About MeridianLink

MeridianLink, Inc. (MeridianLink) operates as an industry-trusted software and services company. With MeridianLink, the company’s customers can accelerate their digital transformation and better serve their clients. The company supports its customers’ digital transformations by helping them create a superior client experience with its mission-critical lending, account opening, and data verification software solutions. The company’s solutions allow its customers to meet their clients’ needs across the institution, which enables improved client acquisition and retention. Additionally, the company’s solutions allow its customers to operate more efficiently.

The company’s lending software solutions provide a fully digital workflow for its customers, extending from their clients’ initial account opening applications to its customers’ final extension of credit and, where necessary, collections activity. The company enables its customers to offer a wide array of products and services to new and existing clients, replacing traditional manual processing and less nimble in-house solutions. The company’s solutions address nearly all categories of consumer lending, including mortgage, credit card, personal, auto, home equity, and small business loans, and provide the software tools and data necessary to deliver frictionless experiences, including automated decisioning.

The company’s data verification software solutions enable its customers to service their clients and make smarter business decisions by retrieving verification data for credit, income, employment, property, and fraud prevention. Mortgage Credit Link is a versatile, stable, and powerful web-based fulfillment hub for consumer data verification. To capitalize on the credit bureaus and other available sources, financial institutions of all sizes turn to MeridianLink to optimize scoring attribute and data management. Instead of investing in wasted development time, customers connect to a single application programming interface, or API, to access credit and verification data from dozens of resellers and service providers.

When it comes to background screening, MeridianLink customers can leverage their TazWorks software as a comprehensive screening software solution with productivity and mobile engagement tools. The TazCloud platform provides a comprehensive technology solution for the background screening industry with a powerful suite of background screening applications, integrations, and advanced business intelligence tools to help customers make better decisions about their business.

The company offers its software solutions using a software-as-a service, or SaaS, model under which its customers pay subscription fees for the use of its solutions and typically have multi-year contracts with an initial term of three years or more. The company’s customer contracts are typically not cancellable without penalty. The company’s subscription fee revenues include annual base fees, platform partner fees, and, depending on the solution, fees per search, per loan application, or per closed loan (with some contractual minimums based on volume) that are charged on a monthly basis, which it refers to as volume-based fees. The company seeks to deepen and grow its customer relationships by providing consistent, high-quality implementations and customer support services, which drive higher customer retention and incremental sales opportunities within its existing customer base.

As of December 31, 2022, the company’s customer mix included more than 2,000 diverse financial institutions, including banks, credit unions, mortgage lenders, specialty lending providers, and consumer reporting agencies (CRAs). The company’s technology enables its customers to bridge the functional silos of their institutions and thereby increase their ability to serve more of their clients’ needs and achieve incremental revenue.

In November 2022, the company acquired Beanstalk Networks L.L.C., doing business as OpenClose, a leader in mortgage lending technology, with a particular focus on supporting depository institutions. This transaction is expected to improve the company’s platform by providing additional advanced, more open, and more customer-friendly capabilities, particularly through its Point of Sale solution.

Strategy

The company seeks to capture additional growth driven by new logo acquisition, organic cross-sell and upsell opportunities with its customers, and potential acquisitions. The key elements of the company’s strategy are to continue adding customers in its target market; expand its target market; pursue unrealized upsell and cross-sell into client base; launch new products; expand monetization of Partner Marketplace; selectively pursue strategic mergers and acquisitions; full public cloud migration to drive enhanced capacity, flexibility, and security; and substantial runway for increasing penetration domestically and enhancing solutions for international expansion.

Technology and Solutions

The company’s software provides its customers with an end-to-end solution that improves workflow within a financial institution. The company’s solutions are not only focused on driving increased loan origination and partner interactions at each digital touch point, but also help its customers simplify how loans are processed and decisioned, so that increased client volume does not materially increase costs incurred by its customers. This enhanced efficiency enabled by the improved workflow the company facilitates allows its customers to improve their financial performance. The company’s actively marketed solutions and services include Lending Software Solutions, which enable financial institutions to better serve consumers and businesses, and Data Verification Software Solutions, which are utilized by CRAs. The company’s software solutions include Point of Sale Systems; account opening software; consumer loan origination software (LOS); mortgage LOS; business lending software; marketing automation software; data verification software; collection software; and analytics and business intelligence.

