About Pampa Energía

Pampa Energía S.A. (Pampa) operates as an independent energy integrated company in Argentina, participating in the electricity and the gas value chains.

The company engages in the generation and transmission of electricity; oil and gas exploration and production; petrochemicals and hydrocarbon commercialization and transportation; and oil distribution.

Segments

The company operates through Electricity Generation, Oil and Gas, Petrochemicals, and Holding and Other Business segments.

Electricity Generation: This segment principally includes the company's direct and indirect interests in HINISA, HIDISA, Greenwind, VAR, CTB, TMB, TJSM and through its own electricity generation activities through thermal plants Güemes, Piedra Buena, Piquirenda, Loma de la Lata, Genelba and Ecoenergía, Pilar, I. White, the Pichi Picún Leufú hydroelectric complex and PEPE II, PEPE III, and PEPE IV wind farms.

Oil and Gas: This segment principally includes the company's interests in oil and gas areas and through its direct and indirect interest in CISA.

Petrochemicals: This segment includes the company's own styrenics operations and the catalytic reformer plant operations conducted in local plants.

Holding and Other Business: This segment principally includes interests in joint businesses CITELEC and CIESA and their respective subsidiaries, which hold the concession over the high voltage electricity transmission nationwide and over gas transportation in the South of the country, respectively, interests in the associates OCP and Refinor, holding activities.

Generation Business

The company's generation installed capacity reached approximately 5,088 MW as of December 31, 2022.

The company's power generation assets include Central Termica Güemes S.A. (CTG), Central Termica Piquirenda (CTP), Central Termica Parque Pilar (CTPP), Central Termica Loma La Lata S.A. (CTLL), Central Termica Ingeniero White (CTIW), Central Piedra Buena S.A. (CPB or Piedra Buena), Central Termica Genelba (CTGEBA), Pichi Picún Leufú Hydroelectric Complex (HPPL), EcoEnergía, Parque Eólico Pampa Energía II (PEPE II), Parque Eólico Pampa Energía III (PEPE III), Parque Eólico Arauco II (PEA), Parque Eólico Ingeniero Mario Cebreiro (PEMC); and interests in Hidroelectrica Los Nihuiles S.A. (HINISA), Hidroelectrica Diamante S.A. (HIDISA), and CT Barragán S.A. (CTB).

Its generation operations derive revenues from the sale of electricity in the spot market and under term contracts, including Energía Plus contracts and wholesale electricity market (WEM) supply agreements.

Thermal Generation Plants

CTGEBA

CTGEBA, a thermal generation plant located at the central node of the Argentine electricity grid, in Marcos Paz, in the western part of the Greater Buenos Aires area, consisted of two combined cycle (CC) gas-fired generating units, one with a 684 MW power capacity, which consists of two gas turbines of 223 MW each and a 238 MW steam turbine, repowered in 2020. The second CC consists of a gas turbine of 182 MW power capacity, known as Genelba Plus, as well as a gas turbine of 188 MW installed in 2019, and the 199 MW steam turbine incorporated in 2020. CTGEBA's CC is sold in the spot market, whereas Genelba Plus' gas turbine energy is sold under Energía Plus, and the new gas turbine incorporated in 2019 is sold in the spot market until the commissioning of the CC, when it will start to be sold under a power purchase agreement (PPA). The total installed capacity of the CTGEBA complex amounts to 1,253 MW, which represents 2.9% of Argentina's installed capacity.

CTEB

CTEB is located in the city of Ensenada, province of Buenos Aires, owned by CTB, a company that the company jointly co-controls with YPF S.A. (YPF). The plant consists of two open cycle gas turbines with a total installed capacity of 567 MW; and a steam turbine that completed the CC with up to a 260 MW capacity, which entered into commercial operations on February 22, 2023. Both have a total installed capacity of 827 MW, which represents 2% of the installed capacity in Argentina.

CTLL

CTLL, a gas-fired thermal generation plant located in the province of Neuquen which consists of three gas turbines with an installed capacity of 375 MW, a 180 MW Siemens steam turbine, a 105 MW General Electric aero-derivative gas turbine, a 105 MW General Electric gas turbine, and 15 MW from MAN gas engines. CTLL has an installed capacity of 780 MW, which represents 1.8% of Argentina's installed capacity.

