Company Info

Chevron Corp Price Chart

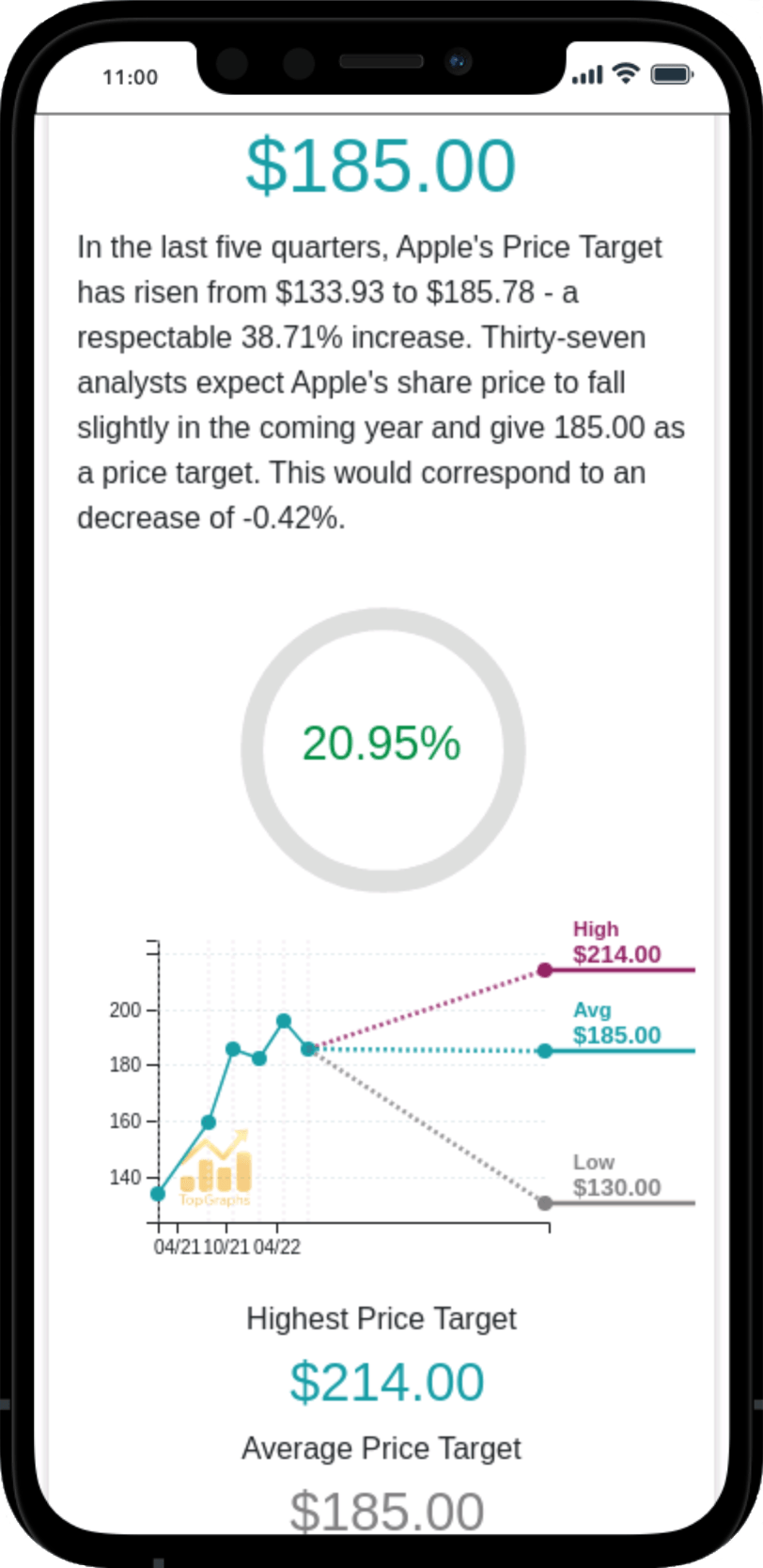

Chevron Corp Stock Forecast 2023

In the last five quarters, Chevron Corp’s Price Target has fallen from $180.09 to $177.53 - a -1.42% decrease. Fiveteen analysts predict that Chevron Corp’s share price will increase in the coming year, reaching $182.57. This would represent an increase of 2.84%.

Highest Price Target $206.00

Average Price Target $182.57

Lowest Price Target $155.00

Chevron Corp Stock Predictions 2025

Stock Forecast for the Price of an Chevron Corp Share in Jan 2025.

In January 2025, analysts believe the stock price will be $145.71. A decrease of -10.22% compared to the previous month's estimate.

