About ThredUp

ThredUp Inc. (thredUP) operates as an online resale platform for apparel, shoes and accessories worldwide.

The company’s custom-built operating platform consists of distributed processing infrastructure, proprietary software and systems and data science expertise.

thredUP’s proprietary operating platform is the foundation for the company’s managed marketplace, where it has bridged online and offline technology to make the buying and selling of tens of millions of unique items easy and fun. The company’s marketplaces enable buyers to browse and purchase resale items for primarily women’s and kids’ apparel, shoes and accessories across a wide range of price points. thredUP’s sellers order a Clean Out Kit, fill it and return it to the company using its prepaid label. The company takes it from there and do the work to make those accepted items available for resale.

In addition to the company’s core marketplace, some of the world’s leading brands and retailers are already taking advantage of the company’s Resale-as-a-Service (RaaS) offering, which allows them to conveniently offer a scalable closet clean out service and/or resale shop to their customers.

The company owns Remix Global AD (Remix), a fashion resale company headquartered in Sofia, Bulgaria, which further expands the company’s reach to the European customer. With this acquisition, the company added a complementary operational infrastructure and an experienced management team to enable the company’s expansion into Europe. In addition, Remix’s product assortment extends the company’s resale offering to include men’s items and items sourced from a variety of supply channels, such as wholesale supply.

Distributed Processing Infrastructure

The company’s infrastructure is purpose-built for ‘single SKU’ logistics, meaning that virtually every item processed is unique, came from or belongs to an individual seller and is individually tracked using its own stock keeping unit (‘SKU’). As of December 31, 2022, the company operated distribution centers that could collectively hold more than 7.3 million items in locations across the United States and Europe. The company’s operations are highly scalable, and the company has the ability to process more than 100,000 unique SKUs per day across its existing distribution center footprint.

The company drives continuous operational efficiency through proprietary technology and ongoing automation of its infrastructure. The company’s existing United States-based distribution centers are located in Arizona, Georgia, Pennsylvania, and Texas. By locating the company’s facilities in strategic locations across the country, the company can be closer to its buyers and sellers, which allows the company to reduce shipping times in transit, and lower the company’s inbound and outbound shipping costs. The company’s European-based distribution center, which services nine countries in Central and Eastern Europe, is located in Sofia, Bulgaria.

Proprietary Software and Systems

The company’s facilities run on a suite of its custom-built applications designed for ‘single SKU’ operations. The company’s engineering team has implemented large-scale, innovative and patented automation for put-away, storage, picking and packing at scale. This automation results in reduced labor and fixed costs while increasing storage density and throughput capacity. The company’s proprietary software, systems and processes enable efficient quality assurance, item-attribution, sizing and photography.

Data Science Expertise

The company harnesses its robust, structured data set across its business to optimize economic decisions, such as pricing, seller payouts, item acceptance, merchandising and sell-through. The company also leverages data to power efficient customer acquisition and lifetime engagement, and to provide a personalized shopping experience.

The company generates revenue primarily from items that are sold to buyers on the company’s websites and mobile app and from integration and service fees charged in connection with the company’s RaaS offerings.

The company’s revenue is consisted of consignment sales and direct product sales.

The company recognizes revenue from its Remix platform primarily through direct product sales. The company anticipates that over time revenue from the Remix platform will migrate to become primarily consignment sales as the company introduces and expands the Clean Out Kit model that the company pioneered in the United States market.

In mid-2021, the company began structuring its RaaS offerings as sources of revenue. RaaS clients typically pay an upfront integration fee, as well as ongoing service fees which are then recorded to consignment revenue. With RaaS, brands and retailers are leveraging the company’s operating platform to deliver resale experiences to their customers across three main service modules: the company’s Clean Out service, its cashout marketplace, and its full-service resale shops. This suite of offerings is called ‘Resale 360’ and enables the company’s RaaS clients to drive incremental revenue and access new customers while promoting a circular business model. As of December 31, 2022, the company worked with 42 RaaS clients, including GAP, Hot Topic, Madewell, Reformation, Tommy Hilfiger, Torrid, and Walmart.

During the year ended December 31, 2022, the company’s buyers placed 6.5 million Orders. Orders means the total number of orders placed by buyers across the company’s marketplaces, including through its RaaS clients, in a given period, net of cancellations.

Intellectual Property

The company has patents issued in the United States. The company also holds trademarks in the United States, as well as in other jurisdictions. ‘THREDUP’ and ‘Think Secondhand First’ are the company’s registered trademarks in the United States. The company has additional registered trademarks in the United States and ‘THREDUP’ is registered in certain other non-United States jurisdictions.

The company also has registered domain names for websites that it uses in the company’s business, such as www.thredup.com and other variations.

Regulation

Apparel, shoes and accessories sold by the company is subject to regulation in the United States by governmental agencies, including the Federal Trade Commission and the Consumer Products Safety Commission. These regulations relate principally to product labeling, licensing requirements, flammability testing and product safety. The company is also subject to environmental laws, rules and regulations. Similarly, apparel, shoes and accessories sold by the company is also subject to import regulations in the United States concerning the use of wildlife products for commercial and non-commercial trade, including the United States Fish and Wildlife Service.

Research and Development

The company’s research and development costs related to its technology were approximately $37.6 million during the year ended December 31, 2022.

Competition

The company’s competitors include secondhand marketplaces, such as eBay Inc., Mercari, Inc., Poshmark, Inc., The RealReal, Inc., Vinted and Vestiaire Collective; large online retailers, such as Amazon.com, Inc., Target Corporation, Kohl’s Corporation and Walmart Inc.; and off-price retailers, such as Burlington Stores, Inc., Ross Stores, Inc. and The TJX Companies, Inc.

History

ThredUp Inc. was founded in 2009. The company was incorporated in 2009 as a Delaware corporation.

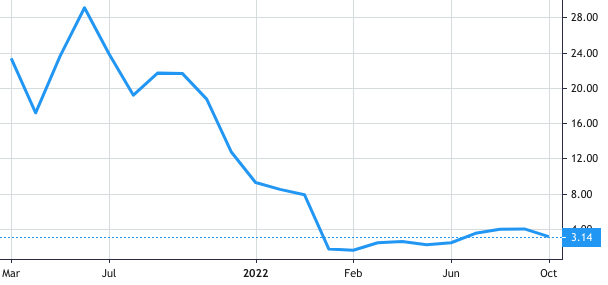

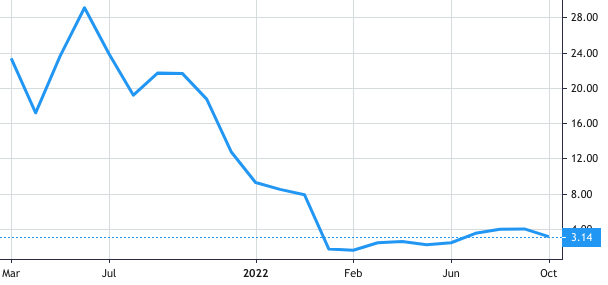

Stock Value

Stock Value