About Natura &Co Holding

Natura &Co Holding S.A. (Natura &Co) operates in the beauty and personal care industries.

The company operates four main brands, namely Natura, Avon, The Body Shop, and Aesop. These brands are complementary components of the company’s portfolio. The product categories the company sells include face and body skin care, hair care and treatment, cosmetics, fragrances, bath products, oral care, and other products and experiences.

Brands

The following is a description of the company’s main brands:

Natura

The company’s Natura product portfolio includes the following brands and categories:

Fragrances: Offered through the company’s brands of fragrances and feminine perfumes (such as Ekos, Natura Humor, Kriska, Natura Essencial, Biografia, Natura Ilia and Natura Luna) and of fragrances and masculine colognes (such as Natura Homem, Natura Essencial, Biografia, Natura Sintonia, Sr. N and Kaiak), as well as the Mamãe e Bebê and Natura Nature children’s lines that complement the portfolio.

Makeup: Offered through the company’s three brands of cosmetics, each with a different identity: Natura Una, Natura Faces and Natura Aquarela.

Body and Facial Care: Natura has two lines dedicated to facial care, Chronos and Natura Tez, in addition to a variety of body lotions under the Natura Ekos, Natura Tododia, Erva Doce and Natura Sou brands.

Sunscreen: Offered through the brand Natura Fotoequilíbrio, which also offers products specifically developed for children.

Soaps: Includes both liquid and bar soap, in addition to other items such as exfoliating products. Natura was the first company in Brazil to introduce liquid hand soaps in 1984 with the Erva Doce brand. This segment of the Brazilian market is led by bar soaps, a category in which Natura is active with brands, such as Natura Tododia and Natura Ekos. Natura’s soaps are all plant-based.

Deodorants: Includes perfumed deodorants that act as extensions of the feminine and masculine fragrance lines and the Natura Tododia and Erva Doce brands.

Body Oils: Offered through two different brands, Seve and Ekos.

Hair Care: This category includes shampoos, conditioners and capillary treatments, such as hydrating masks, and is offered through three brands: Natura Ekos, Natura Sou, Natura Lumina and Natura Plant.

Gifts: Offered through creative and adaptable kits, with a wide range of products for men, women and children, also including exclusive packaging for festive occasions.

The company’s Natura-branded products are manufactured using sustainable ingredients ethically extracted from the Brazilian biodiversity. The formulas the company uses prioritize the use of renewable, vegetable-based raw materials. The company seeks to develop the company’s Natura-branded products based on an open innovation model involving a network of global partners.

Avon

Avon is a global manufacturer and marketer of beauty and related products. Under this brand, the company’s products are distributed predominantly through direct sales by the company’s representatives for beauty, fashion and home segments focused on mass markets in more than 45 countries.

Avon’s product categories are:

Beauty: includes skin care products, cosmetics and fragrances.

Fashion and Home: includes decorative products, houseware, entertainment and leisure products, children's products, as well as jewelry, watches, clothing, footwear, accessories and other gifts.

Gifts: gift kits and souvenirs adaptable for various occasions, as well as a broad product line that includes makeup, body and bath, hair, skin care and packaging.

The Body Shop

The Body Shop is a global developer, distributor and seller of beauty, makeup, and skin care products, with more than 2,500 stores around the world as of December 31, 2022.

The Body Shop brand's product portfolio includes the following product categories:

Body Care: The Body Shop offers body care products, including body butter, lotions, yogurts, hand and foot care hygiene products, body and massage oils, and other products.

Bath: The Body Shop's bath products portfolio includes products, such as bath gels, soaps, body scrubs, liquid body soaps, bath creams and bath foams.

Hair Care: The Body Shop offers shampoos, conditioners, scalp treatments, among other hair care products.

Skin Care: The Body Shop offers quality skin care products that aim for effectiveness, including moisturizers, masks, facial cleansers, serums, toners, anti-spot and anti-acne products, among others.

Makeup: The Body Shop offers face (and with color) makeup, including foundations, eyelash masks, lipsticks, concealers, eyeliners and eye shadows, bronzing powders, sustainably sourced brushes and accessories, among others.

Fragrances: The Body Shop's fragrances include Eau de Parfum, Eau de Toilette, Deo and Mists, as well as fragrances for the home.

Gifts and Accessories: The Body Shop offers a line of gifts and accessories, including seasonal and/or themed gift boxes.

