About Visa

Visa Inc. (Visa) operates as a global payments technology company.

The company facilitates global commerce and money movement across more than 200 countries and territories among a global set of consumers, merchants, financial institutions and government entities through innovative technologies.

The company is focused on extending, enhancing and investing in the company's proprietary advanced transaction processing network, VisaNet, to offer a single connection point for facilitating payment transactions to multiple endpoints through various form factors. As a network of networks enabling global movement of money through all available networks, the company is working to provide payment solutions and services for everyone, everywhere. Through the company's network, the company offers products, solutions and services that facilitate secure, reliable and efficient money movement for participants in the ecosystem.

The company facilitates secure, reliable and efficient money movement among consumers, issuing and acquiring financial institutions and merchants. The company has traditionally referred to this structure as the 'four-party' model. As the payments ecosystem continues to evolve, the company has broadened this model to include digital banks, digital wallets and a range of financial technology companies (fintechs), governments and non-governmental organizations (NGOs). The company provides transaction processing services (primarily authorization, clearing and settlement) to the company's financial institution and merchant clients through VisaNet. During the year ended September 30, 2023 (fiscal year 2023), 276 billion payments and cash transactions with Visa's brand were processed by Visa or other networks, equating to an average of 757 million transactions per day. Of the 276 billion total transactions, 213 billion were processed by Visa.

The company offers a wide range of Visa-branded payment products that the company's clients, including 14,500 financial institutions, use to develop and offer payment solutions or services, including credit, debit, prepaid and cash access programs for individual, business and government account holders.

The company takes an open partnership approach and seek to provide value by enabling access to the company's global network, including offering the company's technology capabilities through application programming interfaces (APIs). The company partners with both traditional and emerging players to innovate and expand the payments ecosystem, allowing them to use the resources of the company's platform to scale and grow their businesses more quickly and effectively.

The company is accelerating the migration to digital payments through the company's network of networks strategy. The company intends to provide a single connection point so that Visa clients can enable money movement for businesses, governments and consumers, regardless of which network is used to start or complete the transaction. This model ultimately helps to unify a complex payments ecosystem. Visa's network of networks approach creates opportunities by facilitating person-to-person (P2P), business-to-consumer (B2C), business-to-business (B2B) and government-to-consumer (G2C) payments, in addition to consumer to business (C2B) payments.

The company provides value added services to its clients, including issuing solutions, acceptance solutions, risk and identity solutions, open banking and advisory services.

The company invests in and promotes its brand to the benefit of the company's clients and partners through advertising, promotional and sponsorship initiatives with the International Olympic Committee, the International Paralympic Committee and the National Football League (NFL), among others. The company also uses these sponsorship assets to showcase the company's payment innovations.

Core Business

In a typical Visa C2B payment transaction, the consumer purchases goods or services from a merchant using a Visa card or payment product. The merchant presents the transaction data to an acquirer, usually a bank or third-party processing firm that supports acceptance of Visa cards or payment products, for verification and processing. Through VisaNet, the acquirer presents the transaction data to Visa, which in turn sends the transaction data to the issuer to check the account holder's account balance or credit line for authorization. After the transaction is authorized, the issuer posts the transaction to the consumer's account and effectively pays the acquirer an amount equal to the value of the transaction, minus the interchange reimbursement fee. The acquirer pays the amount of the purchase, minus the merchant discount rate (MDR), to the merchant.

Visa earns revenue by facilitating money movement across more than 200 countries and territories among a global set of consumers, merchants, financial institutions and government entities through innovative technologies.

Visa provides payment processing for both non-Visa-branded and Visa-branded card transactions. In the context of non-Visa-branded card transactions, the company facilitates payment processing by providing gateway routing services to other payment networks. At the client's request, the company may provide authorization, clearing or settlement services on the company's network before or after the company routes the transaction to the other payments network. In those instances, Visa may earn data processing revenues for the specific services provided. In the context of Visa-branded card transactions on its network, the company provides authorization, clearing and settlement services and may earn service, data processing, international transaction, or other revenues. Depending on applicable regulations, some payment processors may or may not use the company's network to process Visa-branded card transactions. If they use the company's network, the company may earn service revenues and data processing revenues. If they do not use the company's network, the company earns only service revenues.

