About Paymentus Holdings

Paymentus Holdings, Inc. provides cloud-based bill payment technology and solutions.

The company delivers its next-generation product suite through a modern technology stack to more than 1,900 biller business and financial institution clients. The company’s platform was used by approximately 27 million consumers and businesses in North America in December 2022 to pay their bills, make money movements and engage with the company’s clients. The company serves billers of all sizes that primarily provide non-discretionary services across a variety of industry verticals, including utilities, financial services, insurance, government, telecommunications and healthcare. The company also serves financial institutions by providing them with a modern platform that their customers use for bill payment, account-to-account transfers and person-to-person transfers.

The company’s platform provides its clients with easy-to-use, flexible and secure electronic bill payment experiences powered by an omni-channel payment infrastructure that allows consumers to pay their bills using their preferred payment type and channel. Because the company’s biller platform is developed on a single code base and leverages a Software-as-a-Service, or SaaS, infrastructure, the company can rapidly deploy new features and tools to the company’s entire biller base simultaneously. Through a single point of integration to the company’s billers’ core financial and operating systems, the company’s mission-critical solutions provide the company’s billers with a payments operating system that helps them collect revenue faster and more profitably and empower their consumers with the information and transparency needed to control their finances.

The company extends its platform’s reach through its Instant Payment Network, or IPN. This is a proprietary network, consisting of tens of thousands of billers, that connects the company’s integrated billing, payment and reconciliation capabilities with the company’s IPN partners’ platforms. The company’s IPN enables its partners, which include leading consumer technology providers, retailers and financial institutions, to access the company’s next-generation electronic bill payment technology using the same integrated platform the company provides directly to its billers. By being connected to the company’s IPN, its IPN partners provide their consumers with the full capabilities of the company’s next-generation product suite, including the ability to engage with and make payments to the company’s large and growing base of billers. Those partners in turn expand the company’s platform’s reach to millions of additional consumers in the United States and globally.

The company’s platform supports omni-channel, electronic bill payments across multiple commerce channels, including online, mobile, interactive voice response, or IVR, call center, chatbot and voice-based assistants.

The company relies on a diversified go-to-market strategy, including direct sales, software and strategic partnerships, resellers and the company’s IPN. While the direct sales channel is an important part of the company’s business, the company also relies on its software and strategic partners and resellers to deliver the company’s solutions to its billers and financial institutions. The company’s software partners, such as Oracle, integrate its platform into their software products enabling the company to power their bill payment capabilities. The company’s strategic partners, such as JPMorgan Chase, U.S. Bank, and a major payroll solutions provider, refer new billers to the company’s platform and in many cases the company jointly sell to prospective customers with the company’s strategic partners. Some of the company’s strategic partners, particularly banks, also integrate the company’s solutions into their platforms to provide an integrated bill presentment and omni-channel bill payment solution to their customers, and as such they are also IPN partners.

The company’s IPN promotes more rapid adoption of the company’s platform through partnerships with leading business networks, including:

Banking Partners: The company modernizes the bill payment infrastructure of banks and credit unions of all sizes, empowering their digital banking consumers with fast, secure and omni-channel payment technology by seamlessly integrating the company’s solution into their digital platforms.

eCommerce Partner: The company powers electronic bill payments through the mobile app and AI-assistant voice service of a leading global ecommerce retailer, enabling millions of its users to retrieve information about, and pay, their bills for all billers on the company’s network.

PayPal: The company enables PayPal’s U.S. consumers to pay their bills directly from PayPal apps.

Other Partners: Other partners benefit from the company’s IPN in a variety of ways, such as enabling bill payment for consumers across the U.S. For example, the company enables Walmart's consumers to pay their bills either in-store at retail locations or online via Walmart's retail websites or mobile apps, and enable in-person cash payments at more than 90,000 retail locations in the Green Dot network.

Platform and Solutions

The company’s biller platform is purpose-built to transform the way billers get paid and engage with their consumers. The company’s AI-driven SaaS platform provides a single-vendor solution that enhances the bill payment ecosystem with new functionality and added transparency. The company’s single code base architecture maximizes the inherent flexibility, extensibility and configurability of the company’s solutions, which allows the company to rapidly deploy its solutions to the company’s billers.