Aesop

Aesop is a luxury cosmetics brand recognized for its premium face, hair and body care products and the shopping experience it offers its consumers in its exclusive stores.

The Aesop brand’s product portfolio includes the following categories:

Skin: Aesop offers a variety of skin care products, including facial cleansers and moisturizers, exfoliation products, facial treatments, and masks, shaving products, and products specifically for the eye and lip area.

Hair: The portfolio includes various hair care products including shampoos, conditioners, treatments, and products for men.

Body: Aesop offers products for the body, including hand care products, body cleansers, body balms, body scrubs, deodorants, mouth rinses, and toothpastes.

Fragrances: Aesop’s product portfolio includes fragrances for everyone, without gender limits, such as Rozu and Hwyl perfumes.

Home: Aesop's home product portfolio includes soaps, oil diffuser blends, room spray flavorings, oil diffusers, pet products, and other products.

Gifts, Kits and Travel: The Aesop brand offers a range of gifts, travel kits and packaging, including gift cards.

Global Presence

The company is a leading beauty company, including the following brands: Natura, Avon, The Body Shop and Aesop. The company’s business is divided into the following segments: Natura &Co LATAM, The Body Shop International, Aesop International, and Avon International.

Natura &Co LATAM: This segment includes all operations under the company’s Natura, Avon, Aesop and The Body Shop brands located in Brazil and Latin America, which account for a significant portion of the company’s operating revenues.

Aesop International: This segment includes all operations under the company’s Avon brand, except those located in Brazil and Latin America, and has sales operations in 49 countries and territories, and distribution in 23 other countries and territories, as of December 31, 2022.

The Body Shop International: This segment includes all operations under the company’s The Body Shop brand, except those located in Brazil and Latin America, present in 80 countries, as of December 31, 2022.

Avon International: This segment includes all operations under the company’s Aesop brand, except those located in Brazil and Latin America, and has a direct presence in 25 countries and three countries through distributors as of December 31, 2022, largely in Asia.

Strategy

The strategy for the Natura brand is focused on the continuous evolution of market share, channel diversification and investment. The main strategy for the Avon brand is to accelerate the integration of the Avon and Natura businesses in Latin America.

The strategy for Avon International is based on the optimization of its geographic presence with a focus on the most profitable markets, correction or discontinuation of markets that dilute profit, and better capital allocation with the aim of keeping the operations of the focus markets healthy.

The Body Shop’s strategy is focused on stabilizing the brand’s main distribution channels. The company is also focused on rebalancing revenues from the main channels.

The strategy for the Aesop brand comprises the maintenance of a balanced financial condition, as well as the acceleration of investments in new markets (such as Aesop’s entrance in the Chinese markets during 2022) and new categories (such as fragrances and skin care).

Operations

Natura

Natura works jointly with suppliers to reduce the environmental impacts of its products by using recycled materials, such as polyethylene terephthalate and glass. Since 2006, Natura has not performed animal testing during the research and development phases of its product production (Natura only performs in vitro and clinical tests), and it does not acquire active ingredients that were tested on animals.

Under the Natura brand, the company offers a full range of cosmetics, toiletries and fragrances for women and men, including skin care products for the face and body, hair care and treatment products, makeup, fragrances, soaps, deodorants, sunscreen, and baby and child care.

As of December 31, 2022, Natura worked with 48 communities, generating social development and income for approximately 10.6 thousand families, based on sustainable production chains. The company has helped to preserve around two million hectares of forest as of December 31, 2022, with the company’s partnerships with organizations, such as the State Secretariat for the Environment of Amapá (Secretaria de Estado do Meio Ambiente do Amapá), the Chico Mendes Institute for Biodiversity Conservation (Instituto Chico Mendes de Conservação da Biodiversidade) and the State Secretariat for the Environment of Amazonas (Secretaria de Estado do Meio Ambiente do Amazonas), in addition to agricultural communities and social organizations of the region. The company works with these organizations by developing initiatives that generate positive impacts for conservation, in areas, such as ‘Reserva Extrativista Medio Juruá,’ ‘Reserva de Desenvolvimento Sustentável Uacarí’ and ‘Reserva de Desenvolvimento Sustentável do Rio Iratapuru.’

The company’s Natura product portfolio includes fragrances, makeup, body and facial care, sunscreen, soaps, deodorants, body oils, hair care and gifts.