CPB

CPB is a thermal generation plant located in Ingeniero White, Bahía Blanca, in the province of Buenos Aires. CPB is an open-cycle thermal generation plant that consists of two identical conventional units (Unit 29 and Unit 30) with an installed capacity of 310 MW each. CPB can be powered either by natural gas or by oil No.6 (though it was originally designed and partially equipped to burn coal as well). The plant stores up to 60,000 m3 of fuel oil in two separate storage tanks and owns, operates, and maintains a 22-kilometer natural gas pipeline that is connected to the main pipeline of Transportadora de Gas del Sur S.A. (TGS). CPB sells electricity to the spot market. CPB has an installed capacity of 620 MW, which represents 1.4% of Argentina's installed capacity.

CTG

CTG, a thermal gas-fired generation plant located in General Güemes, in the province of Salta. It has a total installed capacity of 361 megawatt (MW), including 261 MW from steam generation units and 100 MW from a gas combustion turbine under the Energy Plus Program, which accounts for 0.8% of Argentina's installed capacity.

CTIW

CTIW, a thermal generation plant consists of 6 dual-fuel (natural gas or fuel oil) Wärtsilä engines located in Ingeniero White, Bahía Blanca, in the province of Buenos Aires. The engines are highly efficient, with a 46% performance rate. The plant is interconnected to the 132 kV grid through Transba substation. Liquid fuel is supplied using CPB's unloading and storage facilities, and natural gas is also provided through CPB's internal facilities. CTIW has an installed capacity of 100 MW, that represents 0.2% of Argentina's installed capacity.

CTPP

CTPP, a thermal power generation plant at Pilar Industrial Complex, located in Pilar in the northern greater Buenos Aires area, which comprises six Wärtsilä motor generators (Wärtsilä W18V50DF) with an approximate 43% performance rate, and which may consume either fuel oil stored in own tanks or natural gas supplied through a dedicated gas pipeline which is connected with Transportadora de Gas del Norte S.A.'s main gas pipeline. CTPP has an installed capacity of 100 MW, which represents 0.2% of Argentina's installed capacity.

CTP

CTP, a thermal gas-fired generation plant located at Piquirenda, General San Martin, in the province of Salta, with an installed capacity of 30 MW, which represents 0.1% of Argentina's installed capacity.

EcoEnergía

EcoEnergía is a co-generation power plant located at TGS' General Cerri complex in Bahía Blanca, in the province of Buenos Aires. The plant consists of a steam turbine and sells electricity in the Energía Plus market. EcoEnergia has a power capacity of 14 MW, which accounts for 0.03% of Argentina's installed capacity.

Hydroelectric Generation Plants

The company holds interests in three hydroelectric generation plants Hidroelectrica Diamante (through its subsidiary HIDISA), Hidroelectrica Los Nihuiles (through its subsidiary HINISA) and, and fully owned HPPL.

HIDISA

The company owns 61% of the voting capital stock of HIDISA, a hydroelectric generation company, located in the province of Mendoza.

HIDISA operates under a provincial concession for the hydroelectric use of water from the Diamante River, located in the department of San Rafael in the province of Mendoza, and under a national concession for the generation, sale, and bulk trading of electricity from Diamante's hydroelectric system (the Diamante System). The Diamante System consists of three dams and three hydroelectric power generation plants (Agua del Toro, Los Reyunos, and El Tigre). The Diamante System covers a total distance of approximately 55 km with a height differential between 873 m and 1,338 m. HIDISA has an installed capacity of 388 MW, which represents 0.9% of the installed capacity in Argentina. Also, HIDISA owns 0.9% of the capital stock of Termoelectrica Jose de San Martín S.A. (TJSM) and 0.8% of the capital stock of Termoelectrica Manuel Belgrano S.A. (TMB).

HINISA

The company owns 52.04% of the voting capital stock of HINISA, a hydroelectric generation company, located in the province of Mendoza.

HINISA operates under a provincial concession for the hydroelectric use of water from the Atuel River, located in the department of San Rafael in the province of Mendoza (approximately 1,100 km southwest of Buenos Aires) and under a national concession for the generation, sale, and bulk trading of electricity from the Los Nihuiles' hydroelectric system (the Nihuiles System). The Nihuiles System consists of three dams and three hydroelectric power generation plants (Nihuil I, Nihuil II, and Nihuil III), as well as a compensator dam, which is used to manage the system's water flow for irrigation purposes. The Nihuiles System covers a total distance of approximately 40 km with the grid's height ranging from 440 m to 480 m. HINISA has an installed capacity of 265 MW, which represents 0.6% of the installed capacity in Argentina. HINISA also owns 1.6% of the capital stock of TJSM and 1.4% of the capital stock of TMB.

