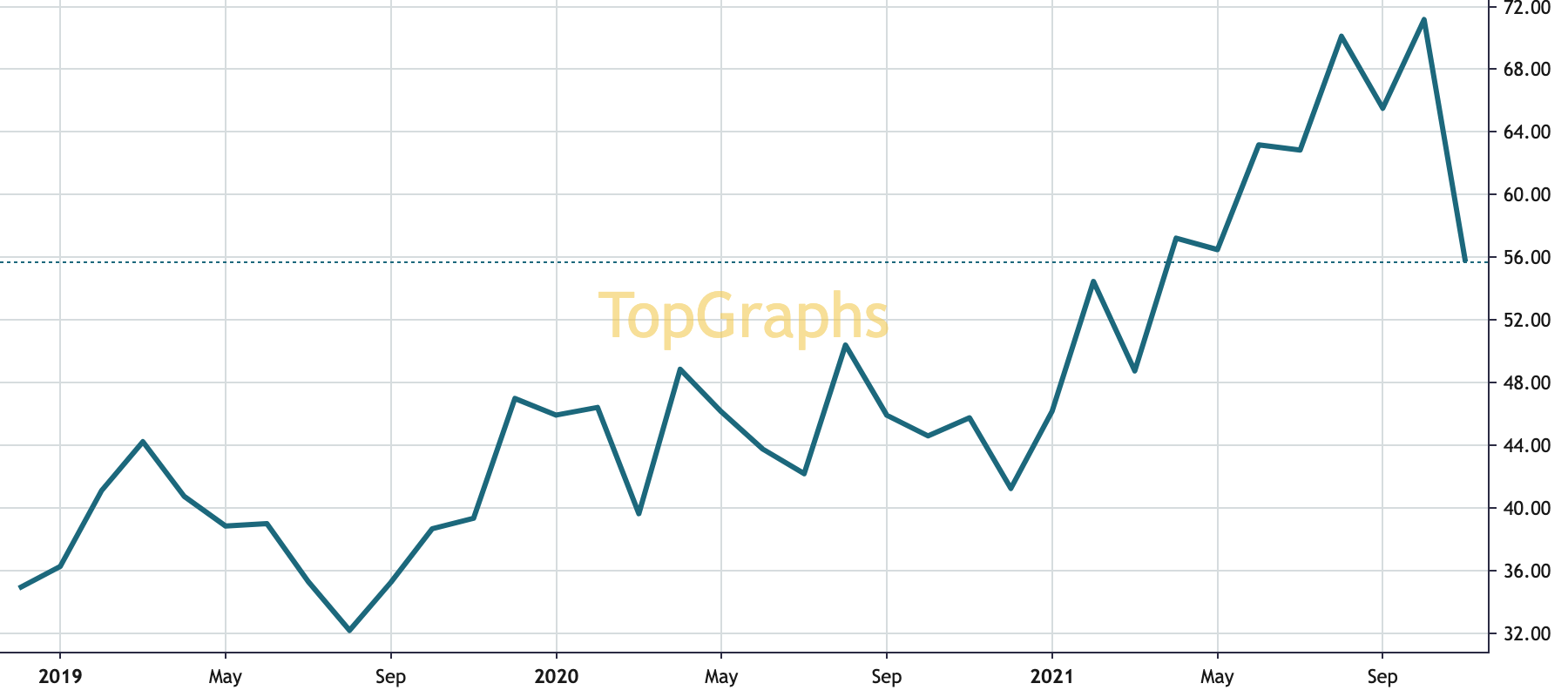

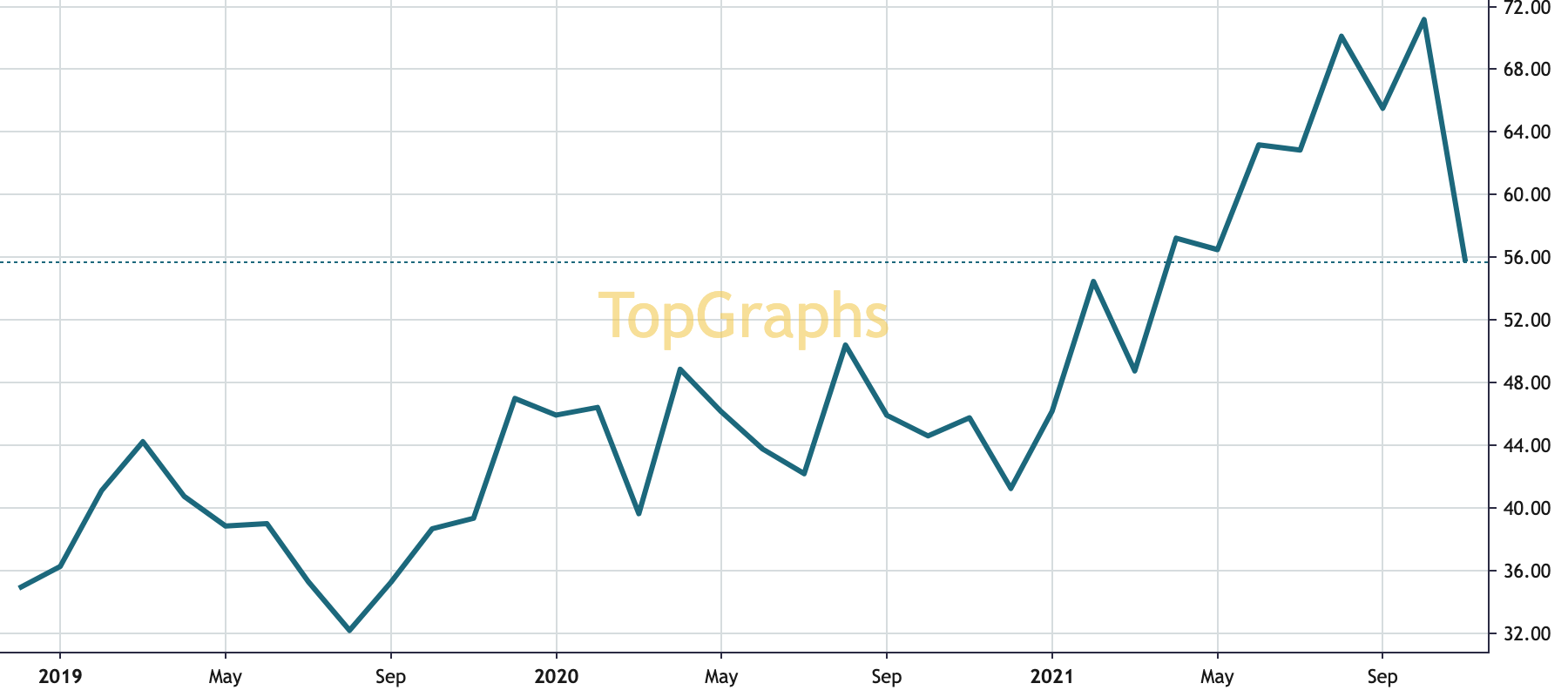

Stock Value

Stock Value