The company’s platform for financial institutions reconnects the financial institutions to their customers by providing a frictionless, real-time financial hub where consumers can consolidate their financial obligations, pay bills, move money in real time and deepen their understanding of their own financial position. Customers get a centralized viewpoint over all their money movement needs and the financial institutions get insights into their customers’ behavior than can inform a meaningful evolution of the customer experience.

Single Point of Access

APIs: The company’s easy-to-use APIs enable billers, financial institutions and partners to seamlessly access the entirety of the company’s network through a single connection.

iFrames: Enables the company’s billers, financial institutions and partners to exercise more control over the user experience by customizing the business logic to meet their specific requirements. Many of the company’s billers who use iFrames have in-house IT resources but use the company’s infrastructure for payment processing and Payment Card Industry Data Security Standard, or PCI-DSS compliance.

Fully Hosted: The company also provides a fully hosted alternative for its billers. In this option, the company’s hosted platform provides the company’s billers the full power of its platform without incurring the cost of using their own IT resources.

Technology Solutions

Engagement: Billers must regularly engage with their consumers using actionable and contextualized data. The company’s smart notifications and messaging tools enable billers to provide billing details to their consumers, such as account status, and directly communicate with them over secure channels. The company’s engagement products help billers and financial institutions facilitate timely and secure bill payments, while driving digital adoption and reducing cost to serve.

Presentment: Consumers are increasingly demanding omni-channel access to their bills through their preferred engagement channels. The company’s solution offers electronic bill presentment across numerous channels, including web, mobile, text, secure PDF, email, IVR, chatbot, social media and through the company’s IPN partners. The company’s electronic bill presentment products help billers maximize their reach to accelerate revenue realization and engage consumers more efficiently.

Empowerment: The company’s comprehensive suite of solutions empowers consumers and billers to customize, control and enhance the bill payment experience. Consumers can control communication preferences, multi-lingual capabilities, self-directed payment scheduling, multi-account management and dispute management. Billers are able to use automated case management and configurable reporting to quickly and comprehensively provide high-quality customer service.

Payment: Consumers demand an omni-channel payment experience that enables use of their preferred payment type and channel. The company’s secure and comprehensive omni-channel payment platform supports traditional and emerging payment technologies across multiple currencies and languages. The company’s platform supports electronic bill payments using credit, debit, ACH and digital wallets across a variety of payment channels, including web, mobile, IVR, text, secure PDF, chatbot, agent-assisted (call center), in-person, the AI-assistant voice service of a leading global ecommerce retailer, in Walmart and certain other retail stores, and through alternative payment rails such as PayPal. The company supports one-time payments, as well as future-dated, recurring and payment plan transactions.

Intelligence: Electronic bill payment transactions contain a rich volume of consumer and behavioral data that can improve the bill payment experience for billers and consumers. The company’s AI-powered analytics engine produces data-driven insights on consumer preferences, channel usage, bill lifecycles, messaging effectiveness and paper suppression and can be used by billers to improve the consumer experience. For example, the company’s analytics engine can analyze frequently asked questions to call centers and enable billers to quickly predict answers to those questions in the future, creating a better consumer experience with reduced cost to serve for the biller.

Technology Architecture

Single Code Base: The company’s extensible, cloud-based payments platform was built from the ground-up on a single code base with no versioning, which enables rapid deployment of new features and tools in part because there is no need to manage and reconcile separate versions of the company’s software code. This flexibility empowers billers, financial institutions and partners across the company’s network to offer their consumers the strength of the company’s platform without paying the company development or implementation fees.

AI / ML: The company’s biller platform uses AI and ML algorithms to increase efficiency and extract data-driven insights from transactions and interactions between consumers, billers, partners and the company’s platform. These algorithms are embedded within, and enhance, each of the company’s technology solutions to deliver a more intelligent and predictive consumer experience.

Platform Features

The electronic bill payment process involves more than just a payment. It requires an end-to-end engagement mechanism that facilitates communication and payment between billers, partners and consumers to ensure timely and transparent payment through a frictionless consumer experience. Various features of the company’s platform support this:

Consumer Engagement: The company enables its billers to improve their consumer engagement with targeted communications, such as smart notifications, broadcast messaging, inbound and outbound communications, and campaign management, all of which are managed by the company’s communications management tools. The company’s engagement modules allow billers to communicate with consumers based on desired characteristics such as regional location, due date, account status (such as late payment), or custom logic. The company’s billers can also communicate new offerings, incentives for payment and new payment types (such as PayPal). In 2022, the company’s billers sent approximately 145 million emails, sent 40 million text messages and had over 2 million IVR calls using the company’s communications modules.