HINISA and HIDISA Concessions: HINISA's and HIDISA's main purpose is the generation, sale, and bulk trading of electric power through the exploitation of hydroelectric systems pursuant to the terms and conditions of the Provincial concessions granted by the Argentine Government of the province of Mendoza with similar terms and conditions (for HINISA and HIDISA) and at each company's own risk for the hydroelectric exploitation of the Atuel River, in the case of HINISA, and the Diamante River, in the case of HIDISA. The term of the HINISA and HIDISA concession agreements is 30 years, starting from June 1, 1994 in the case of HINISA and October 19, 1994 in the case of HIDISA. Thus, the original concessions will expire in 2024.

HPPL

HPPL, a hydroelectric power generation located in the Comahue region, in the province of Neuquen, which has three electricity generating units with an installed capacity of 285 MW, that represents 0.7% of Argentina's installed capacity. It has a total length of 1,045 m, a total height of 54 m at the deepest point of the foundation, and a crest at 480.2 m above sea level.

HPPL Concession: HPPL's main corporate purpose is the generation, sale, and bulk trading of electric power through the exploitation of hydroelectric systems. The term of the HPPL concession agreements is 30 years, starting from August 30, 1999.

Renewable Energy

PEMC

PEMC, a wind farm located in Bahía Blanca, in the province of Buenos Aires that is operated by Greenwind S.A. (Greenwind). The wind farm consists of 29 V-126 Vestas wind turbines, each with a 3.45 MW power capacity and an 87-meter hub height. PEMC has a capacity of 100 MW of renewable energy, which represents 0.2% of Argentina's installed capacity.

PEPE II

PEPE II is the company's second wind farm located in the city of Bahía Blanca, province of Buenos Aires. It consists of 14 V-136 Vestas wind turbines, each with a 3.8 MW power capacity and a 120-meter hub height. PEPE II has an installed capacity of 53 MW of renewable energy, which represents 0.1% of Argentina's installed capacity.

PEPE III and PEPE IV

PEPE III, PEPE II's twin wind farm, is the company's third wind farm located in Coronel Rosales. PEPE III consists of 14 wind turbines. It has an installed capacity of 53 MW of renewable energy, which represents 0.1% of Argentina's installed capacity. PEPE III sells its energy to large electricity consumption users through power purchase agreements (PPAs) executed between private parties.

The wind farm has a committed expansion project, called PEPE IV, which includes the assembly and installation of 18 Vestas wind turbines. In December 2022, the first 4 wind turbines with a capacity of 18 MW begun their operations, and in February 2023, another 4 wind turbines started operating.

PEA

PEA is a wind Farm, located in the province of La Rioja. The wind farm includes 38 Siemens Gamesa G-114 wind turbines, each with a 2.625 MW power capacity and an 80-meter hub height. PEA has a PPA with Wholesale Electric Market Administration Company (CAMMESA) under the RenovAr Program Round 1, and a capacity of 99.75 MW which represents 0.2% of Argentina's installed capacity.

PEPE VI

In February 2023, the company announced PEPE VI, its new wind farm project located 18 km from the city of Bahía Blanca, province of Buenos Aires, next to PEMC and PEPE II. PEPE VI will be built in three stages. The first stage includes the assembly and installation of 21 Vestas wind turbines of 4.5 MW each, the commissioning of which is estimated for the third quarter of 2024.

Oil and Gas Business

Exploration and Production

The company's strategy is to develop profitable oil and gas reserves with social and environmental responsibility. In this segment, the company focuses on the development and monetization of unconventional gas reserves; exploration for reserves replacement; and optimization of operations and existing infrastructure as leverage for new projects.

