About Coronado Global Resources

Coronado Global Resources Inc. operates as a global producer, marketer, and exporter of high-quality Met coals, which is an essential element in the production of steel.

The company’s coals, transformed in the steelmaking process, support the manufacture of everyday steel-based products, including steel required in the manufacture of renewable energy infrastructure. The company’s mining operations and development projects are located in Queensland in Australia, and in Virginia, West Virginia and Pennsylvania in the United States.

The company’s operations in Australia, or its Australian Operations, consist of the 100%-owned Curragh producing mining property located in the Bowen Basin of Australia. The company’s operations in the United States, or its U.S. Operations, consist of two producing mining properties (Buchanan and Logan), one idled mining property (Greenbrier) and two development mining properties (Mon Valley, and Russell County), primarily located in the Central Appalachian region of the United States, or CAPP, all of which are 100%-owned. The company’s U.S. Operations and Australian Operations are strategically located for access to transportation infrastructure. In addition to Met coal, the company’s Australian Operations sell thermal coal under a long-term legacy contract assumed in the acquisition of Curragh, which is used to generate electricity, to Stanwell Corporation Limited, or Stanwell, a Queensland government-owned entity and the operator of the Stanwell Power Station located near Rockhampton, Queensland, and some thermal coal in the export market. The company’s U.S. Operations also produce and sell some thermal coal that is extracted in the process of mining Met coal.

The company’s core business strategy focuses on the production of Met coal for the North American and seaborne export markets. Met coal is a key ingredient in the production of steel using blast furnaces, and approximately 0.78 ton of Met coal is required to produce one ton of steel. The company has a geographically diverse customer base across a range of global markets. Major consumers of the company’s seaborne Met coal in 2023 were located in high-growth Asian markets, Brazil and Europe. These consumers are all major global steel or Met coke producers. The company is well-positioned in the key high-growth Asian markets (Japan, South Korea and India) as sales to direct end users in the region represented 64.1% of its total revenue, including Tata Steel Limited, or Tata Steel, which accounted for 20.5% of total revenue, in 2023.

Operations

Met Coal

Met coal is primarily used in the manufacture of coke, which is used in the steel-making process, as well as direct injection into a blast furnace as a replacement for coke. Sales of Met coal represented 91.4% of the company’s total coal revenues for the year ended December 31, 2023. Most of the Met coal that the company produces is sold, directly or indirectly, to steel producers. Seaborne Met coal import demand, which is most of the company’s business, can be significantly impacted by the availability of indigenous coal production, particularly in the leading Met coal import countries of China and India, among others, and the competitiveness of seaborne Met coal supply, including from the leading Met coal exporting countries of Australia, the United States, Russia, Canada, and Mongolia, among others.

Thermal Coal

Sales of thermal coal represented 8.6% of the company’s total coal revenues for the year ended December 31, 2023. The thermal coal the company produces is predominantly a byproduct of mining Met coal. The thermal coal the company produces is sold, directly or indirectly, to power stations, predominantly Stanwell, as an energy source in the generation of electricity. Demand for the company’s thermal coal is impacted by economic conditions, environmental regulations, dem and for electricity, including the impact of energy efficient products, and the cost of electricity generation from alternative fuels.

Segments

The company operates through Australia and United States segments.

Diversification

The company has access to the key major markets in both the Atlantic and Pacific basins, and its wide footprint provides flexibility to respond quickly to changes in global market demands. The company has a dedicated global marketing team that generates direct sales for its Met coal. The company’s customer bases pans across a full spectrum of key global markets. The company sells directly to a number of large, high-quality and well-known companies in the steel industry globally. Many of its core customers have been its longstanding customers for over 20 years, and source its products as essential base load, which translates into a long history of contract renewal for such customers. The company is a key supplier to tier one steel mills in Japan, South Korea, Taiwan, India, Europe, Brazil, North America and China.