The company’s technologies directly connect its financial institution customers and the clients they serve, creating an omni-channel experience by integrating all potential client touch points onto a single platform. The company provides software solutions that simplify loan decisioning, deposit and loan origination, and workflow by providing accurate information within a streamlined user-friendly platform. The company’s solutions were designed by bankers who understand how financial institutions work and have been built to consistently drive value through increased profitability and efficiency while facilitating regulatory compliance. With a broad set of integrated third-party capabilities and a robust underwriting and pricing engine, the company’s solutions can be configured to fit the needs of a wide variety of financial institutions. In connection with its ongoing development and launch of MeridianLink One, in February 2021, the company introduced a product-wide rebranding of its offerings under the unified brand of MeridianLink. The company’s rebranded core offerings include its Lending Software Solutions and its Data Verification Software Solutions as follows:

Lending Software Solutions

MeridianLink One

MeridianLink One is the company’s multi-product platform that can be tailored to meet the needs of its customers as they digitally transform their organizations and adapt to changing business and consumer demands. Moreover, the company’s expert consultants offer strategic guidance and customized solutions through its modular platform so customers can more quickly reduce costs and increase revenue, efficiency, and customer satisfaction. MeridianLink One provides an all-in-one digital lending and deposit account opening platform that is powered by a smart cross-sell optimization engine. The platform spans mortgage, business lending, and consumer loan origination, offering enhanced transparency and efficiency to process loans. The company designed a patented debt optimization engine to deepen the integration of its data verification and LOS solutions to empower loan officers to maximize loan acceptance rates, boost cross-sell opportunities, and deepen their relationships with clients. Additionally, the platform provides access to the company’s large network of third-party integrations and further accelerate the loan process and reduce expenses for its customers.

MeridianLink Portal

The company offers a Point of Sale system through its MeridianLink Portal that allows financial institutions, regardless of size, to easily expand existing lending and deposit account origination platforms to online consumers while ensuring control of the entire online application experience. From the ability to determine which loan and deposit account applications to make available online, to customizing the look and feel to match an existing web presence, the company’s system has hundreds of configurations available to tailor the online application process to meet a financial institution’s business objectives. The company’s system is the consumer touch point and funnel for consumer loans by integrating seamlessly with the all-in-one platform consumer LOS and account opening software so that online applications route securely and reliably into the customer’s existing platform.

MeridianLink Opening

The company offers a comprehensive cloud-based online account opening and deposit software solution through its MeridianLink Opening product. The platform unifies deposit account opening and funding for all channels and product types. With robust functionality ranging from identity verification, OFAC checks, e-signature, switch kits, and core system connectivity, the company’s platform saves operational costs and increases customer satisfaction from application initiation to account creation.

MeridianLink Consumer

The company offers LOS software, which it calls MeridianLink Consumer, that provides a full loan solution suite to banks and credit unions. The company’s solution offers automated underwriting and pricing for indirect loans (auto and retail), consumer lending (direct auto and unsecured and secured personal loans), lines of credit, business loans, home equity loans, home equity lines of credit, and vehicle leases. As a single loan origination system, the company’s software consolidates applications from all channels, applying the same rules and processes to ensure a streamlined process for institutional staff and a user-friendly consumer experience for customers. The solution provides a frictionless experience by consolidating data from all existing channels—mobile, online, branch, call center, indirect, retail, and kiosk—into a unified consumer experience. The modern, intuitive, and efficient user interface, or UI, makes everyday transaction processing easier. In addition, the company’s cross-sell engine identifies potential cross-sell opportunities, such as credit card debt consolidation or auto loan refinancing, for its customers.