Visa is not a financial institution. The company does not issue cards, extend credit or set rates and fees for account holders of Visa products nor do the company earns revenues from, or bear credit risk with respect to, any of these activities. Interchange reimbursement fees reflect the value merchants receive from accepting the company's products and play a key role in balancing the costs and benefits that account holders and merchants derive from participating in the company's payments networks. Generally, interchange reimbursement fees are paid by acquirers to issuers. The company establishes default interchange reimbursement fees that apply absent other established settlement terms. These default interchange reimbursement fees are set independently from the revenues the company receive from issuers and acquirers. The company's acquiring clients are responsible for setting the fees they charge to merchants for the MDR and for soliciting merchants. Visa sets fees to acquirers independently from any fees that acquirers may charge merchants. Therefore, the fees the company receives from issuers and acquirers are not derived from interchange reimbursement fees or MDRs.

Strategy

Visa's strategy is to accelerate the company's revenue growth in consumer payments, new flows and value added services, and fortify the key foundations of the company's business model.

Consumer Payments

The company remains focused on moving trillions of dollars of consumer spending in cash and checks to cards and digital accounts on Visa's network of networks.

Core Products

Visa's growth has been driven by the strength of the company's core products - credit, debit and prepaid.

Credit: Credit cards and digital credentials allow consumers and businesses to access credit to pay for goods and services. Credit cards are affiliated with programs operated by financial institution clients, co-brand partners, fintechs and affinity partners.

Debit: Debit cards and digital credentials allow consumers and small businesses to purchase goods and services using funds held in their deposit accounts. Debit cards enable account holders to transact in person, online or via mobile without needing cash or checks and without accessing a line of credit. The Visa/PLUS Global ATM network also provides debit, credit and prepaid account holders with cash access, and other banking capabilities, in more than 200 countries and territories worldwide through issuing and acquiring partnerships with both financial institutions and independent ATM operators.

Prepaid: Prepaid cards and digital credentials draw from a designated balance funded by individuals, businesses or governments. Prepaid cards address many use cases and needs, including general purpose reloadable, payroll, government and corporate disbursements, healthcare, gift and travel. Visa-branded prepaid cards also play an important part in financial inclusion, bringing payment solutions to those with limited or no access to traditional banking products.

Enablers

The company enables consumer payments and helps its clients grow as digital commerce, new technologies and new participants continue to transform the payments ecosystem. Some examples include:

Tap to Pay

As the company seeks to improve the user experience in the face-to-face environment, contactless payments or tap to pay, which is the process of tapping a contactless card or mobile device on a terminal to make a payment, has emerged as a preferred way to pay among consumers in many countries around the world. Tap to pay adoption is growing and many consumers have come to expect touchless payment experiences.

Globally, the company has 50 countries and territories with more than 90 percent contactless penetration and more than 100 countries and territories where tap to pay is more than 50 percent of face-to-face transactions. In the U.S., Visa has surpassed 40 percent contactless penetration and more than 520 million tap-to-pay-enabled Visa cards. The company has activated more than 750 contactless public transport projects worldwide. In addition, the company processed more than 1.6 billion contactless transactions on global transit systems in fiscal year 2023.

Tokenization

Visa Token Service (VTS) brings trust to digital commerce innovation. As consumers increasingly rely on digital transactions, VTS is designed to enhance the digital ecosystem through improved authorization, reduced fraud and improved consumer experience. VTS helps protect digital transactions by replacing 16-digit Visa account numbers with a token that includes a surrogate account number, cryptographic information and other data to protect the underlying account information. This security technology can work for a variety of payment transactions, both in person or online.

The provisioning of network tokens continues to accelerate. As of the end of fiscal year 2023, Visa provisioned more than 7.5 billion network tokens, surpassing the number of physical cards in circulation. The milestone reinforces Visa's commitment to secure, reliable and efficient money movement, in person and online.

Click to Pay

Click to Pay provides a simplified and more consistent cardholder checkout experience online by removing time-consuming key entry of personal information and enabling consumer and transaction data to be passed securely between payments network participants. Based on the EMV Secure Remote Commerce industry standard, Click to Pay brings a standardized and streamlined approach to online checkout and meets the needs of consumers shopping across a growing number of connected devices. The goal of Click to Pay is to make digital payments as secure, reliable and interoperable as the checkout experience in person.