Together with its consultants, Natura expanded its sales channels in 2014 through the launch of the company’s e-commerce platform, Rede Natura, in Brazil. The platform was launched in Chile in 2015, Argentina in 2017 and Peru and Colombia in 2019. In 2019, the company also launched Rede Natura in Malaysia as part of a pilot project to internationalize the company’s business. The Rede Natura platform has attracted a new profile of consultant: younger individuals who feel at home in a virtual environment, and who prefer to not deal with operational factors directly, such as payments and delivery of products to customers. In June 2019, the company started its convergence plan, with the objective of enabling consultants to manage their customers’ orders both in the traditional direct selling method and through the e-commerce platform. This unified the company’s online and offline business models and rules. The company also launched the Conta Natura for consultants, an exclusive digital account available on the consultants’ mobile app, which has made the company’s network more inclusive from a digital and financial perspective, in addition to offering a microcredit service.

The company’s e-commerce platform was implemented in Chile in 2015 and in Argentina in 2017. Natura has approximately 1.7 million consultants using Natura’s digital platforms (mobile application and web-based) in Brazil and other Latin American countries as of December 31, 2022. The mobile application contains a number of features which support consultants’ sales, including allowing order entry and access to sales performance records. As of December 31, 2022, 82.1% of Natura’s consultants were using digital platforms.

In 2016, Natura opened physical stores in the city of São Paulo to improve the shopping experience of the company’s consumers.

As of December 31, 2022, Natura had stores in Brazil and outside Brazil (Chile, Argentina and United States). In addition, Natura is growing through a franchise model in Brazil, named ‘Aqui tem Natura.’ As of December 31, 2022, Natura had franchised stores in Brazil.

Avon

Avon is a global manufacturer and marketer of beauty and related products. Avon conducts its business in the highly competitive beauty industry and competes against other CPG and direct-selling companies to create, manufacture and market beauty and non-beauty-related products.

Avon’s product categories are Beauty and Fashion & Home:

Beauty: Consists of skin care, fragrance and color (cosmetics).

Fashion & Home: Consists of fashion jewelry, watches, apparel, footwear, accessories, gift and decorative products, housewares, entertainment and leisure products, children’s products and nutritional products.

Avon’s business is conducted primarily in one channel, direct selling, with a strategy to expand to omnichannel. As of December 31, 2022, Avon’s operations outside the U.S. were conducted primarily through subsidiaries in 49 countries and territories. Outside of the U.S., Avon’s products were also distributed in 23 other countries and territories.

Unlike most of its CPG competitors, which sell their products through third-party retail establishments (e.g., drug stores and department stores), Avon primarily sells its products to the ultimate consumer through the direct-selling channel, with a strategy to expand to omnichannel. Sales of products are made to the ultimate consumer principally through direct selling by representatives, who are independent contractors and not Avon’s employees.

The Body Shop

The Body Shop is a global beauty brand and a certified B Corp. The Body Shop seeks to make positive change in the world by offering high-quality, naturally inspired skincare, body care, hair care and make-up produced ethically and sustainably.

The Body Shop operated retail locations in 83 countries as of December 31, 2022. The Body Shop-branded product portfolio includes the following categories of products:

Body Care: The Body Shop offers body care products including body butters, lotions, yogurts, feet and hand washes, body and massage oils, among other products.

Bath and Shower: The Body Shop’s bath and shower portfolio includes products, such as shower gel, soap, body scrubs, body wash, shower cream and bath foam.

Haircare: The Body Shop offers shampoo, conditioners, scalp treatments, among other hair products.

Skin Care: The Body Shop offers quality and efficacy-driven skin care, including moisturizers, masks, cleansers, serums, toners, anti-blemish solutions, among others.

Makeup: The Body Shop offers face and color makeup, including foundation, mascara, lipstick, concealers, eye liners and eye shadow, bronzing, sustainably sourced brushes and tools, among others.

Fragrance: The Body Shop scents include Eau de Parfum, Eau de Toilette, and mists, as well as home fragrances.

Gifts and Accessories: The Body Shop offers a line of gifts and accessories, including seasonal and/or thematic gift boxes.

The Body Shop’s owned and franchised stores make up its largest sales channel. Also, The Body Shop has 61 e-commerce platforms and approximately 35,300 consultants, in its at-home (direct sales) channel. The Body Shop is present in 83 countries and had owned and franchised stores as of December 31, 2022.

