About Murphy USA

Murphy USA Inc. (Murphy USA), through its subsidiaries, engages in marketing retail motor fuel products and convenience merchandise.

The majority of the company’s existing and new-to-industry (NTI) retail gasoline stores operate under the brand names of Murphy USA and Murphy Express. Plans are under development to transition all Murphy Express branded stores to the Murphy USA brand name. These locations operate within close proximity to Walmart stores or within preferred markets across 25 states in the Southeast, Southwest, and Midwest areas of the United States. The company also operates a combination of convenience stores and convenience stores with retail gasoline under the brand name of QuickChek, which are located in New Jersey and New York. In addition, the company markets fuel to unbranded wholesale customers through a mixture of Company owned and third-party product distribution terminals and pipeline positions. The company is an independent publicly traded company. The company markets fueling products and convenience merchandise through a network of Company retail stores. The company also markets to unbranded wholesale customers through a mixture of Company owned and third-party terminals. During 2023, the company sold approximately 4.8 billion gallons of motor fuel through its retail outlets.

The company has purchased from Walmart the properties underlying many of its stores, and each of these properties that were purchased from Walmart are subject to Easements and Covenants with Restrictions Affecting Land (ECRs), which impose customary restrictions on the use of such properties, which Walmart has the right to enforce. Also pursuant to the ECRs, the company is prohibited from transferring such properties to a competitor of Walmart.

In addition to the motor fuel sold at Company stores, the company’s stores carry a broad selection of snacks, beverages, tobacco products and non-food merchandise, as well as a greater food and beverage offering at its QuickChek locations. In 2023, the company purchased more than 77% of its merchandise from a single vendor, Core-Mark, with whom it renewed a new five-year supply agreement in January 2021.

The company’s business is organized into one reporting segment (Marketing). The Marketing segment includes the company’s retail marketing stores and product supply and wholesale assets.

The company’s operations include the sale of retail motor fuel products and convenience merchandise along with the wholesale and bulk sale capabilities of its product supply and wholesale group. As the primary purpose of the product supply and wholesale group is to support its retail operations and provide fuel for their daily operation, the bulk and wholesale fuel sales are secondary to the support functions played by these groups. As such, they are all treated as one segment for reporting purposes as they sell the same products and have similar economic characteristics. This Marketing segment contains essentially all of the revenue generating activities of the company.

Business Strategy

The key elements of the company’s strategy are to grow organically; diversify merchandise mix; create advantage from market volatility; and invest for the long term.

Seasonality

Consumer demand for motor fuel typically increases during the summer driving season, and typically falls during the winter months. Travel, recreation and construction are typically higher in these months in the geographic areas in which the company operates, increasing the demand for motor fuel and merchandise that it sells. Therefore, the company’s revenues and sales volumes are typically higher in the second and third quarters of its fiscal year (year ended December 31, 2023).

Trademarks

The company sells gasoline primarily under the Murphy USA and Murphy Express brands, which it acquired from Murphy Oil. The company acquired ownership of the QuickChek trademark and others as a result of the QuickChek acquisition.

Environmental

Consumer demand for the company’s products may be adversely impacted by fuel economy standards as well as greenhouse gas (GHG) vehicle emission reduction measures. The U.S. Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) issued Corporate Average Fuel Economy (CAFE) standards in 2012 that set fuel economy standards and regulated emissions of GHGs for fleets of 2017-2025 model year cars and light duty trucks.

The company is subject to the requirements of the federal Occupational Safety and Health Act (OSHA) and comparable state statutes that regulate the protection of the health and safety of workers. In addition, the OSHA hazard communication standard requires that certain information be maintained about hazardous materials used or produced in its operations and that this information be provided to employees, state and local government authorities and citizens.

History

Murphy USA Inc. was founded in 1996. The company was incorporated in Delaware in 2013.

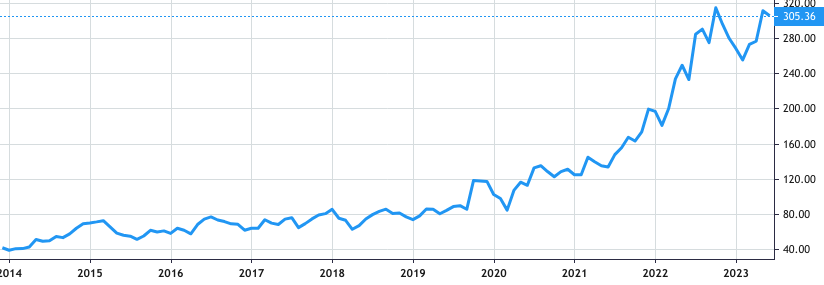

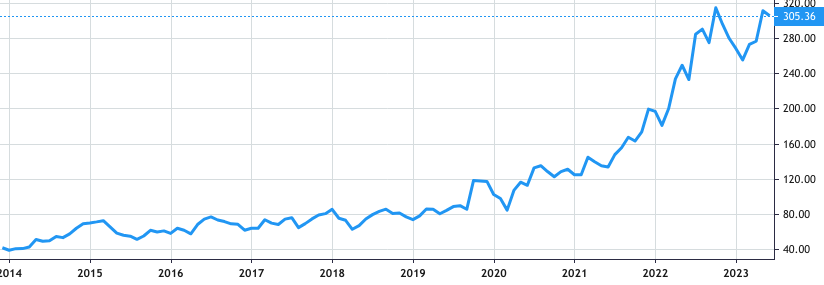

Stock Value

Stock Value