New Flows

New flows focus on facilitating commercial and global money movement across Visa's network of networks. This approach creates opportunities to capture new sources of money movement through card and non-card flows for consumers, businesses and governments around the world by facilitating P2P, B2C, B2B and G2C payments.

Visa Direct

Visa Direct is part of Visa's strategy beyond C2B payments and helps facilitate the delivery of funds to eligible cards, deposit accounts and digital wallets across more than 190 countries and territories. Visa Direct supports multiple use cases, such as P2P payments and account-to-account transfers, business and government payouts to individuals or small businesses, merchant settlements and refunds.

Visa Direct utilizes more than 70 domestic payment schemes, 10 real-time payments schemes, 15 card-based networks and five payment gateways, with the potential to reach more than 8.5 billion cards, deposit accounts and digital wallets. In fiscal year 2023, Visa Direct processed more than 7.5 billion transactions across more than 2,800 global programs. Visa Direct solutions supported more than 500 partners across more than 65 use cases. The company also announced in fiscal year 2023 Visa's partnership with DailyPay, i2C, PayPal, TabaPay, Venmo and Western Union to pilot Visa+, an innovative service that aims to help individuals send money quickly and securely between different participating P2P digital payment apps.

The company continues to build on its network of networks strategy by investing in the company's own capabilities with Visa+ and Visa Alias Directory Service, which offers capabilities to the company's clients to link aliases, such as mobile numbers or email addresses, to payment credentials, as well as strategically collaborating with digital and mobile payment providers to expand the reach of Visa Direct and deliver even stronger domestic and cross-border payment and connection capabilities to the company's clients.

Visa Commercial Solutions

The company is also expanding its network with B2B payments. The company's three strategic areas of focus include investing in and growing card-based payments, accelerating the company's efforts in non-card, cross-border payments and digitizing domestic accounts payable and accounts receivable processes. The company offers a portfolio of commercial payment solutions, including small business, corporate (travel) cards, purchasing cards, virtual cards and digital credentials, non-card cross-border B2B payment options and disbursement accounts, covering most major industry segments around the world. These solutions are designed to bring efficiency, controls and automation to small businesses, commercial and government payment processes, ranging from employee travel to fully integrated, invoice-based payables.

Visa B2B Connect is a multilateral B2B cross-border payments network designed to facilitate transactions from the bank of origin directly to the beneficiary bank, helping streamline settlement and optimize payments for financial institutions' corporate clients. The network delivers B2B cross-border payments that are reliable, flexible, data-rich, and secure. Visa B2B Connect continues to scale and is available in more than 100 countries and territories.

Visa Cross-Border Solutions

Visa Cross-Border Solutions aligns with the company's global network of networks strategy, as the company is focused on building the infrastructure that enables the company's clients of all sizes to deliver cross-border products with visibility, speed and security. This includes a series of solutions for the company's established cross-border consumer payments business, as well as use cases enabled by the company's digitally native Currencycloud platform, which includes real-time foreign exchange rates, virtual accounts, and enhanced liquidity and settlement capabilities.

Value Added Services

Value added services represent an opportunity for the company to diversify its revenue with products and solutions that differentiate the company's network, deepen the company's client relationships and deliver innovative solutions across other networks.

Issuing Solutions

Visa DPS is one of the largest issuer processors of Visa debit transactions in the world. In addition to multi-network transaction processing, Visa DPS also provides a wide range of value added services, including fraud mitigation, dispute management, data analytics, campaign management, a suite of digital solutions and contact center services. The company's capabilities in API-based issuer processing solutions, like DPS Forward, allow the company's clients to create new payments use cases and provide them with modular capabilities for digital payments.

The company also provides a range of other services and digital solutions to issuers, such as account controls, digital issuance, and branded consumer experiences. Additionally, Visa provides loyalty and benefits solution to issuers aimed at creating compelling and differentiated cardholder experiences, as well as Buy Now, Pay Later (BNPL) capabilities. BNPL or installment payments allow shoppers the flexibility to pay for a purchase in equal payments over a defined period of time. Visa is investing in installments as a payments strategy - by offering a portfolio of BNPL solutions for traditional clients, as well as installments providers, who use the company's cards and services to support a wide variety of installment options before, during or after checkout, in person and online.