Aesop

Aesop is a luxury cosmetic brand founded in Australia, in which the company acquired a majority stake in 2012. The company completed its acquisition of Aesop in 2016. The Aesop brand is recognized for the premium products it develops and for the shopping experiences it offers to its consumers. The high-quality formulations, based on botanical ingredients, are all scientifically tested for safety.

Like the other brands in the company’s group, Aesop seeks to improve the company’s practices of reducing environmental impact, as well as carrying out philanthropic missions around the world. As a result, the company launched the Aesop Foundation in 2017.

The company’s major sales channel under the Aesop brand is through Aesop’s retail channel, comprising signature stores and concession department store counters. Aesop’s retail locations are uniquely designed by renowned architects, aiming to create the best shopping experience for the company’s customers. The Aesop brand’s products also are sold through e-commerce (both through its own website and other third-party e-commerce platforms, such as the T-mall in China and the gifting platform Kakao in South Korea), and through certain wholesalers.

As of December 31, 2022, the Aesop brand was present in Asia, Oceania, Europe, the Middle East and the Americas, in 25 countries directly and three countries through distributors, with signature stores, concession department store counters and wholesale department stores.

The company’s Aesop-branded product portfolio includes the following categories of products:

Skin: Aesop offers a variety of Aesop-branded skin care products, including facial cleansing and moisturizing products, exfoliating products, treatments and masques, shaving products, and products specifically for eyes and lips.

Hair: Aesop’s portfolio includes several hair care products, including shampoo, conditioners, treatments and grooming products.

Body: Aesop offers body products, including hand care products, body cleansers, body balms, body scrubs, deodorant, mouthwash and toothpaste.

Fragrance: Aesop’s product portfolio includes fragrances for both women and men.

Home: Aesop’s home portfolio includes products, such as soap, oil burner blends, room sprays, an oil burner, animal products and other products.

Gifts, Kits and Travel: The Aesop brand offers a line of gifts, travel kits and packages, including gift cards.

Distribution Processes

Natura

The company distributes Natura-branded products through direct sales channel. The company has opted for the direct sales channel due to the company’s belief in the power of sales through relationships, which allows greater interaction between the buyer and the seller, thereby providing a more individualized service. This commercial model has been adopted in Brazil, Argentina, Chile, Peru, Colombia and Mexico. Accordingly, the company’s products are distributed through a network of approximately 2.05 million consultants as of December 31, 2022, as shown in the table below:

The consultants use a catalogue of Natura products, or the Natura Magazine, available in both print and digital form, to present and resell products to their clients. Natura Magazine offers almost all of the products in Natura’s portfolio, as well as the suggested sale price to the consumer, even though Natura consultants are free to establish prices and sales conditions for the final consumer. Natura Magazine is an important marketing tool for the brand and transmits Natura’s beliefs and values, as well as the concepts of each sub-brand.

In order to better communicate and strengthen the relationship with consultants, the company is also investing in a mobile application and in the Natura Network (an online business). With these tools, consultants can view Natura Magazine, place orders, receive online training, and check their default status and other activities.

Natura offers its products through a direct sales model with high levels of service. In 2018, the company transformed this direct selling model, renaming it to ‘Relationship Sales Model,’ which is now guided by three core principles: Prosperity, Partnership and Purpose.

The new model offers progression levels to consultants, who begin as Seeds, and as they improve their performance, progress to Bronze, Silver, Gold and Diamond. At each new level, their sales margin increases, and they also have access to distinct benefits, such as training courses, awards and a recognition plan. Other progression options offered to consultants include the opportunity of becoming a Business Leader (upon reaching the Silver level), a position that combines the sale of products with the task of leading a group of consultants and assisting them in developing their business. Business Leaders, like consultants, do not have labor ties with the company and are not exclusive to Natura. Consultants with an entrepreneurial profile and high sales volumes also have the opportunity to launch a Natura franchise store (named ‘Aqui tem Natura’), thereby becoming Beauty Entrepreneurs.

In the year ended December 31, 2022, approximately 1.8 million consultants from Brazil and other Latin American countries used the company’s digital platform, which is available in both a mobile and web browser format.

