About Monolithic Power Systems Inc

Monolithic Power Systems, Inc. (MPS) is a fabless company with a global footprint that provides high-performance, semiconductor-based power electronic solutions. The company plans to continue to introduce new products within its existing product families, as well as in new innovative product categories.

End Markets and Applications

The company designs and develops its products for the storage and computing, enterprise data, automotive, industrial, communications and consumer markets, with the storage and computing market representing the largest portion of its revenue in 2022.

Product Families

The company’s proprietary process technologies enable it to design and deliver smaller, single-chip power management integrated circuits (ICs). These technologies simplify the design process and are applicable across a wide range of analog applications within the storage and computing, enterprise data, automotive, industrial, communications and consumer markets. The company’s product families are differentiated with respect to their high degree of integration and strong levels of accuracy, power efficiency, quality and longevity, making them cost-effective and more sustainable relative to many competing solutions. The company’s key product families include the following:

Direct Current (DC) to DC Products: DC to DC ICs are used to convert and control voltages within a broad range of electronic systems, such as portable electronic devices, wireless LAN access points, computers and notebooks, monitors, infotainment applications and medical equipment. The company’s DC to DC products are differentiated in the market, particularly with respect to their high degree of integration, high voltage operation, high load current, high switching speed, small footprint, and high energy efficiency. These features are important to the company’s customers as they result in fewer components that need to be produced and consumed, a smaller form factor, more accurate regulation of voltages, lower power consumption and, ultimately, lower system cost, increased reliability and lower carbon emissions through the elimination of many discrete components and power devices. The DC to DC product family accounted for 95% of the company’s total revenue in 2022.

Lighting Control Products: Lighting control ICs are used in backlighting and general illumination products. Lighting control ICs for backlighting are used in systems that provide the light source for LCD panels typically found in computers and notebooks, monitors, car navigation systems and televisions. Backlighting solutions are typically either white light emitting diode lighting sources or cold cathode fluorescent lamps. The Lighting Control product family accounted for 5% of the company’s total revenue in 2022.

In the future, the company plans to continue to introduce new products within its existing product families, as well as in new innovative product categories. The company’s ability to achieve revenue growth will depend in part upon its ability to continue to innovate while fulfilling its customers’ evolving needs, enter new market segments, gain market share, grow in regions outside of China, Taiwan and other Asian markets, expand its customer base and continue to secure manufacturing capacity.

Customers, Sales and Marketing

The company sells its products through third-party distributors, value-added resellers and directly to original equipment manufacturers (OEMs), original design manufacturers (ODMs), electronic manufacturing service (EMS) providers and other end customers. The company’s third-party distributors are subject to distribution agreements with it, which allow the distributors to sell its products to end customers and other resellers, including OEMs, ODMs or EMS providers. The company’s value-added resellers may second source its products and provides other services to customers. ODMs typically design and manufacture electronic products on behalf of OEMs, and EMS providers typically provide manufacturing services for OEMs and other electronic product suppliers.

Sales to the company’s largest distributor accounted for 24% of its total revenue in 2022. In addition to the company’s largest distributor, one distributor accounted for 19% of its total revenue in 2022.

Current distribution agreements with several of the company’s major distributors provide that each distributor has the non-exclusive right to sell and use its best efforts to promote and develop a market for its products.

The company has sales offices in China, India, Japan, South Korea, Singapore, Taiwan, the United States and throughout Europe. The company’s products typically require a highly technical sales and applications engineering effort where it assists its customers in the design and use of its products in their application. The company maintains a staff of applications engineers who work directly with its customers’ engineers in the development of their systems’ electronics containing its products.

The company’s sales are made primarily pursuant to standard individual purchase orders. The company often builds inventory in advance based on its forecast of future customer orders.

Research and Development

The company’s research and development expenses included $240.2 million for the year ended December 31, 2022.

Patents and Intellectual Property Matters

As of December 31, 2022, the company had 1,557 patents/applications issued or pending, of which 546 patents have been issued in the United States. The company’s issued patents are scheduled to expire at various times through December 2042.

Seasonality

Historically, the company’s revenue has generally been higher in the second half of the year (year ended December 31, 2022) than in the first half although various factors, such as market conditions and the timing of key product introductions, could impact this trend.

Competition

The company considers its primary competitors to include Analog Devices, Infineon Technologies, NXP Semiconductors, ON Semiconductor, Power Integrations, Renesas Electronics, ROHM Semiconductor, Semtech, and Texas Instruments.

History

Monolithic Power Systems, Inc. was founded in 1997. The company was incorporated in California in 1997 and reincorporated in Delaware in 2004.

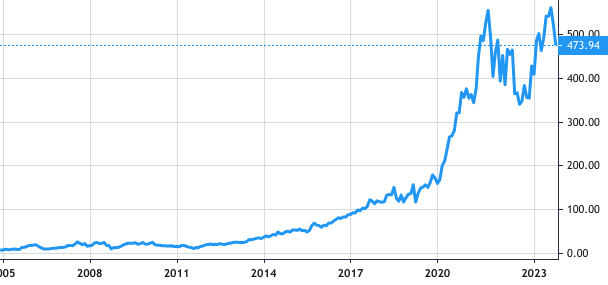

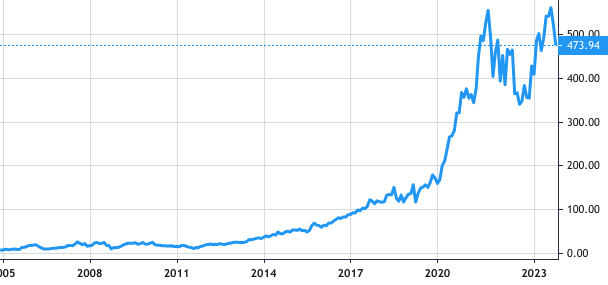

Stock Value

Stock Value