About The Progressive

The Progressive Corporation and its insurance and non-insurance subsidiaries and affiliates (Progressive) operate as an insurance holding company.

The company’s insurance subsidiaries write personal and commercial auto insurance, personal residential property insurance, business-related general liability and commercial property insurance predominantly for small businesses, workers’ compensation insurance primarily for the transportation industry, and other specialty property-casualty insurance and provide related services. The company’s non-insurance subsidiaries generally support its insurance and investment operations. The company operates throughout the United States.

In California, the company operates a separate agency auto organization with its own management and customer relationship management organization. At least one of the company’s insurance subsidiaries is licensed and subject to regulation in each of the 50 states, the District of Columbia, Puerto Rico, Bermuda, and Canada.

Personal Lines

The company’s Personal Lines segment writes insurance for personal autos and recreational vehicles, which the company refers to as its special lines products. This business generally offers more than one program in a single state, with each program targeted to a specific distribution channel, market, or customer group. As of December 31, 2023, the company wrote its Personal Lines products in all states, however, the company’s special lines products are not written in the District of Columbia.

The Personal Lines segment consists of personal auto and special lines products.

Special lines products include insurance for motorcycles, ATVs, RVs, watercraft, snowmobiles, and similar items. Due to the seasonal nature of these products, the company typically experiences higher losses during the warmer weather months. The company is the market share leader for both the motorcycle and boat products and that the company is one of the largest providers of RV insurance.

The company’s Personal Lines products are sold through both the Agency and Direct channels.

The Agency business includes business written by the company’s network of more than 40,000 independent insurance agencies located throughout the United States, including brokerages in New York and California. These independent insurance agents and brokers have the ability to place business with Progressive for specified insurance coverages within prescribed underwriting guidelines, subject to compliance with the company’s mandated procedures. The agents and brokers do not have authority to establish underwriting guidelines, develop rates, settle or adjust claims, or enter into other transactions or commitments. The Agency business also writes insurance through strategic alliance business relationships with other insurance companies, financial institutions, and national agencies.

The Direct business includes business written directly by the company on the Internet, through the Progressive mobile app, and over the phone.

The company’s Personal Lines strategy is to be a competitively priced provider of a broad range of personal auto and special lines insurance products with distinctive service, distributed through whichever channel the customer prefers, and bundled with property insurance and other products when appropriate to match the company’s customers’ needs.

The company seeks to refine its personal auto segmentation, underwriting models, and pricing over time. The company regularly elevates new product models. At any one time, the company could have multiple product models in the marketplace, as new versions are rolled out on a state-by-state basis.

The company continue to provide customers in both the Agency and Direct channels the opportunity to improve their auto insurance rates based on their personal driving behavior through Snapshot, the company’s usage-based insurance (UBI) program. The company offers Snapshot through its hardware-based and/or mobile-app versions in all states, other than California. This mobile app improves the user experience. In addition to the personal benefits for the company’s customers, the data collected via the mobile app affords the company a unique perspective on vehicle operations, accidents, and mobile device usage. The company’s updated auto product models, discussed above, often also include Snapshot enhancements intended to improve its accuracy and competitiveness and broaden its applicability.

The company’s Personal Lines business is focused on efforts to form deeper and longer-term relationships with its customers through the company’s Destination Era strategy, which supports the pursuit of the company’s vision described above. Through this strategy, the company seeks to leverage its Property business, as well as insurance and non-insurance products offered by unaffiliated third parties, to provide the company’s customers access to a range of products addressing their diverse needs and, if the customer chooses, to ‘bundle’ certain of the products together. Bundled products are an integral part of the company’s consumer offerings and an important part of the company’s strategic agenda.

The company’s Destination Era strategy involves a number of initiatives, including:

In the company’s Agency channel, the company offers customers the opportunity to bundle the company’s auto, special lines, and Property offerings. To further drive bundling in the Agency channel, the company offers the Platinum program to those select agents who have the appropriate customers for the company’s bundled offering. This program combines the company’s auto and Property insurance with the compensation, coordinated policy periods, single event deductible, and other features that meet the needs and desires that the company’s agents have expressed. As of December 31, 2023, the company had nearly 7,500 Platinum agents.

The company offers independent agents an agency quoting system that makes it easier for them to bundle multiple policies with the company. The company’s ‘Portfolio’ quoting system reduces data entry, displays all available products eligible for bundled quotes, simplifies the agents’ experience on third-party comparative rater systems, and provides agents and their customers an overview of premium, bundle savings, and applied discounts to allow them to add or remove products with one click. Portfolio is available for all agents appointed to write new business where the company offers Property products.