The company has 100% ownership over all of its operating mines, allowing it full control over all operating decisions. The company’s Met coal production is diversified across high quality products, such as hard coking coal, or HCC, semi coking coals, or SCC, and pulverized coal injection, or PCI, coal from its Australian Operations, and significant production of HCC, comprising high volatile content, or High-Vol, (including sub-category A of High-Vol , or HVA, and sub-category B of High-Vol, or HVB) and coal with low volatile content, or Low-Vol, coals from its U.S. Operations.

Australian Operations—Curragh

Curragh: Curragh is located in Queensland’s Bowen Basin, one of the world’s premier Met coal regions. Curragh produces a variety of high-quality, low-ash Met coal products. The company’s HCC product is recognized by steelmakers for its low-ash content, consistency of quality and favorable coking attributes

Revenues from the company’s Australian Operations represented 58.2% of its total revenue for the year ended December31, 2023.

For the year ended December 31, 2023, 68.7% of the total volume of coal sold by the company’s Australian Operations was Met coal and 31.3% of the total volume of coal sold by its Australian Operations was thermal coal, the majority of which is sold to Stanwell. For the year ended December 31, 2023, Curragh sold 6.7MMt of Met coal into the seaborne coal markets. The majority of customers purchase multiple grades or products and have purchased Curragh coal continuously through all stages of the coal/commodity pricing cycle. In 2023, substantially all of Curragh’s Met coal export sales were made under term contracts.

The U.S. Operations—Buchanan and Logan

The company’s producing mining properties in the United States are located in the CAPP region, specifically in Virginia and West Virginia, which is a highly-developed and active coal-producing region. Met coal produced by the company’s U.S. Operations is consumed regionally by North American steel producers or exported by seaborne transportation to steel producers (primarily in Asia, Europe and South America). The U.S. Operations also produce small quantities of thermal coal that is extracted in the process of mining Met coal, which is sold predominantly to global export markets, as well as within North America. The company’s U.S. Operations offer a range of Met coal products, with significant production of HCC, comprising coal with High-Vol (including HVA and HVB) and coal with Low-Vol.Sales from its U.S. Operations to export markets are typically priced with reference to a benchmark index.

For the year ended December 31, 2023, 87.7% of the total volume of coal sold by the company’s U.S. Operations was Metcoal and 12.3% was thermal coal. The company sold 74.3% of total Met coal from its U.S. Operations into the seaborne Met coal markets for the year ended December 31, 2023.

Customers

The company sells most of its coal to steel producers, either directly or through intermediaries, such as brokers. The company also sells thermal coal to electricity generators either directly or through intermediaries such as brokers. Major consumers of the company’s seaborne Met coal in 2023 were located in India, China, Japan, South Korea, Taiwan, Brazil and Europe. These consumers are all major global steel or Met coke producers. The majority of the company’s sales are made under contracts with terms of typically one year or on a spot basis.

Tata Steel

The company’s U.S. Operations and Australian Operations are parties to Long Term Coal Sale and Purchase Agreements with TS Global Procurement Company Pte Ltd, or Tata Steel, with terms ending March 31, 2025. These Long Term Agreements provide for the sale of a minimum aggregate total of 2.25 MMt of coal per contract year across the Group, consisting of certain specific quantities of HCC, and pulverized coal injection, or PCI, Coal.

Stanwell

The company is party to contractual arrangements with Stanwell, including a Coal Supply Agreement, or the CSA, and the Curragh Mine New Coal Supply Deed, dated August 14, 2018, or the Supply Deed.

Under the CSA, the company delivers thermal coal from Curragh to Stanwell at an agreed price and quantity. Stanwell may vary the quantity of thermal coal purchased each year so the total quantity to be delivered to Stanwell each year cannot be precisely forecast.

In addition, the CSA also provides for a tonnage rebate to Stanwell per Mt on the first 7.0 MMtpa of export coal sales and on export coal sales above 7.0 MMtpa; and a rebate on run-of-mine, or ROM, coal mined in the Curragh Pit U East Area.

Transportation

Coal produced at the company’s mining properties is transported to customers by a combination of road, rail, barge and ship. Rail and port services are typically contracted on a long-term, take-or-pay basis in Australia, while these contracts are typically negotiated on a quarterly basis in the United States.

