About National Australia Bank

National Australia Bank Limited provides financial services to individuals and businesses in Australia, New Zealand, and internationally. The company provides about 10 million customers with secure, easy and reliable banking services.

The company focuses on priority small and medium (SME) customer segments. This includes diversified businesses, as well as specialised Agriculture, Health, Professional Services, Franchisees, Government, Education and Community service segments, along with Private Banking and JBWere.

The company works to deepen relationships with business customers as a trusted advisor in a dynamic economic environment. The company helps customers secure a home loan and manage personal finances through deposits, credit card or personal loan facilities. It includes the Citi consumer business, acquired in 2022.

In 2023, the company introduced a number of new initiatives to help protect customers from scams and fraud including removing links in text messages, increasing prompts for in-app payments and improved card features to block transactions.

The company serves more than 1.2 million customers across New Zealand with personal and business banking services, through a nationwide network of customer centres, digital and assisted channels. It is New Zealand's largest business bank, one of the largest providers of agricultural financing and has continued to gain market share in personal and business segments.

Strategy

The company's strategic focus is on clear market leadership for Business and Private Banking; simple and digital experiences for Personal Banking; disciplined growth for Corporate and Institutional Banking; personal and SME growth for BNZ, and digital customer acquisition through ubank.

Customers

The company serves customers well is a core part of its strategy. In 2023, the company has provided customers with financial support on 15,354 accounts.

The NAB Assist Customer Support Hub supported 2,635 customers experiencing vulnerability including domestic and family violence, scams, financial abuse, problem gambling and other challenging circumstances.

Segments

Business and Private Banking: This segment focuses on the company's priority small and medium (SME) customer segments. This includes diversified businesses, as well as specialised Agriculture, Health, Professional Services, Franchisees, Government, Education and Community service segments along with Private Banking and JBWere.

Personal Banking: This segment provides banking products and services to customers including securing a home loan and managing personal finances through deposits, credit card or personal loan facilities. Customers are supported through a network of branches and ATMs, call centres, digital capabilities as well as through proprietary lenders and mortgage brokers. Personal Banking results include the financial performance of the Citi consumer business, acquired effective 1 June 2022.

Corporate and Institutional Banking: This segment provides a range of products and services including client coverage, corporate finance, markets, asset servicing, transactional banking and enterprise payments. The division serves its customers across Australia, the United States, Europe and Asia, with specialised industry relationships and product teams. It includes Bank of New Zealand's Markets Trading operations.

New Zealand Banking: This segment provides banking and financial services across customer segments in New Zealand. It consists of Partnership Banking servicing retail, business and private customers; Corporate and Institutional Banking servicing corporate and institutional customers, and includes Markets Sales operations in New Zealand. New Zealand Banking also includes the Wealth franchise operating under the 'Bank of New Zealand' brand. It excludes the Bank of New Zealand's Markets Trading operations. New Zealand Banking results include the financial performance of the New Zealand liquidity management portfolio, effective 1 October 2022.

Corporate Functions and Other: This segment include ubank and enabling units that support all businesses, including Treasury, Technology and Enterprise Operations, Digital, Data and Analytics, Support Units and eliminations.

Geographical information

The company has operations in Australia, New Zealand, Europe, the United States and Asia.

Deposits

The company's deposits include term deposits, on-demand and short-term deposits, certificates of deposit, and deposits not bearing interest.

Investment Portfolio

The company's investment portfolio includes government bonds, notes and securities, semi-government bonds, notes and securities, corporate / financial institution bonds, notes and securities, and other bonds, notes and securities.

Regulations

The company is subject to a commitment in accordance with the rules governing clearing and settlement arrangements contained in the Australian Payments Network Regulations for the Australian Paper Clearing System, the Bulk Electronic Clearing System, the Consumer Electronic Clearing System and the High Value Clearing System. The company also has a commitment in accordance with the Austraclear System Regulations and the Continuous Linked Settlement Bank Rules to participate in loss-sharing arrangements in the event that another financial institution fails to settle. The company is a member of various central clearing houses, most notably the London Clearing House (LCH) SwapClear and RepoClear platforms and the ASX Over-The-Counter Central Counterparty, which enables the Group to centrally clear derivative and repurchase agreement instruments respectively.

History

National Australia Bank Limited was founded in 1834. The company was incorporated in 1893.