As of December 31, 2022, the company's combined oil and gas production in Argentina averaged 53.1 thousands of barrels of oil equivalent (boe) per day. Crude oil accounted for approximately 5.3 thousands of boe per day, while natural gas accounted for approximately 346 million standard cubic feet per day, or 57.8 thousands of boe per day; and the company holds a 2.1% direct interest in Oleoductos del Valle S.A. (Oldelval). Oldelval operates main oil pipelines providing access to Allen, in the Comahue area, and the Allen - Puerto Rosales oil pipeline, which allow for the evacuation of the oil produced in the Neuquina Basin to Puerto Rosales (a port in the city of Bahía Blanca) and the supply of the Plaza Huincul and Luján de Cuyo distilleries located in the pipeline's area of influence.

The company also engages in the oil and gas business directly and through investments Oleoducto de Crudos Pesados Ltd. (OCP). For December 2022, the company's consolidated oil and gas production accounted for approximately 1% and 8% of total oil production and gas production in Argentina.

As of December 31, 2022, the company had interests in 18 areas, joint operations (Unión Transitoria) and agreements in Argentina comprising 13 oil and gas production areas and 5 exploration blocks located within exploration areas or pending authorization for production. As of December 31, 2022, the company was directly the contractual operator of eight of the 18 blocks in which it holds equity interest.

Drilling Activities

In 2022, the company's activity was focused on complying with the production commitments within the Plan to Promote Argentine Natural Gas Production (Plan Gas.Ar). The core of the activity was concentrated in the Neuquen Basin, mainly in El Mangrullo, where 20 wells were drilled, and Río Neuquen, with 10 wells drilled.

Oil and Gas Production

The company transports its oil and gas production through several methods depending on the infrastructure available. It uses the oil pipeline system and oil tankers to transport oil to its customers. The company maintains limited storage capacity at each oil site and at the terminals from which oil is shipped.

During 2022, the company's production was concentrated in three basins, such as the Neuquen, San Jorge, and Noroeste. In Argentina, the company owns 517,000 net acres, and in the Neuquen basin - the major basin in the country in terms of oil and gas production -it owns approximately 369,000 net acres (representing 71% of its total acres). The company's most important fields in the Neuquen basin are El Mangrullo, Sierra Chata, Río Neuquen, and Rincón del Mangrullo. As of December 31, 2022, the company lifted hydrocarbons from 895 productive wells in Argentina.

During 2022, the company's average daily production was 5,336 barrels of crude oil and 346 million cubic feet of natural gas.

Exploration

In Argentina, the company owns substantial acreage containing undeveloped unconventional reservoirs, including both tight and shale gas in the Neuquen basin. As of December 31, 2022, it held interests in approximately 223,000 gross exploration acres in Argentina.

Delivery commitments

Natural Gas: The company is committed to providing fixed and determinable quantities of crude oil and natural gas in the near future under a variety of contractual arrangements.

Oil: In November 2022, Oldelval launched a tender in order to assign crude oil producers for a total of 50,000 m3/day of new transportation capacity between Allen-Puerto Rosales, from the period beginning with the pipeline operational entry (estimated on April 2025) and November 2037. Pampa was awarded a capacity of 1,002 m3/day.

Additionally, Oiltanking Ebytem S.A. (an operator of a oil terminal located in Bahia Blanca), launched a storage and dispatch capacity tender with export destination that followed the Oldelval capacity expansion. In this tender, Pampa was awarded with the same capacity as in Oldelval.

Petrochemicals Business

The company's petrochemical operations are entirely based in Argentina where the company owns three high-complexity plants producing styrene, styrene butadiene rubber (SBR) and polystyrene, with a domestic market share ranging between 91% and 99%. The company produces an array of products, such as intermediate gasoline, aromatic solvents, hexane and other hydrogenated paraffinic solvents, propellants for the cosmetic industry, monomer styrene, as well as rubber and polymers for the domestic and foreign markets from natural gas, virgin naphtha, propane, and other supplies.

In Argentina, the company produces styrene, polystyrene and elastomers, and plastics derived from oil production.

The petrochemicals division has various assets, such as an integrated petrochemicals complex at Puerto General San Martín, located in the province of Santa Fe, with an annual production capacity of 50,000 tons of gases (liquefied petroleum gas (LPG)), which is used as raw material, and propellants; 155,000 tons of aromatics; 290,000 tons of gasoline and refines; 160,000 tons of styrene; 55,000 tons of SBR; 180,000 tons of ethyl benzene; and 31,000 tons of ethylene, as well as a polystyrene plant located in the city of Zárate, province of Buenos Aires, with a production capacity of 65,000 tons of polystyrene.

