About Nicolet Bankshares

Nicolet Bankshares, Inc. operates as the holding company for Nicolet National Bank that provides banking products and services for businesses and individuals.

The company is a registered bank holding company under the Bank Holding Company Act of 1956, as amended. The company also wholly owns a registered investment advisory firm, Nicolet Advisory Services, LLC (Nicolet Advisory) that provides brokerage and investment advisory services to customers, and Nicolet Insurance Services, LLC (Nicolet Insurance), to facilitate the delivery of a crop insurance product associated with the company’s agricultural lending. The company has a subsidiary that provides a web-based investment management platform for financial advisor trades and related activity.

Products and Services Overview

The company’s principal business is banking, consisting of lending and deposit gathering, as well as ancillary banking-related products and services, to businesses and individuals of the communities it serves, and the operational support to deliver, fund and manage such banking products and services. Additionally, trust, brokerage and other investment management services predominantly for individuals and retirement plan services for business customers are offered. The company delivers its products and services principally through 56 bank branch locations, online banking, mobile banking and an interactive website. Nicolet’s call center also services customers.

The company offers a variety of loans, deposits and related services to business customers (especially small and medium-sized businesses and professional concerns), including but not limited to: business checking and other business deposit products and cash management services, international banking services, business loans, lines of credit, commercial real estate financing, construction loans, agricultural real estate or production loans, and letters of credit, as well as retirement plan services. Similarly, the company offers a variety of banking products and services to consumers, including but not limited to: residential mortgage loans and mortgage refinancing, home equity loans and lines of credit, residential construction loans, personal loans, checking, savings and money market accounts, various certificates of deposit and individual retirement accounts, safe deposit boxes, and personal brokerage, trust and fiduciary services. The company also provides online services including commercial, retail and trust online banking, automated bill payment, mobile banking deposits and account access, remote deposit capture, and other services such as wire transfers, debit cards, credit cards, pre-paid gift cards, direct deposit, and official bank checks.

The company seeks creditworthy borrowers principally within the geographic area of its branch locations. As a community bank with experienced commercial, agricultural, and residential mortgage lenders, the company’s primary lending function is to make loans in the following categories:

commercial-related loans, consisting of commercial, industrial, and business loans and lines; owner-occupied commercial real estate (owner-occupied CRE); agricultural (AG) production and AG real estate; commercial real estate investment loans (CRE investment); and construction and land development loans;

residential real estate loans, consisting of residential first lien mortgages; residential junior lien mortgages; home equity loans and lines of credit; residential construction loans; and other loans (mainly consumer in nature).

Market Area

The company is a full-service community bank, providing services ranging from commercial, agricultural, and consumer banking to wealth management and retirement plan services. The company primarily operates in Wisconsin, Michigan, and Minnesota. The company markets its services to owner-managed companies, the individual owners of these businesses, and other residents within its market area, which at December 31, 2023 is through 56 branches located principally within the geographic area of its branch locations.

Deposits

The company’s deposits include noninterest-bearing demand, interest-bearing demand, money market, savings, and time

Investment Portfolio

As of December 31, 2023, the company’s investment portfolio included U.S. Treasury securities; U.S. government agency securities; state, county and municipals; mortgage-backed securities; and corporate debt securities.

Supervision and Regulation

The company is extensively regulated, supervised and examined under federal and state law. Generally, these laws and regulations are intended to protect the company’s bank’s depositors, the FDIC’s Deposit Insurance Fund and the broader banking system, and not its shareholders.

Because the company owns all of the capital stock of the bank, it is a bank holding company under the federal Bank Holding Company Act of 1956, as amended (the Bank Holding Company Act). As a result, the company is primarily subject to the supervision, examination, and reporting requirements of the Bank Holding Company Act and the regulations of the Board of Governors of the Federal Reserve System (the Federal Reserve). As a bank holding company located in Wisconsin, the Wisconsin Department of Financial Institutions (the WDFI) also regulates and monitors all significant aspects of its operations.

Under Federal Reserve policy and the Dodd-Frank Act, the company is expected to act as a source of financial strength for the bank and to commit resources to support the bank. The company must continue to be considered well managed and well capitalized by the Federal Reserve, and the bank must continue to be considered well managed and well capitalized by the Office of the Comptroller of the Currency (the OCC) and has at least a satisfactory rating under the Community Reinvestment Act.

Because the bank is chartered as a national bank, it is primarily subject to the supervision, examination, and reporting requirements of the National Bank Act and the regulations of the OCC. The OCC regularly examines the bank’s operations and has the authority to approve or disapprove mergers, the establishment of branches and similar corporate actions. Because the bank’s deposits are insured by the FDIC to the maximum extent provided by law, it is also subject to certain FDIC regulations and the FDIC also has examination authority and back-up enforcement power over the bank. The bank is also subject to numerous state and federal statutes and regulations that affect the company, its business, activities, and operations.