To encourage Natura consultants to provide quality service in their resale and product consulting activities, Natura invests in recognition and training on the brand, products and categories, especially training relating to the fragrance, face care and makeup categories. Natura’s direct sales model has been adapted to the regional characteristics of each country. For this reason, although Natura operates the same sales model within Brazil, it operates different direct sales models in each country throughout Latin America.

Avon

During 2022, the company had sales operations in 49 countries and territories, and distributed products in 23 other countries and territories.

Unlike most of its CPG competitors, which sell their products through third-party retail establishments (e.g., drug stores and department stores), Avon primarily sells its products to the ultimate consumer through the direct-selling channel, with a strategy to expand to omnichannel. Sales of products are made to the ultimate consumer principally through direct selling by representatives, who are independent contractors and not employees of Avon. As of December 31, 2022, Avon had approximately 4 million Active Representatives (calculated as the number of representatives submitting an order in a sales campaign, totaled for all campaigns during the year ended December 31, 2022 and then divided by the number of campaigns).

Avon employs certain web-enabled systems to increase Representative support, which allow Representatives to run their business more efficiently and also allow Avon to improve its order-processing accuracy. For example, in many countries, representatives can utilize the internet to manage their business electronically, including order submission, order tracking, payment and communications with Avon. In addition, in many markets, representatives can further build their own business through personalized web pages provided by Avon, enabling them to sell a complete line of Avon products online. Self-paced online training also is available in certain markets. Avon is actively deploying and training the representatives on additional digital tools and sales methods to help increase its customer reach.

In some markets, particularly in the Asia Pacific, Avon uses decentralized branches, satellite stores and independent retail operations (e.g., beauty boutiques) to serve representatives and other customers. Representatives come to a branch to place and pick up product orders for their customers. The branches also create visibility of the Avon brand, channel with consumers and help reinforce Avon’s beauty image. In certain markets, Avon allows its beauty centers and other retail-oriented and direct-to-consumer opportunities to reach new customers in complementary ways to direct selling. Avon increasingly utilizes e-commerce and markets its products through consumer websites.

The Body Shop

The company relies on a multichannel distribution strategy, based around a franchise network, to offer the company’s products under The Body Shop brand, with the majority of the company’s revenue being generated through owned stores, franchised stores, e-commerce and at-home, among others. The company relies on the following sales channels:

Owned Stores: The company operates with a network of stores located in Europe, Asia and Oceania, and North America.

E-commerce: Online sales accounted for approximately 13% of The Body Shop’s net revenue in the year ended December 31, 2022.

At-home: At-home sales accounted for approximately 9% of The Body Shop’s net revenue in the year ended December 31, 2022.

Head Franchise and Subfranchise Markets: Head franchise markets refer to territories where the company’s operations are run by a third party, ‘Head franchisee.’ Some of these markets are Master franchisee grants with a right to grant subfranchises. Most third-party franchise markets are direct franchisee agreements only. In certain markets, the franchise grant is also extended to franchisee e-commerce, third-party e-commerce, and selective wholesale within department stores. In head franchise markets, the company sells its products under The Body Shop brand via a network of stores operated by third-party franchisees. The company has a strong and long-standing relationship with the company’s head franchisees. Subfranchise consists of a network of countries where the company operates directly.

Other Channels: This includes wholesale channel, which accounted for approximately 2% of net revenue for the year ended December 31, 2022.

Aesop

Aesop operates largely with a direct-to-consumer retail sales model with Aesop brand products sold across 25 countries directly and three countries through distributors as of December 31, 2022 in Oceania, Asia, Europe and the Americas, primarily through signature stores and department stores.

Aesop takes a meticulous approach to product development, store design and customer service, in particular within its Signature Store and Department Store Counter environments where Aesop employs over 2,500 consultants and store managers. The focus is on developing trusted relationships with customers through the consultation process, with consultants recommending a prescription of products for a customer’s specific skin type and making thoughtful suggestions of other products that may complement their preferences.

Aesop.com enables customers not only to purchase across the entire Aesop product range but also to experience a deeper exploration of Aesop with online tutorials on skin care rituals and Aesop publications, such as ‘the Ledger’ and ‘the Fabulist,’ which are curated collections of fiction and non-fiction content.

While Aesop takes a customer-centric view of its business, the sales channels through which Aesop serves its customers can be broken down as follows:

Retail Locations: Retail (signature stores and concession department store counters) remain the primary sales channel, contributing 69% of total sales in the year ended December 31, 2022, through signature store locations, and concession department store counters.