Stock Forecast for the Price of an Chevron Corp Share in Feb 2025.

In February 2025, analysts believe the stock price will be $143.79. A decrease of -11.4% compared to the previous month's estimate.

Stock Forecast for the Price of an Chevron Corp Share in Mar 2025.

In March 2025, analysts believe the stock price will be $141.88. A decrease of -12.58% compared to the previous month's estimate.

Stock Forecast for the Price of an Chevron Corp Share in Apr 2025.

In April 2025, analysts believe the stock price will be $139.97. A decrease of -13.76% compared to the previous month's estimate.

Stock Forecast for the Price of an Chevron Corp Share in May 2025.

In May 2025, analysts believe the stock price will be $138.05. A decrease of -14.94% compared to the previous month's estimate.

Stock Forecast for the Price of an Chevron Corp Share in Jun 2025.

In June 2025, analysts believe the stock price will be $136.14. A decrease of -16.12% compared to the previous month's estimate.

Stock Forecast for the Price of an Chevron Corp Share in Jul 2025.

In July 2025, analysts believe the stock price will be $134.23. A decrease of -17.3% compared to the previous month's estimate.

Stock Forecast for the Price of an Chevron Corp Share in Aug 2025.

In August 2025, analysts believe the stock price will be $132.32. A decrease of -18.47% compared to the previous month's estimate.

Stock Forecast for the Price of an Chevron Corp Share in Sep 2025.

In September 2025, analysts believe the stock price will be $130.40. A decrease of -19.65% compared to the previous month's estimate.

Stock Forecast for the Price of an Chevron Corp Share in Oct 2025.

In October 2025, analysts believe the stock price will be $128.49. A decrease of -20.83% compared to the previous month's estimate.

Stock Forecast for the Price of an Chevron Corp Share in Nov 2025.

In November 2025, analysts believe the stock price will be $126.58. A decrease of -22.01% compared to the previous month's estimate.

Stock Forecast for the Price of an Chevron Corp Share in Dec 2025.

In December 2025, analysts believe the stock price will be $124.66. A decrease of -23.19% compared to the previous month's estimate.

Chevron Corp Stock Prediction 2030

Stock Prediction for the Price of One Chevron Corp Share in Jan 2030.

In Jan 2030 analysts predict a share price of $201.71. An increase of 24.28% compared to today's share price.

Stock Prediction for the Price of One Chevron Corp Share in Feb 2030.

In Feb 2030 analysts predict a share price of $199.14. An increase of 22.7% compared to today's share price.

Stock Prediction for the Price of One Chevron Corp Share in Mar 2030.

In Mar 2030 analysts predict a share price of $196.57. An increase of 21.12% compared to today's share price.

Stock Prediction for the Price of One Chevron Corp Share in Apr 2030.

In Apr 2030 analysts predict a share price of $194.00. An increase of 19.53% compared to today's share price.

Stock Prediction for the Price of One Chevron Corp Share in May 2030.

In May 2030 analysts predict a share price of $191.44. An increase of 17.95% compared to today's share price.

Stock Prediction for the Price of One Chevron Corp Share in Jun 2030.

In Jun 2030 analysts predict a share price of $188.87. An increase of 16.37% compared to today's share price.

Stock Prediction for the Price of One Chevron Corp Share in Jul 2030.

In Jul 2030 analysts predict a share price of $186.30. An increase of 14.79% compared to today's share price.

Stock Prediction for the Price of One Chevron Corp Share in Aug 2030.

In Aug 2030 analysts predict a share price of $183.73. An increase of 13.21% compared to today's share price.

Stock Prediction for the Price of One Chevron Corp Share in Sep 2030.

In Sep 2030 analysts predict a share price of $181.16. An increase of 11.62% compared to today's share price.

Stock Prediction for the Price of One Chevron Corp Share in Oct 2030.

In Oct 2030 analysts predict a share price of $178.60. An increase of 10.04% compared to today's share price.

Stock Prediction for the Price of One Chevron Corp Share in Nov 2030.

In Nov 2030 analysts predict a share price of $176.03. An increase of 8.46% compared to today's share price.

Stock Prediction for the Price of One Chevron Corp Share in Dec 2030.

In Dec 2030 analysts predict a share price of $173.46. An increase of 6.88% compared to today's share price.

Chevron Corp Analyst Ratings Frequently Asked Questions

Who are the analysts watching Chevron Corp?

The following analysts have recently covered Chevron Corp:

Who are the sell-side analysts watching Chevron Corp?

The following sell-side analysts have recently covered Chevron Corp:

Stock Value

Stock Value