Acceptance Solutions

Visa Acceptance Solutions, which includes Cybersource, provides modular, value added services in addition to the traditional gateway function of connecting merchants to payment processing. Using the platform, acquirers, payment service providers, independent software vendors, and merchants of all sizes can improve the way their consumers engage and transact; help to mitigate fraud and lower operational costs; and adapt to changing business requirements. They can also connect with other fintechs through a global payment management platform to use their services. Visa Acceptance Solutions' capabilities provide new and enhanced payment integrations with ecommerce platforms, enabling sellers and acquirers to provide tailored commerce experiences with payments seamlessly embedded. Visa Acceptance Solutions enables an omnichannel solution with a cloud-based architecture to deliver more innovation at the point of sale.

In addition, Visa provides secure, reliable services for merchants and acquirers that reduce friction and drive acceptance. Examples include Global Urban Mobility, which supports transit operators to accept Visa contactless payments in addition to closed-loop payment solutions; and Visa Account Updater, which provides updated account information for merchants to help strengthen customer relationships and retention. Visa also offers dispute management services, including a network-agnostic solution from Verifi that enables merchants to prevent and resolve disputes with a single connection.

Risk and Identity Solutions

Visa's risk and identity solutions transform data into insights for near real-time decisions and facilitate account holder authentication to help clients prevent fraud and protect account holder data. With the increasing popularity of omnichannel commerce and digital payments among consumers, fraud prevention helps increase trust in digital payments. Solutions such as Visa Advanced Authorization, Visa Secure, Visa Risk Manager and Decision Manager, Visa Consumer Authentication Service, and payment-decisioning solutions from CardinalCommerce empower financial institutions and merchants with tools that help automate and simplify fraud prevention and enhance payment security.

Aligned to the company's network of networks strategy, Visa is increasingly bringing the company's expertise and capabilities to emerging fraud challenges, working with network operators and financial institutions to help mitigate fraud. These value-added fraud prevention tools layer on top of a suite of the company's network programs that protect the safety and integrity of the payment ecosystem, and along with the company's investments in intelligence and technology, help to prevent, detect and mitigate threats. These programs and Visa's fraud prevention expertise are among the core benefits of being part of the Visa network. Through the combined efforts of security and identity tools and services, payment and cyber intelligence, insights and learnings from client or partner breach investigations, and law enforcement engagement, Visa helps protect financial institutions and merchants from fraud and solve payment security challenges.

Open Banking

In March 2022, Visa acquired Tink AB, an open banking platform, to catalyze fintech innovation and accelerate the development and adoption of open banking securely and at scale. Visa's open banking capabilities range from data access use cases, such as account verification, balance check and personal finance management, to payment initiation capabilities, such as account-to-account transactions and merchant payments. These capabilities can help the company's partner businesses deliver valuable services to their customers.

Advisory Services

Visa Consulting and Analytics (VCA) is the payments consulting advisory arm of Visa. The combination of the company's deep payments expertise, proprietary analytical models applied to a breadth of data and the company's economic intelligence allows the company to identify actionable insights, make recommendations and help implement solutions that can drive better business decisions and measurable outcomes for clients. VCA offers consulting services for issuers, acquirers, merchants, fintechs and other partners, spanning the entire customer journey from acquisition to retention. Further, VCA Managed Services, the company's dedicated execution arm within the consulting division, is being increasingly utilized by clients to implement the company's recommendations and wider value added services product enablement.

Network of Networks

The company's network of networks strategy means moving money to all endpoints and to all form factors, using all available networks and being a single connection point for its partners; and providing the company's value added services on all transactions, no matter the network. The key component of the company's network of networks strategy is interoperability. The company is opening up its network and increasingly using other networks to reach accounts the company could not otherwise reach and enabling new types of money movement. Visa B2B Connect, Visa Direct, and Visa+ are examples of the company's strategy.

Technology Platforms

Visa's leading technology platforms comprise software, hardware, data centers and a large telecommunications infrastructure. Visa's four data centers are a critical part of the company's global processing environment and have a high redundancy of network connectivity, power and cooling designed to provide continuous availability of systems. Together, these systems deliver the secure, convenient and reliable service that the company's clients and consumers expect from the Visa brand.