Australian Operations

The company’s Australian Operations typically sell export coal FOB, with the customer paying for transportation from the outbound shipping port. The majority of Curragh’s export Met coal is railed approximately 300 kilometers to the Port of Gladstone for export via two main port terminals, RG Tanna Coal Terminal, or RGTCT, and Wiggins Island Coal Export Terminal, or WICET. Curragh also has capacity available to stockpile coal at the Port of Gladstone .For sales of thermal coal to Stanwell, Stanwell is responsible for the transport of coal to the Stanwell PowerStation.

Rail Services

Curragh is linked to the Blackwater rail line of the Central Queensland Coal Network, or CQCN, an integrated coal haulage rail system owned and operated by Aurizon Network Pty Ltd, or Aurizon Network. Curragh has secured annual rail haulage capacity of up to 11.5 MMtpa (plus surge capacity) under long-term rail haul age agreements with Aurizon Operations Limited, or Aurizon Operations, and Pacific National Holdings Pty Limited, or Pacific National.

The RGTCT Coal Transport Services Agreement with Aurizon Operations is for 8.5 MMtpa of haulage capacityto RGTCT. Curragh pays a minimum monthly charge (components of which are payable on a take-or-pay basis), which is calculated with reference to the below-rail access charges, haulage/freight charges, a minimum annual tonnage charge and other charges. The RGTCT Coal Transport Services Agreement terminates on June 30,2030.

The Coal Transport Services Agreement with Pacific National is for 1.0 MMtpa of haulage capacity to RGTCT.Curragh pays a minimum monthly charge (components of which are payable on a take-or-pay basis), which is calculated with reference to the below-rail access charges, haulage/freight charges, a minimum annual tonnagecharge and other charges. The Coal Transport Services Agreement with Pacific National terminates on July 31,2029.

The Wiggins Island Rail Project, or WIRP, Transport Services Agreement with Aurizon Operations is for 2.0MMtpa of capacity to WICET. This contract is effectively 100% take-or-pay (for a portion of the rail haulage and all capacity access charges). This agreement expires on June 30, 2030.

Port Services

Curragh exports coal through two terminals at the Port of Gladstone, RGTCT and WICET. At RGTCT, Curraghand Gladstone Port Corporation Limited, or GPC, are parties to a coal handling agreement that expires on June 30, 2030. The agreement may be renewed at its request and, subject to certain conditions, GPC is required to agree to the extension if there is capacity at RGTCT to allow the extension. The company has the right to export between 7.7 MMtpa and 8.7 MMtpa at its nomination on a take-or-pay basis.

The company has a minority interest in WICET Holdings Pty Ltd, whose wholly-owned subsidiary, Wiggins Island CoalExport Terminal Pty Ltd, or WICET Pty Ltd, owns WICET. Other coal producers who export coal through WICETalso hold shares in WICET Holdings Pty Ltd. In addition, the company and the other coal producers (or shippers) have take-or-pay agreements with WICET Pty Ltd and pay a terminal handling charge to export coal through WICET. The company’s take-or-pay agreement with WICET Pty Ltd, or the WICETTake -or-Pay Agreement, provides Curragh with export capacity of 1.5 MMtpa.

U.S. Operations

The company’s U.S. Operations’ domestic contracts are generally priced FOR at the mine with customers bearing the transportation costs from the mine to the applicable end user. For direct sales to export customers, the company holds the transportation contract and are responsible for the cost to the export facility, and the export customer is responsible for the transportation/freight cost from the export facility to the destination.

Rail Services

The company’s U.S. Operations are served by Norfolk Southern and CSX Transportation railroads.

Norfolk Southern railroad serves the company’s Buchanan mining property and transports Buchanan’s coal to Lamberts Point Coal Terminal Pier 6 and to CNX Marine Terminal for export customers and to its domestic customers either directly or indirectly via inland river dock facilities where the coal is transloaded on to barges and then transported to the customer’s facilities.