National banks are required by the National Bank Act to adhere to branching laws applicable to state banks in the states in which they are located. Under Wisconsin law and the Dodd-Frank Act, and with the prior approval of the OCC, the bank may open branch offices within or outside of Wisconsin, provided that a state bank chartered by the state in which the branch is to be located would also be permitted to establish a branch. In addition, with prior regulatory approval, the bank may acquire branches of existing banks located in Wisconsin or other states.

The bank is subject to the provisions of Regulation W promulgated by the Federal Reserve, which implements Sections 23A and 23B of the Federal Reserve Act. Regulation W places limits and conditions on the amount of loans or extensions of credit to, investments in, or certain other transactions with, affiliates and on the amount of advances to third parties collateralized by the securities or obligations of affiliates. Regulation W also prohibits, among other things, an institution from engaging in certain transactions with certain affiliates unless the transactions are on terms substantially the same, or at least as favorable to such institution or its subsidiaries, as those prevailing at the time for comparable transactions with nonaffiliated companies. Federal law also places restrictions on the bank’s ability to extend credit to its executive officers, directors, principal shareholders and their related interests. These extensions of credit must be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with unrelated third parties; and must not involve more than the normal risk of repayment or present other unfavorable features.

The bank is also subject to consumer laws and regulations intended to protect consumers in transactions with depository institutions, as well as other laws or regulations affecting customers of financial institutions generally. These laws and regulations include the Truth in Lending Act, the Truth in Savings Act, the Electronic Funds Transfer Act, the Expedited Funds Availability Act, the Equal Credit Opportunity Act, the Fair Housing Act, the Real Estate Settlement and Procedures Act, the Fair Credit Reporting Act and the Federal Trade Commission Act, among others. Under privacy protection provisions of the Gramm-Leach-Bliley Act of 1999 and related regulations, the company is limited in its ability to disclose non-public information about consumers to nonaffiliated third parties. The Dodd-Frank Act centralized responsibility for consumer financial protection including implementing, examining and enforcing compliance with federal consumer financial laws with the Consumer Financial Protection Bureau (the CFPB). Depository institutions with less than $10 billion in assets, such as the bank, are subject to rules promulgated by the CFPB but will continue to be examined and supervised by federal banking regulators for consumer compliance purposes.

Under privacy protection provisions of the Gramm-Leach-Bliley Act of 1999 and related regulations, the company is limited in its ability to disclose non-public information about consumers to nonaffiliated third parties. These limitations require disclosure of privacy policies to consumers and, in some circumstances, allow consumers to prevent disclosure of certain personal information to a nonaffiliated third party. Federal banking agencies have adopted guidelines for establishing information security standards and cybersecurity programs for implementing safeguards under the supervision of the board of directors. These guidelines, along with related regulatory materials, increasingly focus on risk management and processes related to information technology and the use of third parties in the provision of financial services.

History

The company, a Wisconsin corporation was incorporated in 2000. The company was formerly known as Green Bay Financial Corporation and changed its name to Nicolet Bankshares, Inc. in 2002.