Digital: Aesop operates its own online channel, Aesop.com, and through the third-party channel Tmall, an online channel in mainland China and Hong Kong, and Kakao, an online gifting platform in Korea.

Wholesale: Aesop sells through a number of other wholesale channels, including through third-party online resellers, amenity accounts with hotels and restaurants, as well as other physical multibrand retailers.

Logistics Network

Natura

After the company’s Natura-branded products are manufactured in the industrial unit, large volumes are transferred to the warehouse (which functions as a hub). Later the company’s products are sold either to Natura Comercial Ltda. to serve retail stores, or to Natura Cosmeticos to be transported and stored at the company’s distribution centers in Brazil or exported to distribution centers and warehouses in other Latin American countries, France and the United States.

Natura’s logistics network is as follows:

Brazil: Seven distribution centers located in São Paulo (state of São Paulo), Matias Barbosa (state of Minas Gerais), Uberlândia (state of Minas Gerais), Murici (state of Alagoas), Canoas (state of Rio Grande do Sul), Simões Filho (state of Bahia), Castanhal (state of Pará) and one warehouse (hub) in Itupeva (state of São Paulo); and

Other regions operations: based out of five distribution centers (Argentina, Chile, Peru, Colombia and Mexico).

The company owns the equipment that sorts orders made by Natura consultants in these distribution centers, although the buildings where this equipment is installed are owned by third parties.

In addition to the hub, the company operates with seven distribution centers throughout Brazil.

Avon

Avon’s principal properties worldwide consist of manufacturing facilities for the production of Beauty products, distribution centers where administrative offices are located and where finished merchandise is packed and shipped to representatives in fulfilment of their orders, and one principal research and development facility located in Suffern, New York.

The Body Shop

The company has eight regional distribution centers dedicated to the delivery of the company’s products under The Body Shop brand: two in the United Kingdom, one in Germany, one in Singapore and one in the United States. The company also has distribution centers located in Hong Kong, Japan and Australia. Five of these centers are third-party providers located in Germany, Singapore, Hong Kong, Australia, and Japan; and three are operated by The Body Shop (two in the United Kingdom and one in the United States).

The company’s main U.K. distribution center acts as The Body Shop’s global hub for finished product inventory, thereby allowing for the management of supply to different distribution centers in accordance with the demand in each region. All logistics management is supported by advanced demand planning systems centrally from the U.K. supply chain.

The U.K. distribution center (including the satellite distribution center) manages five channels: e-commerce, at-home (direct sales), company markets, wholesale markets and franchise. The main U.K. distribution center is equipped with cutting-edge sorting technology, is highly automated and consumes very little energy, thereby contributing to productivity gains and reducing the cost of each order. The Asia Pacific franchise markets are shipped from the U.K. distribution center, as well as from the Singapore distribution center.

The Body Shop’s U.S. distribution center, located in Wake Forest, North Carolina, manages four channels for North America: e-commerce, company markets, at-home (direct sales) and wholesale markets. The company’s U.S. distribution center replenishes all stores across the United States and Canada and ships directly to e-commerce and wholesale customers in both countries.

The company’s logistics in Germany were established in 2019 in the form of a third-party logistics center and partners with Dachser Logistics to support the EU market, considering the continuing uncertainty surrounding trade negotiations between the EU and the U.K. following Brexit. This distribution center supports the EU e-commerce, company markets and franchise businesses.

The Singapore and Australia businesses both use Bollore as their third-party logistics provider supporting local markets within these regions.

The Japan business uses Hitachi as their third-party logistics provider supporting company stores and e-commerce channels.

All deliveries are tracked to secure service levels and compliance with contracts.

Aesop

Aesop manufactures the finished goods in industrial units owned by third-party manufacturers. Once manufactured, the products are shipped to one of two centralized distribution warehouses (hubs) in Melbourne, Australia in the Netherlands, and later sold to Aesop subsidiaries in Oceania, Asia, Europe and the Americas. Products are exported to regional distribution warehouses to supply the subsidiaries. Subsidiaries in Australia and New Zealand are supplied by the Melbourne distribution warehouse, and subsidiaries in Europe are supplied by the Netherlands warehouse. Products are transported to the regional distribution centers in accordance with the demand in each region. All supply management is supported by advanced demand planning systems implemented in 2019. The distribution centers are each owned by third-party logistics providers and are not owned by Aesop. The warehouse management systems of each distribution center are integrated into Aesop’s enterprise resource planning system.