Styrene division

In 2022, monomer styrene sales volumes totaled 47 thousand tons and polystyrene sales volumes totaled 58 thousand tons. In 2022, the company sold 46 thousand tons of rubber.

Reforming Gasoline division

In 2022, octane bases and gasoline sales totaled 216 thousand tons; and 16,000 tons of bases and naphtha were dispatched as toll processing, which were not registered as volume sold. Hexane, paraffin solvents, and aromatics sales volumes totaled 35 thousand tons in 2022. In 2022, propellant sales totaled 11 thousand tons.

Holding and Other Business

This segment consists of the company's direct and indirect interest in TGS, Argentina's major gas transportation company, which owns a 9,233 kilometre-long gas pipeline network and a gas fuel processing plant, General Cerri, with an output capacity of one million tons a year. Furthermore, it jointly controls Compañía de Transporte de Energía Electrica en Alta Tensión Transener S.A. (Transener) with Integración Energetica Argentina S.A. (IEASA). Transener is a company that operates and maintains the Argentine high voltage transmission grid covering 14,648 kilometre of proprietary lines, as well as 6,771 kilometre of Transba-owned high voltage lines. Transener transports 86% of the electricity in Argentina.

Interest in TGS

TGS is the major gas transportation company in Argentina, and it operates the major pipeline system in Latin America. It also engages in the production and sale of natural gas liquids for both domestic and export markets, conducting its business from the General Cerri Complex located in Bahía Blanca, in the province of Buenos Aires. TGS also provides comprehensive solutions in the natural gas area and it has also acted in the telecommunications area through its controlled company, Telcosur.

TGS' Business Segments

Regulated Segment: Gas Transportation

Revenues from this segment result mainly from firm natural gas transportation agreements, whereby the gas pipeline capacity is reserved and paid for regardless of its actual use. TGS provides an interruptible service, where natural gas transportation is subject to the gas pipeline's available capacity. Moreover, TGS provides operation and maintenance services for assets allocated to the natural gas transportation service for the expansions fostered by the Federal Government and held under trusts created for such effects. For this service, TGS receives from customers with incremental natural gas transportation capacities the charge of access and use established by National Gas Regulatory Entity (ENARGAS).

As of December 31, 2022, the total capacity hired on a firm basis amounted to 83.1 million m3/day with a weighted average life of 11 years.

During 2022, TGS executed 148 new contracts, 57 of interruptible transport services, and 91 of exchange and displacement services.

Non-Regulated Segment: Production and Marketing of Gas Liquids

Liquids production and commercialization activities are conducted at the Cerri Complex, located close to the city of Bahía Blanca, supplied by all of TGS' main gas pipelines. Ethane, propane, butane, and natural gasoline are recovered at this complex. TGS sells liquids to both domestic and foreign markets.

Moreover, in addition to seaborne exports, TGS makes inland exports to neighboring countries. Although their volumes are substantially lower than those conducted by sea, they allow TGS to capitalize on a higher operating margin. In 2022, propane and butane deliveries overseas were made in the spot market. Natural gasoline was sold both through term contracts and spot transactions.

Regarding the domestic market, during 2022 TGS continued participating in the Household Gas Bottles' Program and the Propane for Grids Agreement. Prices are regulated by a set of resolutions, provisions, and agreements. Outside these programs, TGS sold 163,625 tons of propane and 13,338 tons of butane, mainly to the reseller market and, to a lower extent, to the industrial, propellant, and automotive market.

In 2022, TGS continued selling ethane under the long-term agreement. Furthermore, in 2022 TGS continued effectively rendering logistic services at the Puerto Galván facilities, selling LPG by inland transport, dispatching approximately 16,156 trucks (372,813 tons) of its products.

Non-Regulated TGS' Segment: Other Services

TGS provides midstream services, which mainly includes treatment, impurity separation, and gas compression. This business segment also includes revenues from telecommunication services provided through its subsidiary Telcosur.

The gathering gas pipeline in the Vaca Muerta formation has a 150-km length, with a 60 million m3 per day transportation capacity and a plant in Tratayen with an initial conditioning capacity of 14,8 million m3 per day. Moreover, to face the increase in flows, there are three projects comprising the installation of two gas conditioning modular plants with a capacity of 3.5 million m3/day each, and a gasoline stabilizer tower; a conditioning plant with a capacity of 6.6 million m3/day; and a 32 km extension of the northern section of the collector gas pipeline (Los Toldos I Sur - El Tapial), with a transport capacity of 17 million m3 per day.