MeridianLink Mortgage

The company offers cloud-based software designed for financial professionals to optimize the end-to-end mortgage loan origination process through its MeridianLink Mortgage product. The company uses automation, technology, and a dedicated support staff to help lenders deliver fast and compliant loans. This includes a complete decision engine that provides deep credit analysis, automated condition generation, and automated fee calculations – all of which increase the efficiency of the origination. The company’s suite of tools (including Open API, PriceMyLoan, eDocs, LenderAssist, DecisionAssist, and web portals) allows for individual customization while enabling regulatory compliance.

MeridianLink Business

Originally launched as Atlas Platform by StreetShares, which the company acquired in 2022, MeridianLink Business is a key component of the company’s multi-product platform, MeridianLink One. The company’s business lending offering brings together the innovation of both the StreetShares and MeridianLink teams to optimize financial institutions’ business lending capabilities. MeridianLink Business serves financial institutions looking for businesses/commercial lending solutions in order to serve businesses in their communities. MeridianLink Business provides certain functions specifically for business lending, which are not found within MeridianLink Consumer, such as automated cash flow statement creation, business credit reports, and business risk and identity verification.

MeridianLink Collect

The company offers a web-based debt collection software that helps customers easily and efficiently manage delinquencies, which it refers to as MeridianLink Collect. The software provides benefits with a sleek UI that is simple to use, allowing users to be quickly trained to set up and to manage the product. It replaces tedious workflows with automation, sophisticated analytics, and easy-to-use functionality.

Analytics and Business Intelligence

The company offers a range of solutions that deliver the quality and expertise of an internal team through agile analytics and business intelligence tools, offered through MeridianLink Engage, MeridianLink Consulting, and MeridianLink Insight. The company’s analytics tools are aimed at maximizing its customers’ credit portfolio performance through tailored services, as well as allowing its customers to make better and faster business decisions. The solutions are designed with interactive visualizations and various filter dimensions to enable its customers to optimize their experience. The company provides intuitive dashboards, easy-to-read reports, and a powerful exploratory sandbox, presenting a comprehensive solution for a multi-level audience while providing insights for omni-channel execution.

Data Verification Software Solutions

The company offers a plug-and-play, cloud-based order fulfillment hub for bankers and credit officers, which it refers to its Data Verification Software Solutions and encompasses its Mortgage Credit Link, TazCloud, and Credit API products. The company’s software simplifies product ordering with an intuitive web interface and integrated tools for order fulfillment. The solution provides users access to a large network of consumer credit, data, and verification service providers and allows them to process credit, income verification, employment, criminal and rental history, and other related services. A comprehensive list of product and service APIs allows for integrations into a number of applications for a seamless experience to minimize human error and to reduce costs.

Additional Solutions

The company supports additional loan origination systems, other credit decisioning tools, and additional solution modules. Several of these additional solutions, such as ACTion, LCC/Appro, BizMark/Mark4, Sail/Teres, and Synergy, came to it via acquisitions, and it is proud of the legacy of these solutions and committed to ensuring the best journey for these customers. Wherever possible, the company seeks to make available the capabilities and innovations of its new solutions to those customers on older versions of its solutions.

Financial Model and Key Metrics

The company’s revenues are broken out between three components: subscription fees, professional services, and other revenues. The company’s subscription fees consist of revenues from software solutions that typically are multi-year contracts with an initial term of three years or more. The company’s customer contracts are typically not cancellable without penalty. The company’s subscription fee revenues include annual base fees, platform partner fees, and, depending on the solution, fees per search or per loan application or per closed loan (with some contractual minimums based on volume) that are charged on a monthly basis, which it refers to as volume-based fees. The company’s professional service fees are driven by professional services for the setup and configuration of platform modules for customer needs, as well as certain consulting engagements regarding best practices and analytics. The company’s other fees consist of one-time and recurring fees that include implementation fees, annual fees, and revenue sharing based on revenue generated, applications or loans, or some combination of the above.

The company has high customer and revenue retention due to the nature of the services it provides. Customer onboarding and loan origination workflows within financial institutions are complicated with significant compliance requirements and often require integration with legacy systems that are highly customized and fragmented.