CSX Transportation railroad serves the company’s Logan and Greenbrier mining properties. CSX transports Logan and Greenbrier’s coal to Kinder Morgan Pier IX Terminal or CNX Marine Terminal or Dominion Terminal Associates (DTA) for export customers and either directly to the customers or to inland river dock facilities for domestic customers.

Port Services

Norfolk Southern’s Lamberts Point Coal Terminal Pier 6 is the largest coal loading facility in the Northern Hemisphere with 48 million tons of annual export capacity and is the main terminal at Lamberts Point located in Norfolk, Virginia. Kinder Morgan’s Pier IX is a coal export terminal with an annual export capacity of 16 million tons located in the Port of Hampton Roads in Newport News, Virginia.

The company’s U.S. Operations have dedicated inventory capacity and a take-or-pay obligation to transload one million net tons per year through Kinder Morgan’s Pier IX Terminal to the end of March 2024. On November 1, 2022, the company extended its arrangement with Kinder Morgan from April 2024 to March 2027, with an option to extend for and additional three years, for a dedicated inventory capacity and take-or-pay obligation to transload 650,000 net tons per year. The company’s U.S. Operations also have alternate port access through CNX Marine Terminal which is a transshipping terminal at the Port of Baltimore owned by CONSOL Energy.

Regulatory Matters

The company’s Australian Operations are regulated by the laws and regulations of the Commonwealth of Australia, or Cth, the State of Queensland, or Qld, and local jurisdictions. Most environmental laws are promulgated at the state level, but the Australian federal government has a role in approval of actions which have national environmental significance.

The U.S. Clean Water Act of 1972 and corresponding state laws affect coal mining operations by imposing restrictions on discharges of wastewater into waters of the United States through the National Pollutant Discharge Elimination System, or NPDES, or an equally stringent program delegated to a state agency. The EPA and states may develop standards and limitations for certain pollutants, including through the technology-based standard program and water quality standard program. These restrictions often require the company to pre-treat the wastewater prior to discharging it. The company’s surface mining operations are subject to numerous regulations relating to blasting activities, including the Federal Safe Explosives Act, or SEA.

The primary health and safety legislation that applies to Curragh are the Coal Mining Safety and Health Act 1999(Qld) and the Coal Mining Safety and Health Regulation 2001 (Qld), which the company refers to, together, as the Coal Mining Safety Legislation.

The company controls the coal mining rights at Curragh under 14 coal and infrastructure mining leases, or MLs, and three mineral development licenses, or MDLs, granted pursuant to the Mineral Resources Act 1989 (Qld). All at the company’s Australian Operations, were covered by a single, federally-certified collective Enterprise Agreement, or the EA, for specified groups of mining and maintenance employees. In July 2023, the Australian Fair Work Commission approved the four year Curragh Mine Enterprise Agreement 2023.

History

Coronado Global Resources Inc. was founded in 2011 by Garold Spindler, James Campbell and a fund affiliated with The Energy & Minerals Group (EMG). The company was incorporated in 2018 pursuant to the laws of the state of Delaware.