In the Direct channel, the company bundles Progressive personal auto with its Property products in almost all states, as well as with homeowners and renters products provided by unaffiliated insurance carriers nationwide. The company offers these bundles by providing a single destination to which consumers may come for both their auto and property insurance needs. In many cases, the company may offer discounts to incentivize or reward this bundling.

Where available, the company’s special lines products and umbrella insurance can be combined with any of the personal auto, home, or renters coverages that the company offers, in either the Direct or Agency channel.

HomeQuote Explorer (HQX) is the company’s multi-carrier, direct-to-consumers online property offering. Through HQX, consumers are able to quickly and easily quote and compare homeowners insurance online from Progressive and other carriers, with the HQX online buy button available in almost every state.

As the company increases its penetration of the more complex, multi-product customers who are critical to the company’s Destination Era success, the company is further expanding the roster of products provided by unaffiliated companies that the company makes available through online and telephonic referrals and for which the company receives commissions, or other compensation, that are reported as service revenues. The company’s list of unaffiliated company products includes items, such as pet health, life, and classic and specialty car insurance.

Commercial Lines

The Commercial Lines segment writes auto-related liability and physical damage insurance, business-related general liability and property insurance predominately for small businesses, and workers’ compensation insurance primarily for the transportation industry. The company expanded its portfolio of offerings to larger fleet, workers’ compensation coverage for trucking, along with trucking industry independent contractors, and affinity programs in 2021, when the company acquired Protective Insurance Corporation and subsidiaries (Protective Insurance).

The company offers its commercial auto products in all states. The company’s commercial auto customers insure approximately two vehicles per policy, excluding large fleet policies. During 2023, the company wrote about 90% of its commercial auto business through the agency channel.

The Commercial Lines business operates in the following commercial auto business market targets (BMT):

Business auto – autos, vans, pick-up trucks used by small businesses (e.g., retailing, manufacturing, farming) and for-hire livery (e.g., non-fleet (i.e., five or fewer vehicles) taxis, black-car services, and airport taxis).

For-hire transportation – tractors, trailers, and straight trucks primarily used by regional general freight and expeditor-type businesses and long-haul operators.

Contractor – vans, pick-up trucks, and dump trucks used by light contractors (e.g., painters, plumbers, landscapers), and heavy construction.

For-hire specialty – dump trucks, log trucks, and garbage trucks used by dirt, sand and gravel, logging, garbage/debris removal, and coal-type businesses.

Tow – tow trucks and wreckers used in towing services and gas/service station businesses.

Similar to Snapshot in the personal auto business, the Commercial Lines business offers its commercial auto customers UBI options. Smart Haul is the UBI program that uses driving data from a motor carrier’s existing electronic logging device. Smart Haul offers owner operators and small fleets the ability to receive discounts on their insurance by sharing their electronic logging device generated data with the company. Snapshot ProView is the UBI program for commercial auto customers without their own electronic logging device. Snapshot ProView allows customers to earn upfront discounts and provides value-added services, like fleet management and personalized tips to encourage safe driving. Both programs are available in almost all states.

In addition to the BMTs, as of December 31, 2023, the company provided commercial auto coverage in the transportation network company (TNC) business to Uber Technologies subsidiaries in 16 states and to Lyft’s rideshare operations in 4 states.

The company’s Commercial Lines business also offers business-related general liability and property insurance through the company’s BOP insurance. These products are geared specifically to small businesses and at year-end 2023 were available to agents in 44 states, excluding the District of Columbia, with plans to expand to additional states during 2024.

The company also offers workers’ compensation insurance tailored for the transportation industry. The company’s offering includes loss prevention services that promote safe operations and dedicated claims-handling specialists. This product is available through a limited network of licensed brokers and includes options ranging from guaranteed premium cost plans to loss dependent plans, to meet the varying needs of small to large trucking fleets.

The company also continues to act as an agent for business customers to place BOP, general liability, professional liability, and workers’ compensation coverage through unaffiliated insurance carriers and are compensated through commissions, which are reported as service revenues. To further help the company’s direct customers, the company offers BusinessQuote Explorer (BQX), a digital application that allows small business owners to obtain quotes for the company’s BOP product and the products offered from a select group of unaffiliated carriers.

Property

The company’s Property segment writes residential property and renters insurance in virtually all states, primarily in the independent agency channel and through select agents under the company’s Platinum program discussed above. The company also acts as a participant in the ‘Write Your Own’ program for the National Flood Insurance Program (NFIP) under which the company writes flood insurance in virtually all states; 100% of this business is reinsured with the NFIP.