Security

The company's in-depth, multi-layer security approach includes a formal program to devalue sensitive and/or personal data through various cryptographic means; embedded security in the software development lifecycle; identity and access management controls to protect against unauthorized access; and advanced cyber detection and response capabilities. The company deploys security tools that help keep its clients and consumers safe. The company also invests significantly in its comprehensive approach to cybersecurity. The company deploys security technologies to protect data confidentiality, the integrity of its network and service availability to strengthen the company's core cybersecurity capabilities to minimize risk. The company's payments fraud disruption team continually monitors threats to the payments ecosystem to help ensure attacks are detected and prevented efficiently and effectively.

Brand

Visa's strong brand helps deliver added value to the company's clients and their customers, financial institutions, merchants and partners through compelling brand expressions, a wide range of products and services, as well as innovative brand and marketing efforts. In line with the company's commitment to an expansive and diverse range of partnerships for the benefit of the company's stakeholders, Visa is a sponsor of top entertainment and sports events, including the FIFA Women's World Cup 2023, the Olympic and Paralympic Games, and the Super Bowl.

Intellectual Property

The company owns and manages the Visa brand, which stands for acceptance, security, convenience, speed and reliability. The company's portfolio of Visa-owned trademarks is important to the company's business.

Competition

The company's electronic payment competitors principally include:

Global or Multi-Regional Networks: Examples include American Express, Discover, JCB, Mastercard and UnionPay.

Government Regulation

The company is subject to anti-corruption laws and regulations, including the U.S. Foreign Corrupt Practices Act (FCPA), the U.K. Bribery Act and other laws that generally prohibit the making or offering of improper payments to foreign government officials and political figures for the purpose of obtaining or retaining business or to gain an unfair business advantage. The company is also subject to anti-money laundering and anti-terrorist financing laws and regulations, including the U.S. Bank Secrecy Act. In addition, the company is subject to economic and trade sanctions programs administered by the Office of Foreign Assets Control (OFAC) in the U.S.

Visa is subject to financial sector oversight and regulation in substantially all of the jurisdictions in which the company operates. In the U.S., for example, the Federal Banking Agencies (FBA) has supervisory oversight over Visa under applicable federal banking laws and policies as a technology service provider to the U.S. financial institutions.

In the U.K., Visa Europe is designated as a Recognized Payment System, bringing it within the scope of the Bank of England's supervisory powers and subjecting it to various requirements, including on issues, such as governance and risk management designed to maintain the stability of the U.K.'s financial system. Visa Europe is also regulated by the U.K.'s Payment Systems Regulator (PSR), which has wide-ranging powers and authority to review the company's business practices, systems, rules and fees with respect to promoting competition and innovation in the U.K., and ensuring payment systems take care of, and promote, the interests of service-users.

History

Visa Inc. was founded in 1958. The company was incorporated in 2007.

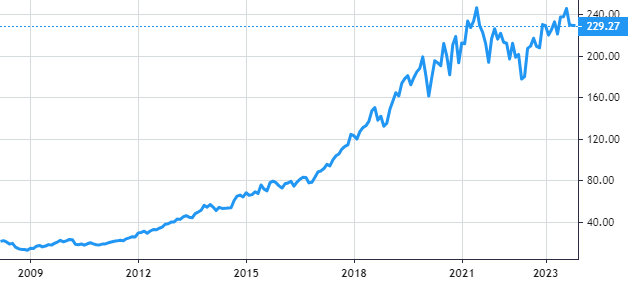

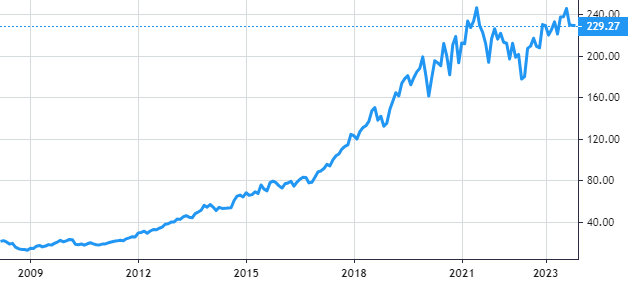

Stock Value

Stock Value