Bill Presentment: Billers can present electronic bills and balance amounts through the biller’s own mobile app, text, secure PDFs, IVR, and chatbots or via alternative channels such as digital wallets, the AI-assistant voice service of a leading global ecommerce retailer, PayPal’s bill pay app, social media and the company’s other IPN Partners.

Consumer and Biller Employee Empowerment: The company enables billers and financial institutions to empower both their consumers and employees, which significantly increases consumer satisfaction and on-time bill payment rates for many of the company’s billers. Billers and financial institutions are able to empower consumers with an array of choices:

Communications preferences – consumers can choose email, text, portal or otherwise;

Language preferences – consumers can select their preferred language for receiving billing information and interact via IVR;

Payment scheduling and type – consumers can schedule payments at specific times and use specific payment type to best suit their needs; and

Multi-account management – consumers can manage multiple accounts with a single provider in one place.

The company offers complementary features to the company’s biller’s employees, including tools for automated case management, configurable reporting and ‘see what they see’ where the customer service employees can see exactly what the consumer sees to quickly resolve problems.

The company has also made significant investments in research and development, including in an automated, streamlined onboarding experience to help the company’s billers and financial institutions go live faster and in self-service features to help billers quickly adapt to consumer needs.

Payment Types: The company has significantly invested in innovative payment types to provide billers a seamless, omni-channel suite of tools. No other provider in the company’s markets offers a similar array of easy-to-implement options.

These features are seamlessly integrated with the company’s engagement and empowerment tools to provide a superior consumer biller and financial institutions experience. The company’s platform supports a variety of payment types, including ACH and eCheck; debit card; credit card; and emerging payment types.

Emerging payment types include PayPal, Venmo, PayPal Credit, Apple Pay, Google Pay and Amazon Pay. These payment types are gaining increasing traction with consumers, and as a result, are viewed as increasingly important by billers and financial institutions.

Payment Channels: The company’s platform offers an omni-channel payment infrastructure, which means that it enables bill payments through all the traditional payment channels billers and consumers expect, as well as many emerging payment channels. These include web portal, mobile, IVR, text, secure PDF, chatbot, agent-assisted (call center), in-person, the AI-assistant voice service of a leading global ecommerce retailer, in Walmart stores and through alternative payment rails, such as PayPal. Key features and examples of several of these channels are described and illustrated in the following pages.

Chatbot: Enable billers to engage with consumers through an automated, AI-powered interface that constantly improves the customer service experience through data-driven insights.

PayPal App: Leveraging the company’s APIs, PayPal’s U.S. consumers can pay their bills directly from PayPal.

Secure Service: The company’s patented Secure Service feature enables billers to accept payments over the phone while minimizing PCI-DSS compliance risk. Many billers avoid accepting payment information over the phone by directing consumers to websites or automated phone systems, which creates poor experiences and results in abandoned payments. The company’s Secure Service allows the biller’s employee and the consumer to remain connected throughout the process, while removing the biller’s employee from PCI-DSS scope by concealing payment details. As a result, the transaction is able to be completed securely and the consumer can be returned to the same employee directly on completion.

AI-assistant Voice Service: The company powers bill payments for the AI-assistant voice service of a leading global ecommerce retailer, enabling millions of its users to retrieve information about, and pay, their bills for all billers on the company’s network using voice commands.

Text-based: Pay by text leverages the company’s text based bill presentment technology for a text payment authorization, which then uses stored payment types in the consumer’s account.

IVR: Interactive voice response is a powerful tool to make payments and check balances, and is available in multi-lingual options.

Agent-assisted Call Center Payments: The company’s agent-assisted call center capability enables a biller to support and assist their consumers with bill payments and other related issues.

Portal: The company’s bill payment portal enables billers to provide advanced usage and consumption data to their consumers, such as power use by day.

In-person Payments: The company also powers in-person payments, which include payments at kiosks or a counter for point-of-sale transactions. This is particularly appealing for many billers who may have a local customer service center.