Interest in Transener

Pampa holds 50% of Compañía Inversora en Transmisión Electrica Citelec S.A. (CITELEC's) capital stock, which in turn owns 52.65% of the capital stock of Transener.

Transener is the company in the utility service of high voltage electricity transmission in Argentina at the 500 kV level under an exclusive 95-year concession agreement. It directly operates and maintains 14,926 km high voltage electricity transmission lines and 60 transforming stations, that represent 86% of the high voltage lines of the country.

Transener also indirectly owns one of the seven regional transmission networks in Argentina, the Transba network. The Transba concession grants Transba an exclusive 95-year concession to provide electricity transmission services (from the 66 kV to the 220 kV levels) in the Province of Buenos Aires via trunk lines, which are the main transmission lines that connect to all other lower voltage transmission systems owned and maintained by distribution companies in a certain region, throughout the Transba network spanning approximately 6,771 km and 110 transforming substations.

Transener also generates additional revenues from the operation and maintenance of the fourth line, and services provided to third parties.

Engineering Services

Services related to the Transmission of Electric Energy

Activities relating to the operation, maintenance, and other services, such as specific tests hired by private clients who own transmission facilities, used for private and/or utility services (independent and international transporters) have been conducted by Transener since the beginning of its activity.

Furthermore, Transener also performs tasks, such as bushing replacements, oil analysis, diagnosis tests, optical fiber repairs, electric and magnetic field measurement, implementation of automatisms, line and equipment maintenance of transformer stations, among others.

Communications

In 2022, Transener has continued to provide infrastructure services to different communication companies, including the assignment of dark fiber optics over the system property (line IV), and the lease of space in microwave station and in antenna support structure. In addition, Transener continued support services in operative communication and data transmission to the WEM agents.

Enecor S.A. (Enecor)

Pampa holds a 70% interest in Enecor, an independent power transportation company, which provides operation and maintenance services, by subcontracting Transener, for 21 km of 132 kV double-triad electricity lines from the Paso de la Patria transforming station, in the Province of Corrientes. It is under a 95-year concession, which expires in 2088.

Acquisitions

On August 12, 2022, Pampa Group acquired from its business partner 50% of its indirect stake in Greenwind. Therefore, Pampa Group is the sole shareholder of Greenwind.

On December 16, 2022, the company acquired 100% of Vientos de Arauco Renovables S.A.U. (VAR), a company that operates PEA, located in the Province of La Rioja, with a nominal capacity of 99.75 MW.

On September 30, 2022, the company acquired 100% of the capital stock of Autotrol Renovables S.A., an entity holder of the Wayra I Wind Farm project (registered with the National Renewable Energy Projects Registry, RENPER).

History

The company was incorporated in 1945 under the laws of Argentina. The company was formerly known as Pampa Holding S.A. and changed its name to Pampa Energía S.A. in 2008.

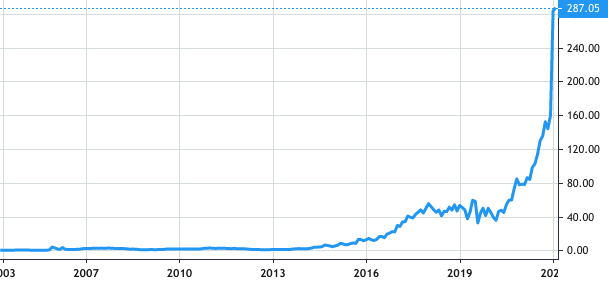

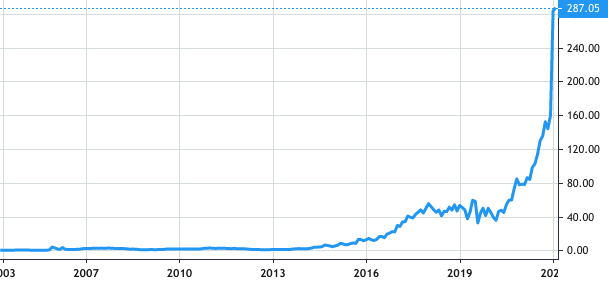

Stock Value

Stock Value