The Melbourne hub acts as a point for receiving and consolidating ingredients, components and finished product inventory, thereby allowing for management of supply from different suppliers and finished goods factories. The regional distribution centers are responsible for (with instructions from Aesop) the sorting and delivery to retail stores and wholesale customers.

Aesop’s logistics network is as follows:

Australia & the Netherlands: Two central distribution warehouses (supplying Australia/New Zealand and Europe respectively); and

International: Seven additional regional distribution centers located in the United States (supplying the United States and Canada), Hong Kong (supplying Hong Kong and Macau), Taiwan, Singapore (supplying Singapore and Malaysia), South Korea, Japan and China.

Suppliers

The company’s main suppliers for the Natura brand include Gera – Gestão de Modelos, Wheaton Brasil Vidros Ltda, IFF Essencias e Fragrancias Ltda, Cia Refinadora da Amazonia, Givaudan, Prebel SA, Aptar, Andromeda, and Vitro e Symrise.

The Body Shop’s main suppliers include Fareva Fillcare, Avon (Poland), Meiyume, S&J International, Cosmint SpA, Spectra Private Brands (Asia), Tatra Spring, Soapworks Limited, Zhongshan Fulin Cosmetics and Meiyume Thailand.

Aesop’s main manufacturing suppliers are Delta Laboratories, Ensign Laboratories, Ross Cosmetics, Australian Botanical Products, Baxter Laboratories, Jacomo and Briemar Nominees.

The main component and ingredient suppliers are Visy Pet Pty Ltd, Techpack Pty Ltd, Norquest Brands Pvt. Ltd., Watermark Products, Gunn & Taylor Printers Pty Ltd, Le Nez Limited, Dutjahn Sandalwood Oils Pty Ltd, Linhardt GmbH & Co. KG, Sasu Listen to Material, Sunoprod S.R.L and Metallgiesserei Wilheml Simon GmbH.

Competition

Natura &Co LATAM

In the fragrance and makeup categories, the main competitors are O Boticário, Mary Kay and Hinode. For body and skin care, the main competitors are Beiersdorf AG (specifically the Nivea brand) and Unilever. For hair care, the main competitors are Unilever, L'Oreal, Colgate-Palmolive and Johnson & Johnson.

The Body Shop

On a global level, The Body Shop’s competitors include major beauty and personal care brands, such as L’Oreal Paris (L’Oreal Groupe), Nivea (Beiersdorf AG), Dove (Unilever Group), L’Occitane and Bath & Body Works.

In the Asia-Pacific region, one of The Body Shop’s key competitors is Innisfree, which offers a variety of products, from skincare to makeup, hair care and fragrances, and prices that are generally lower than its competitors. Other key brands in this region include Wardah (Indonesia), Lakme (India) and DHC (Japan).

In Europe, The Body Shop’s competitor brands include Lush, Rituals and L’Occitane.

Aesop

Aesop’s main competitors include Estee Lauder, Clinique, LancÔme, Clarins, Shiseido, Kiehl’s and La Mer.

Seasonality

In Brazil, the company observes peaks in demand in the second and fourth quarters (year ended December 2022): during the weeks leading up to Mother’s Day, which occurs during the first half of the month of May; and in November, in the run up to Christmas sales and Black Friday-type sales, which are the company’s most significant peaks in demand. The company’s international operations are subject to the same kind of seasonality, but the timing of the Mother’s Day sales peak varies depending by country.

Intellectual Property

Trademarks

The Natura, The Body Shop, Aesop and Avon trademarks are Natura &Co’s most important trademarks:

The Natura trademark was considered a highly renowned brand in 2005 by the Brazilian National Institute of Intellectual Property (Instituto Nacional de Propriedade Intelectual), or INPI, meaning that, as a brand, the company enjoys significant recognition in all classes of products and services. With this recognition, the Natura trademark benefits from special protection in Brazil. The INPI renewed this recognition in 2010, and subsequently in 2016 for a period of 10 years. In addition to Brazil, the Natura trademark is registered in the following countries and regions, among others: Argentina, Chile, Colombia, Peru, Mexico, Malaysia, France, the United States and the EU.