Payment Timing: The company supports an array of timing alternatives, including one-time guest payments, recurring payments, future-dated payments, multiple payments and payment plans.

Network

The company’s innovative technology platform enables the company to sit at the nexus of a powerful multi-sided network of billers, financial institutions, partners and consumers. The company uses the power of this network to enhance the number of product features each biller uses to promote transaction growth. The company’s portfolio data shows that payment adoption is highly correlated to feature utilization. By increasing feature usage, the company will realize an increase in transaction volume from the company’s billers.

Billers

The company’s innovative technology platform empowers billers to offer electronic bill payment acceptance across multiple payment types, engage with their consumers and streamline their business operations efficiently and cost-effectively. The company attracts billers to its platform because the company’s platform modernizes their payment infrastructure and helps them collect revenue faster and more profitably. The company’s platform is capable of posting payments directly to billers’ systems, which simplifies revenue operations and strengthens the relationship the company has with billers.

Financial Institutions

The company’s network connects its financial institutions to thousands of billers and sources of money movement, including virtually every bank and credit union in the U.S., debit card and credit card payments and multiple digital wallets. The network also enables consumers to make loan payments to the company’s financial institutions from its other network partners. By using open application programming interfaces, or APIs, software development kit, or SDK, widgets and single-sign-on, or SSO, interfaces, the company’s financial institutions have complete flexibility and control over how they integrate and deliver their services, including modern digital bill presentment, payment and money movement services.

Value Proposition to Billers and Financial Institutions

Flexible and Integrated Platform: Billers and financial institutions can offer their consumers a variety of traditional and emerging payment and engagement technologies that enable the billers to collect revenue faster and drive improved customer satisfaction, while reducing costs, such as their PCI-DSS compliance burden. Billers and financial institutions have the flexibility to integrate directly to the company’s platform through APIs, iFrames or a fully hosted solution, which allows them to cost-effectively select and customize the company’s solutions to fit their specific requirements. Because the company’s platform is flexible and scalable, the company’s value proposition applies to all billers whether they ultimately choose to use the company’s platform for all of their bills or continue using legacy bill payment systems or biller-direct solutions together with the company’s solutions.

Long-term Growth and Operating Leverage: The scalability of the company’s platform allows billers and financial institutions to capitalize on growth opportunities for their business. While helping billers grow their revenue, the company also helps reduce costs by leveraging the company’s integrated technology architecture to automate manual workflows, which reduces error-prone manual data entry and efficiently reconciles payments to backend financial and operating systems.

Partners

As the company’s biller base expands, the company attracts market-leading software, strategic and IPN partners that use the company’s platform to power bill payment experiences within their ecosystems. The company’s innovative platform facilitates a modern bill presentment, consumer engagement and bill payment experience for the company’s partners’ customers, regardless of partner type.

Software Partners: The company’s software partners include large third-party technology providers, such as Oracle, which integrate the company’s platform into their software suites to power bill payments for their customers and refer billers and financial institutions to the company. For example, ERP providers integrate the company’s platform into their own suite of solutions to offer a comprehensive solution set that enhances their ERP software with bill presentment, consumer engagement and bill payment capabilities. In certain cases, the company has revenue sharing arrangements with the company’s software partners based on the company’s transaction fees. In other cases, rather than a revenue sharing arrangement, the company and its software partner mutually benefit from the partnership as the software partner can offer a more comprehensive solution and stronger value proposition to its customers and the company receives broader reach to potential billers and consumers, an efficient biller acquisition channel and stronger biller retention from an integrated solution.

Strategic Partners: Similar to the company’s software providers, the company’s strategic partners refer billers to the company and, in many cases, integrate the company’s solutions into their platforms. The company’s strategic partners, including JPMorgan Chase, U.S. Bank, and a major payroll solutions provider, work with the company to offer bill presentment, consumer engagement and bill payment capabilities to their customers, which are billers. For example, a large commercial bank has many business clients who seek to improve and streamline the bill presentment and bill payment experience for their consumers. In that case, the large commercial bank partners with the company to sell a joint solution. In other cases, the commercial bank may prefer to sell a white-labeled solution, which it obtains from the company. Both co-sale and white-label arrangements typically involve revenue sharing agreements with the strategic partner based on the transaction fees the company receives.