The company tends to see more business written during the second and third quarters of the year (year ended December 2023) based on the cyclical nature of property sales. Losses also tend to be higher during the warmer weather months when storms are more prevalent. As a property insurer, the company has exposure to losses from catastrophes, including hurricanes, and other severe weather events.

The company specializes in residential property insurance for homeowners, other property owners, and renters, as well as insurance for manufactured homes, personal umbrella insurance, and primary and excess flood insurance.

As discussed above, the company’s Property business is an important component of the company’s Destination Era strategy.

Patents

Some of the patents the company holds include a usage-based insurance patent (expiring in 2024 or after), two patents on the Name Your Price functionality on the company’s website (expiring in 2028 or after), three multi-product quoting patents (expiring in 2032 or after), three patents for the company’s implementation of a mobile insurance platform and architecture (expiring in 2032 or after), a patent on the company’s system of providing customized insurance quotes based on a user’s price and/or coverage preferences (expiring in 2033 or after), two patents for the company’s loyalty call routing system (expiring in 2033 or after), a patent for a multivariate predictive system that processes usage-based data (expiring in 2035 or after), four patents for the implementation of chatbots in online quoting and servicing (expiring in 2038 or after), two patents for the company’s Commercial Lines business classification system (expiring in 2039 or after), three patents for the company’s automated document classification system (expiring 2040 or after), and one patent for embedded quoting (expiring in 2043 or after).

Insurance Licenses

The company’s insurance subsidiaries operate under licenses issued by various insurance regulatory authorities. These licenses may be of perpetual duration or renewable periodically, provided the holder continues to meet applicable regulatory requirements. The company’s licenses govern the kinds of insurance coverages that may be written by the company’s insurance subsidiaries in the issuing jurisdiction. Such licenses are normally issued only after the filing of an appropriate application and the satisfaction of prescribed criteria. All licenses that are material to the company’s subsidiaries’ businesses are in good standing.

Investments

The company’s investment portfolio consists of fixed-maturity securities, short-term investments, and equity securities (nonredeemable preferred stocks and common equity securities). The company’s fixed-maturity securities, short-term investments, and nonredeemable preferred stocks are collectively referred to as fixed-income securities. The company’s portfolio is invested primarily in short-term and intermediate-term, investment-grade fixed-income securities.

Service Businesses

The company’s service businesses primarily include its commission- or fee-based businesses, where the company often acts as an agent for other insurance companies. The company offers home, condominium, and renters insurance, among other products, written by unaffiliated insurance companies in almost all states in the direct channel. The company also offers its customers the ability to package their commercial auto coverage with other commercial coverages that are written by unaffiliated insurance companies. The company receives commissions for the policies written under this program and allocate marketing and other administration costs associated with maintaining these programs.

Prior to the expiration of the company’s Commercial Automobile Insurance Procedures/Plans (CAIP) service contract in August 2022, the company acted as a servicing carrier, on a nationwide basis, for the CAIP plans, which are state-supervised plans servicing the involuntary market in nearly all states. The expiration of the company’s participation as a CAIP service provider did not materially affect the company’s financial condition, results of operations, or cash flows.

History

The Progressive Corporation was founded in 1937.

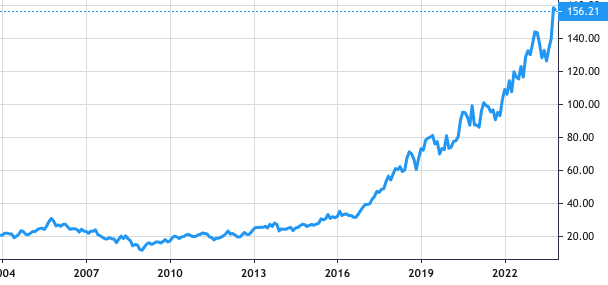

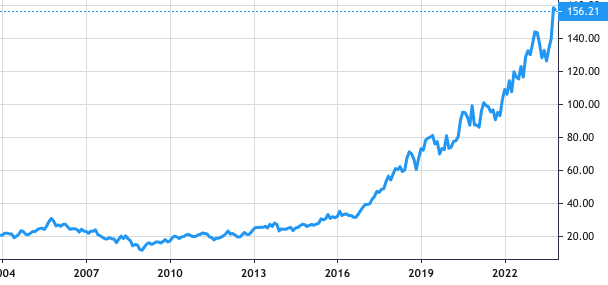

Stock Value

Stock Value