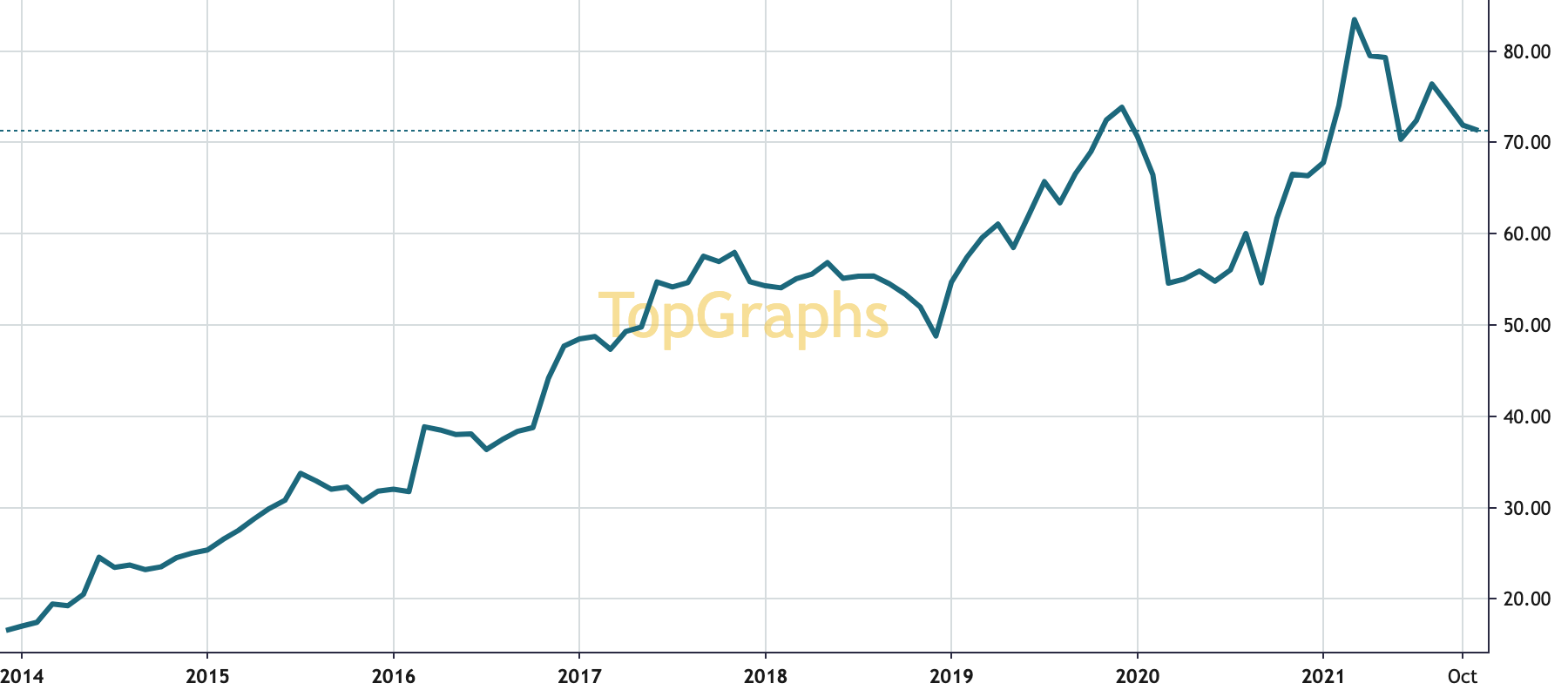

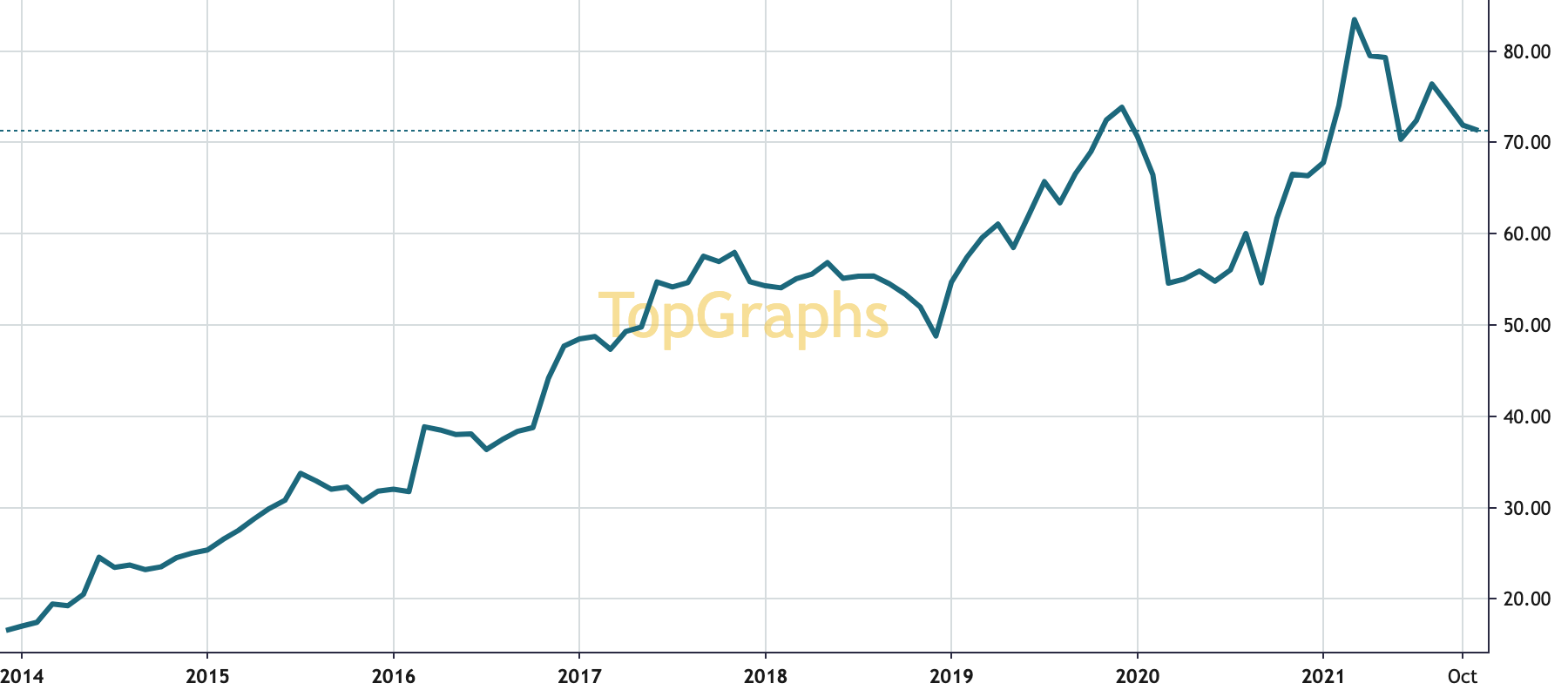

Stock Value

Stock Value