An additional opportunity for generating revenues in excess of what is contractually committed is through the company’s Partner Marketplace. Through reseller and referral relationships, it receives revenues based on its customers’ use of a partner’s services. In many instances, the company’s partners have their own sales and marketing efforts targeted at its customers – and when those third-party sales efforts are successful for its partners, it also generates fees for it. The company also markets its partners’ solutions to its customers as a way to generate revenues and also to ensure that its customers are leveraging the full benefit of its solution, which includes the capabilities offered through its partners.

Sales and Marketing

The company’s sales team primarily consists of its new logo sales team, which focuses on selling into accounts that do not have a relationship with it, and its account manager sales team, which sells into existing customer accounts. Both sales teams are supported by its sales engineers, who demonstrate the functionality of its solutions to prospects, and its sales operations team, which manages reporting, analytics, and sales enablement.

The company’s new logo team is responsible for expanding its customer base. This team is trained to nurture the company’s customer prospects, including through discovery of such prospects’ implemented solutions, if any, and through demonstration of the capabilities its solutions offer and the potential benefits to the customer prospect if they implement its solutions from it.

The company’s account management team maintains close relationships with existing customers and acts as advisors to each customer, helping them identify and understand their specific needs, challenges, goals, and opportunities with the intention to expand the breadth of its solutions the customer uses. It is the role of this team to ensure that the company’s existing customers get the maximum benefit from the breadth of the solutions it provides.

The company also has a sales team supporting its channel partners to ensure they receive the sales support that is required to capitalize on prospects that are identified through the partner’s selling efforts. The channel sales team also seeks to identify new potential channel partners who can expand the breadth of its reach to potential prospects.

To build brand awareness and generate sales leads, the company conducts digital marketing campaigns, webinars, public relations campaigns, lead development activities, and advertise through multiple avenues, including industry publications and conferences. The company has also historically hosted an in-person annual user forum to foster a customer community, showcase its most recent solution enhancements, and engages in a discussion on the direction and roadmap of its solutions. As a result of the positive feedback and growing attendance, the company plans to expand the event to a larger venue in 2023.

Competition

Loan Origination

Within non-mortgage consumer loan origination, the company’s main source of competition is the similar capabilities offered by a customer’s core banking system provider, such as Fiserv, Inc., Fidelity National Information Services, Inc., Jack Henry & Associates, and Temenos, with Fiserv, Inc. and Jack Henry and Associates also being MeridianLink partners. Other financial technology software companies, such as nCino and Q2, also have competitive functionality. Additionally, the company competes with customers who have a narrower focus like CU Direct’s Origence product and Sync1 Systems product offering.

The company’s primary competitors in the mortgage loan origination market are Calyx, Intercontinental Exchange, Mortgage Cadence, and to a lesser extent, Black Knight.

Data Verification

The company competes with both direct competitors and vendors who have developed proprietary in-house solutions that replicate the functionality of its Data Verification Software Solution. CRAs that have developed proprietary in-house credit reporting capabilities include CoreLogic and CBC Innovis, and proprietary in-house background screening capabilities include HireRight and Checkr. The company has a limited number of competitors that provide a platform solution similar to the capabilities of MeridianLink Mortgage Credit Link but there is more direct competition in background screening, including Accio and Deverus.

Government Regulation

As a technology service provider to banks and credit unions, the company is not required to be chartered by the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, the National Credit Union Administration, or other federal or state agencies that regulate or supervise its customers and other providers of financial services. The U.S. lending industry is heavily regulated. Originators, lenders, CRAs, and service providers with which the company does business are subject to federal, state, and local laws that regulate and restrict the manner in which they operate in the lending industry, including but not limited to, the Real Estate Settlement Procedures Act of 1974, as amended, the Truth in Lending Act of 1968, as amended, the Equal Credit Opportunity Act of 1974, as amended, and the Fair Credit Reporting Act of 1970, as amended, or FCRA. Other than the company’s indirect, wholly-owned subsidiary, Professional Credit Reporting, Inc., which is a consumer reporting agency and is subject to the FCRA, and MeridianLink Wholesale Data, LLC, a wholesale data company.