IPN Partners: The company’s IPN partners work with the company to gain access to broader biller networks and provide their consumers with innovative technology to streamline bill payments. The company’s IPN partners include PayPal, for which the company power bill payment capabilities, a leading global ecommerce retailer, through which the company offers electronic bill presentment and payment via its AI-assistant voice service and mobile app, Walmart, for which the company enhances in-person bill payment capability at Walmart Money Centers, and Green Dot, to enable in-person cash payments at more than 90,000 retail locations in the Green Dot network. Unlike software and strategic partners, IPN partners typically have direct interactions with consumers, and leverage the company’s platform to connect to its biller network. Through this connection, consumers can initiate bill payments through the company’s IPN partners, which the company routes to the billers. There are many types of IPN partners, including consumer networks, retailers, banks and financial institutions. The company offers consumer networks and retailers increased engagement with consumers by enabling streamlined bill presentment payment experiences for an array of billers through their networks. The company similarly offers banks and financial institutions increased engagement with their retail clients. For IPN partners, the company will typically receive a fee per transaction processed through the company’s platform and in some cases the company pays a referral fee to IPN partners.

Multiple Roles for Partners: Notably, partners may fit into multiple categories, particularly banks and financial institutions. For example, a bank can be a biller, a strategic partner and an IPN partner. As a biller, the bank generates bills, such as mortgage and credit card statements. As a strategic partner, the same bank uses the company’s platform to power an omni-channel bill payment experience for a commercial customer of the bank. In this way, that commercial customer becomes a new biller for the company’s network. Finally, as an IPN partner, the same bank leverages the company’s IPN network to enable a more robust bill payment experience for its business customers and consumers by, for example, enabling its business customers and those businesses’ consumers to pay bills using alternative payment channels, such as PayPal. For clarity, financial institutions may also be customers where the financial institution uses the company’s platform to provide bill payment and other money movement services directly to consumers and businesses.

Value Proposition to Partners

Higher Consumer Satisfaction: Partners gain access to the company’s network of billers and can provide turnkey electronic bill payment functionality to their consumers through flexible integration options. By integrating the company’s platform into their ecosystems, partners can provide a more comprehensive solution and drive higher customer satisfaction.

Access to Innovative Technology Solutions: As consumers demand a more seamless and secure experience, partners require consumer engagement and payment technology that caters to the latest consumer trends. The company’s platform offers cutting edge technology that enables partners to grow mind and wallet share with their consumers.

Billers’, Financial Institutions' and Partners’ Consumers

As the company’s platform reaches more consumers, the company captures and monetizes more payment transactions. In December 2022, approximately 27 million consumers and businesses used the company’s platform to pay their bills. As consumers increasingly demand omni-channel bill payment solutions for more of their bills, the company attracts more billers and partners who look to its platform to meet that demand.

Value Proposition to Consumers

Next-Generation Electronic Bill Payment Tools: Consumers gain access to advanced payments functionality to streamline their omni-channel bill payment experience. Consumers can view and pay bills through a variety of payment channels and types, engage with their billers, financial institutions and retrieve actionable insights regarding their payments and billing history.

Control Over Financial Health: Consumers gain added control and visibility over their financial health on a daily basis through the advanced tools and features the company provides. The company’s platform allows consumers to set the terms of their bill payments in a way that best suits their needs.

Growth Strategies

The key elements of the company’s strategy are to continue to win new billers, financial institutions and partners; grow with existing billers, financial institutions and partners; expand into new channels and industry verticals; build new products; leverage the company’s platform to expand internationally; and pursue selective strategic acquisitions.

Go-to-Market Strategy

The company employs a diversified go-to-market strategy that leverages targeted marketing efforts, a direct sales team and relationships with technology partners and resellers as the company seeks to acquire billers and financial institutions in an efficient manner. The company’s marketing strategy targets prospective billers and financial institutions through industry- and role-based marketing efforts at trade shows and industry events, direct marketing and social media programs. The company also leverages partnerships and referral relationships of various types.

The company’s direct sales team is responsible for outbound lead generation, driving new business and helping to manage account relationships and renewals. The company’s sales team also maintains close relationships with existing billers and financial institutions and acts as an advisor to each biller to help identify and understand their specific needs, challenges, goals and opportunities.