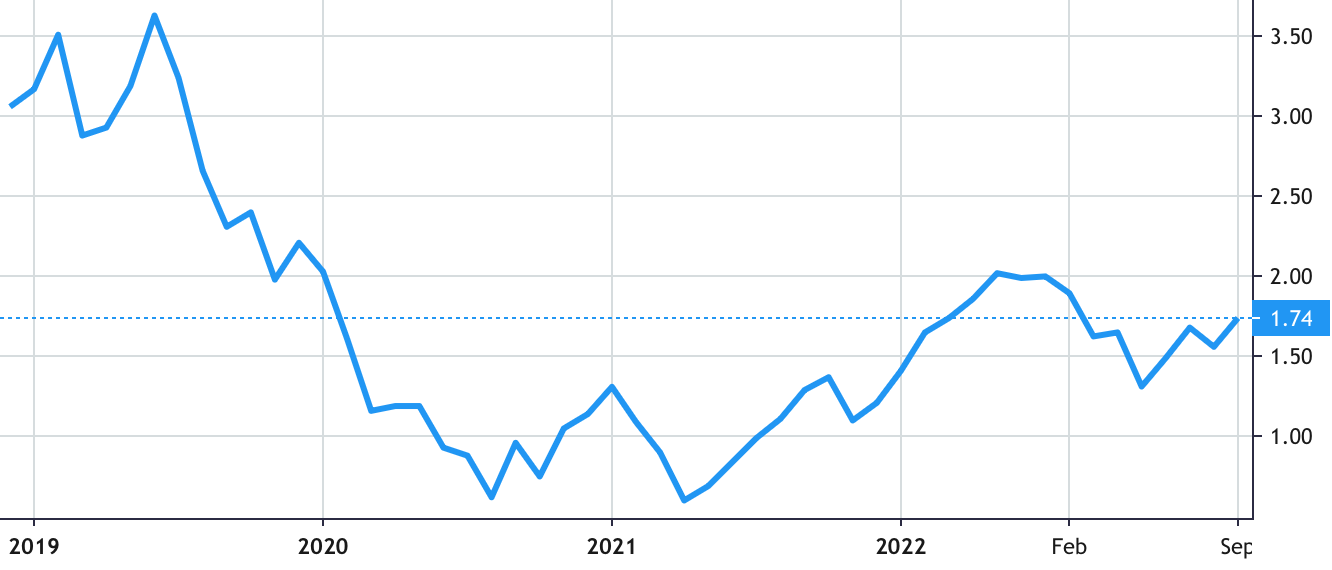

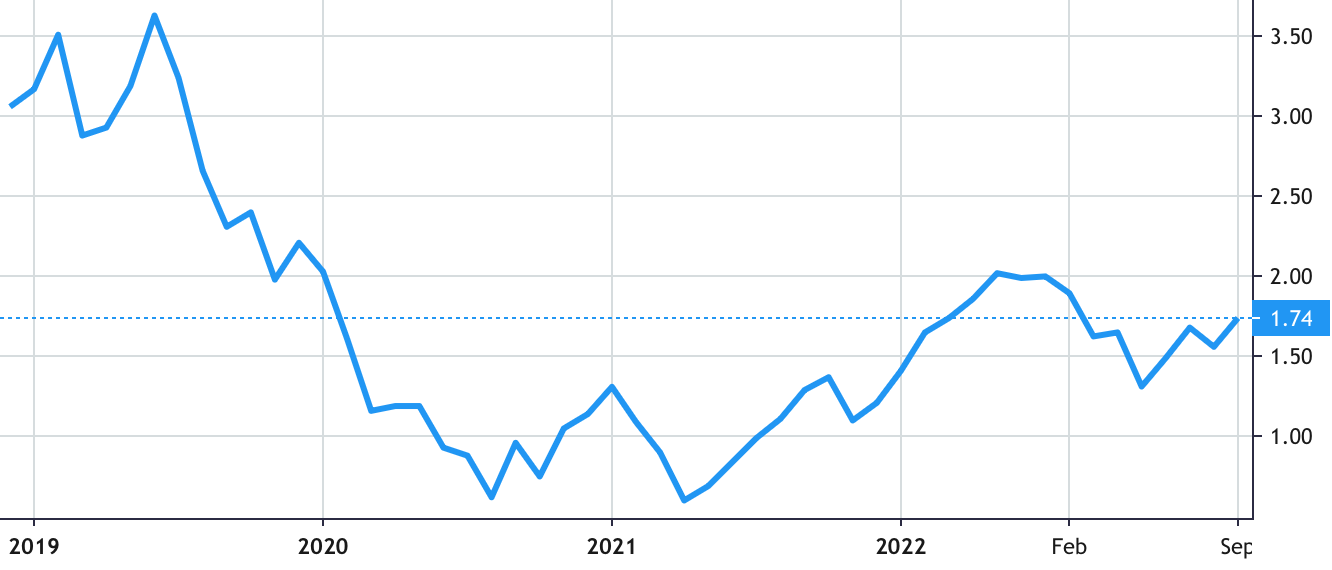

Stock Value

Stock Value