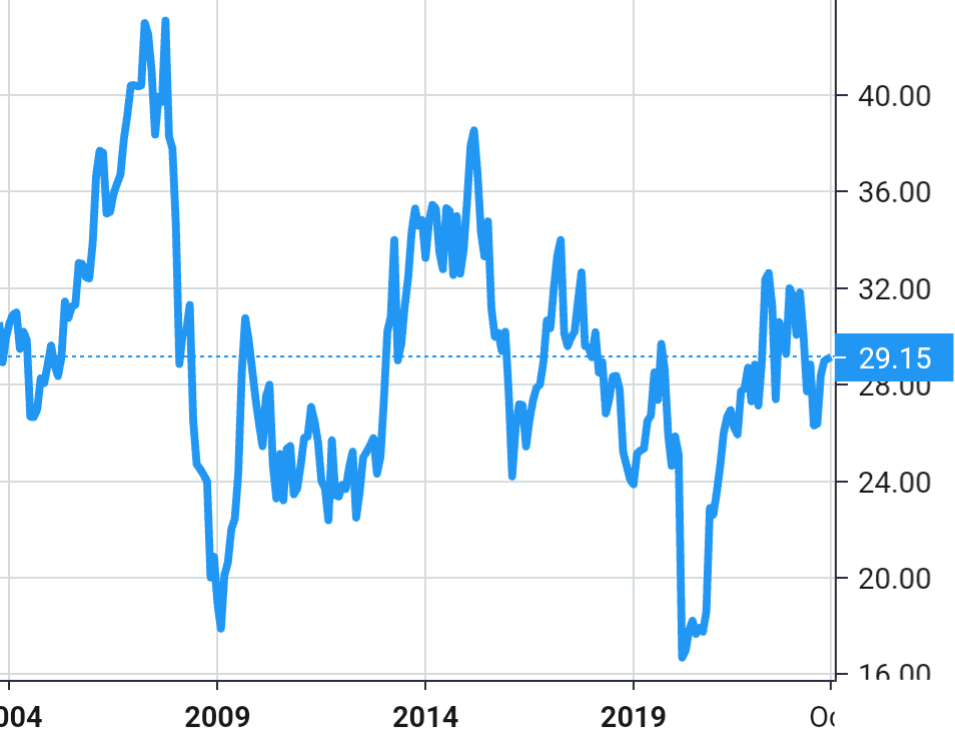

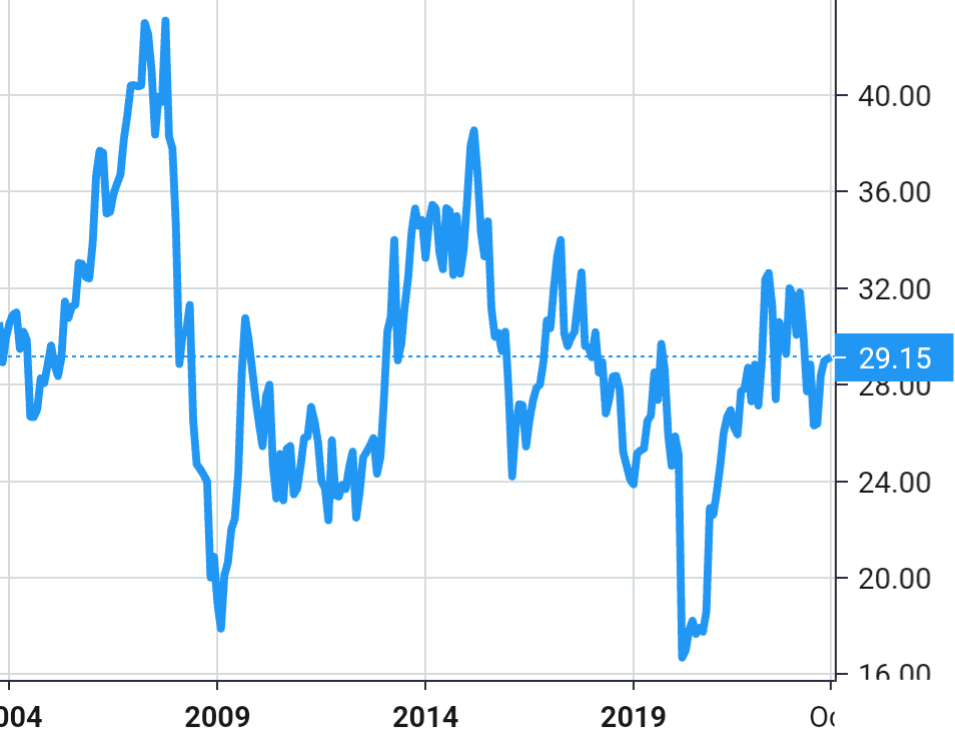

Stock Value

Stock Value