Information Security

The company has an established information security program aligned to the NIST SP 800-53 standard and the Payment Card Industry, or PCI, Data Security Standard, or DSS. The company’s program is led by its Chief Information Security Officer and implemented by a dedicated information security team. The company’s solutions are hosted in data centers and public cloud providers located within the United States. The company’s data centers employ advanced measures designed to protect the integrity and security of its data. The company has also implemented disaster recovery measures and continue to invest in its data center and other technical infrastructure.

Customer data processed by the company’s servers is encrypted, password protected, and stored on secure hardened servers. Customers transmit data to the company’s servers though a TLS encryption channel, with AES 256-bit ciphers protecting the data against third party disclosure in transit. Data at rest is encrypted utilizing AES 256-bit Key Management Systems. The company also employs anti-virus, anti-malware, and advanced threat protection capabilities. The company engages a third-party audit firm to conduct an annual SOC 2 Type 2 audit of its information security program and a PCI-DSS audit of its cardholder data environment.

Seasonality

The company’s business is generally subject to seasonal trends with activity generally decreasing during the winter months, especially home purchase loans and related services. The company’s lowest revenue levels during the year have historically been in the fourth quarter (year ended December 31, 2022). The timing of the company’s implementation activities and corresponding revenues from new customers also are subject to fluctuation based on the timing of its sales. The timing of the company’s implementations also varies period-to-period based on its implementation capacity, the number of solutions purchased by its customers, the size and unique needs of its customers, and the readiness of its customers to implement its solutions. The company’s solutions are often the most frequent point of engagement between its customers and their clients. As a result, the company and its customers are very deliberate and careful in its implementation activities to help ensure a successful roll-out of the solutions to their clients.

Intellectual Property

The company has an ongoing trademark and service mark registration program pursuant to which it registers its brand names and product names, taglines, and logos in the United States to the extent it determines appropriate. As of December 31, 2022, the company had a total of 29 registered trademarks in the United States. The company also has registered domain names for websites that it uses in its business, such as www.meridianlink.com and other variations, including domains from acquisitions. Additionally, on February 15, 2022, the U.S. Patent and Trademark Office issued to MeridianLink U.S. Patent Number 11,250,505. The patent is titled Optimizing Loan Opportunities in a Loan Origination Computing Environment and relates to MeridianLink’s loan origination platforms. MeridianLink also has certain patents by assignment from its acquisition of StreetShares, Inc. (StreetShares).

History

MeridianLink, Inc. was founded in 1998. The company was incorporated in 2018.

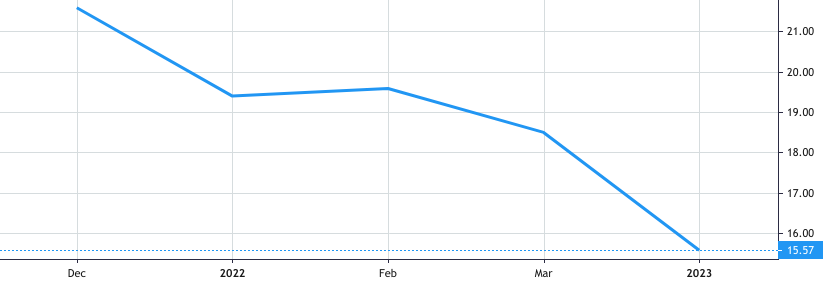

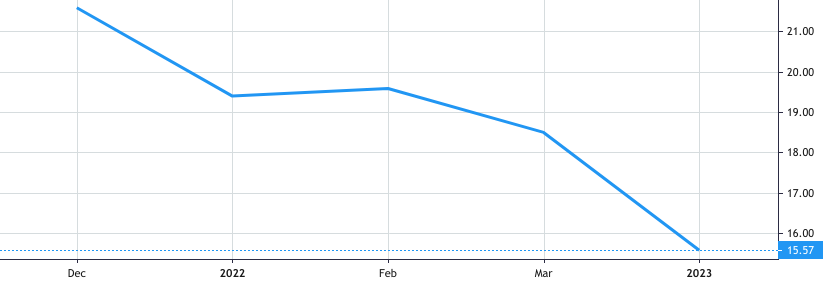

Stock Value

Stock Value