The company also leverages strong relationships with the company’s partners to extend the reach of the company’s platform and receive new biller referrals. The company’s software partners, including Oracle, integrate the company’s platform into their software products, enabling the company to power their bill payment capabilities for their consumers. The company’s strategic partners, including JPMorgan Chase, U.S. Bank and a major payroll solutions provider, also refer new billers to the company’s platform. The company’s software is regularly integrated with the company’s software partners’ offerings and with the software suites of other market-leading software providers commonly used by the company’s billers, including SAP and Guidewire, in each case to power electronic bill payment functions for the company’s billers and their consumers.

Through partnerships with PayPal, a leading global ecommerce retailer and financial institution partners, the company’s platform reaches millions of consumers. Jointly delivering the company’s platform with its software and strategic partners provides consistency of approach and a high-quality experience for billers, financial institutions, partners and consumers.

Intellectual Property

As of December 31, 2022, the company held 22 issued U.S. patents and one issued Canadian patent related to the company’s proprietary technologies. As of December 31, 2022, the company also held one allowed, seven published and two pending U.S. patent applications, and three pending PCT patent applications. If the company’s issued patents are maintained until the end of their terms, they will expire between 2025 and 2040. The expiration of these patents is not reasonably likely to have a material adverse effect on the company’s business, financial condition or results of operations. In addition, as of December 31, 2022, the company owned 10 registered U.S. trademarks and one registered trademark in each of the European Union, India, Japan, New Zealand and the United Kingdom. The company also held 10 pending trademark applications in the U.S., two pending trademark applications in each of China and India, and one pending trademark application in each of Australia and Canada.

Government Regulation

The company and its handling of data are subject to a variety of laws, rules and regulations relating to privacy, data protection and information security, including regulation by various governmental authorities, such as the U.S. Federal Trade Commission, or FTC, and various state, local and foreign agencies.

In addition, many states in which the company operates have enacted laws that protect the privacy and security of sensitive and personal data, such as the California Consumer Privacy Act, or CCPA, and the California Privacy Rights Act, or CPRA, in California.

Because the company processes individually identifiable protected health information in certain cases, the company is also subject to certain obligations under the Health Insurance Portability and Accountability Act of 1996, or HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act of 2009, or HITECH, as well as certain state laws and related contractual obligations.

The company is also subject to the rules and standards of Visa, Mastercard, American Express, the National Automated Clearinghouse Association, or NACHA, and INTERAC and other payment networks and their participants.

Further, the company and its billers, financial institutions and partners are subject to a variety of the U.S. state and federal laws, rules and regulations related to telemarketing, recording and monitoring of communications, such as the Telephone Consumer Protection Act, or TCPA, the Controlling the Assault of Non-Solicited Pornography and Marketing Act, or CAN-SPAM Act and others, because the company’s platform enables the company’s billers and partners to communicate directly with their consumers, including via e-mail, text messages and calls, and also enables recording and monitoring of calls between the company’s billers, financial institutions and partners and their consumers for training and quality assurance purposes.

History

Paymentus Holdings, Inc. was founded in 2004. The company was incorporated in the state of Delaware in 2011.

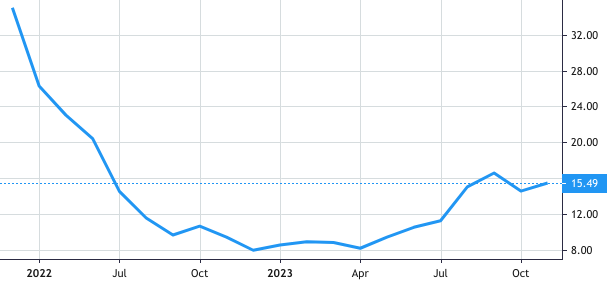

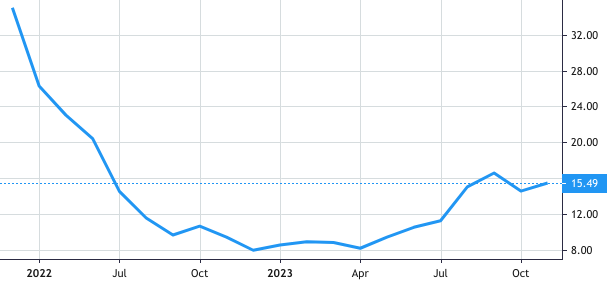

Stock Value

Stock Value