The Body Shop trademark is Natura &Co’s most important trademark under The Body Shop brand. This trademark, The Body Shop ‘Pod Device’ logo, and many other products, campaigns and marketing brands are registered worldwide, including in the United Kingdom, the EU, the United States, Canada, Brazil, Australia, China, Hong Kong, South Korea and Japan.

The Aesop trademark is Natura &Co’s most important trademark under the Aesop brand. This trademark is registered as both a word mark and/or with Aesop’s distinctive macron across Aesop’s existing markets and planned market entries, including Europe, the United States, Canada, the United Kingdom, Australia, Japan, South Korea and Brazil. Several of Aesop’s more distinctive product names have been registered as trademarks in some of Aesop’s key global markets.

The Avon trademark is Natura &Co’s most important trademark under the Avon brand. The Avon trademark is registered worldwide, including in the United States, Canada, the EU, the United Kingdom, France, Japan, China and Brazil, where the trademark was considered a highly renowned brand in 2019 by the INPI. With this recognition, the Avon trademark also benefits from special protection in Brazil. Avon’s intellectual property rights, including trademark rights, are subject to an Intellectual Property License Agreement, or the ‘New Avon IPLA,’ by which Avon has licensed all intellectual property rights used in its North America business as of March 1, 2016 to New Avon Company (formerly New Avon, a privately held company majority owned and managed by Cerberus NA Investor LLC, an affiliate of Cerberus), now a subsidiary of LG Household & Healthcare, on an exclusive basis with respect to the sale of beauty, wellness, fashion, and home products in the North America region, including the United States of America (including its possessions and territories), Canada, and some Caribbean countries with the exception of the Dominican Republic. Certain of Avon’s Japan and Korea trademarks and domain names are also subject to a non-exclusive, royalty-bearing Trademark License Agreement between Avon and FMG & Mission Co., Ltd (Japan) (formerly Avon Products Company Ltd. (Japan)) dated December 18, 2017.

As of December 31, 2022, Natura &Co had 935 trademarks registered and 76 trademark registration requests pending in Brazil, and 22,349 trademarks registered and 1,697 trademark registration requests pending outside of Brazil.

Registration and Renewal

In Brazil, registration of a brand with the INPI grants the brand owner the exclusive right to use the brand throughout Brazil for an initial 10-year period, which may be extended by successive 10-year periods. During the registration process, the applicant has the right to the use of the relevant brands for identification of its products or services.

Trademarks registered in other countries are subject to the legislation of the relevant jurisdiction. Natura &Co uses a computerized system to monitor trademark expirations and to manage its portfolio.

Patents

As of December 31, 2022, Natura &Co had 791 patents granted and 224 patent registration requests pending worldwide.

Industrial Designs

As of December 31, 2022, Natura &Co had 123 industrial designs registered and 31 industrial design registration requests pending worldwide.

Domain Names

Natura &Co and its subsidiaries are the holders of certain domain names in Brazil and abroad, including ‘natura.com,’ ‘thebodyshop.com,’ ‘aesop.com,’ and ‘avonworldwide.com.’ Avon also owns ‘avon.com’ subject to an exclusivity granted to New Avon Company with respect to the marketing and sale of products in the North America region.

Government Regulation

The company is subject to the U.S. Foreign Corrupt Practices Act, or the FCPA, as well as other countries’ anti-corruption and anti-bribery regimes, such as the U.K. Bribery Act.

History

Natura &Co Holding S.A. was founded in 1969. The company was incorporated in 2019 under the laws of Brazil.

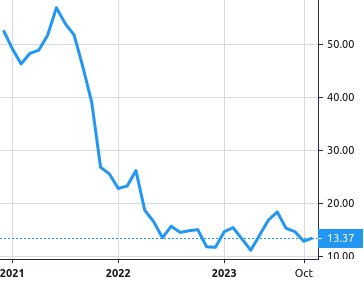

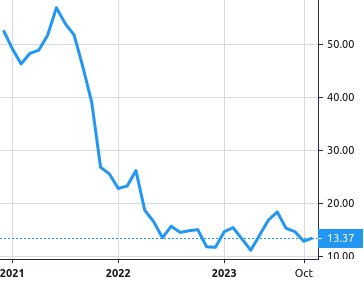

Stock Value

Stock Value