About Prudential Financial

Prudential Financial, Inc. (Prudential Financial) operates as a global financial services leader and premier active global investment manager.

The company has operations in the United States, Asia, Europe, and Latin America. Through the company’s subsidiaries and affiliates the company offers a wide array of financial products and services, including life insurance, annuities, retirement-related products and services, mutual funds and investment management. The company offers these products and services to individual and institutional customers through proprietary and third-party distribution networks.

The company’s principal operations consist of PGIM (the company’s global investment management business), the company’s U.S. Businesses (consisting of the company’s Retirement Strategies, Group Insurance and Individual Life businesses), the company’s International Businesses, the Closed Block division and the company’s Corporate and Other operations. The Closed Block division is accounted for as a divested business that is reported separately from the Divested and Run-off Businesses that are included in Corporate and Other. Divested and Run-off Businesses are composed of businesses that have been, or will be, sold or exited, including businesses that have been placed in wind-down status that do not qualify for ‘discontinued operations’ accounting treatment under generally accepted accounting principles in the United States of America (‘U.S. GAAP’). The company’s Corporate and Other operations include corporate items and initiatives that are not allocated to business segments, as well as the Divested and Run-off Businesses described above.

In September 2023, the company, together with Warburg Pincus and a group of institutional investors, announced the launch of Prismic Life Reinsurance, Ltd. (‘Prismic Re’), a licensed Bermuda-based life and annuity reinsurance company. In conjunction with this announcement, the company made an initial equity investment through its Corporate and Other operations of approximately $200 million, equivalent to a 20% interest, in Prismic Life Holding Company LP (‘Prismic’), the Bermuda-exempted limited partnership that owns all of the outstanding capital stock of Prismic Re. The company expects the increased reinsurance capacity that this partnership provides to support the company’s intention of expanding access to investing, insurance, and retirement security for people around the world. As this investment is accounted for under the equity method, both Prismic and Prismic Re are considered related parties.

The company’s strategy centers on leveraging the company’s mutually-reinforcing business system to become a higher growth, less market-sensitive and more nimble company. The company’s business system includes a mix of high-quality protection, retirement and investment management businesses which creates growth potential due to earnings diversification and the opportunity to provide customers with integrated cross-business solutions, as well as capital benefits from a balanced risk profile. The company is well-positioned to meet the needs of customers and tap into significant market opportunities through PGIM, the company’s U.S. Businesses and the company’s International Businesses.

PGIM

Provides investment management services and solutions related to public fixed income, public equity, real estate debt and equity, private credit and other alternatives, and multi-asset class strategies, to institutional and retail clients globally, as well as the company’s general account.

Products

The company’s products and services are offered through the following businesses:

PGIM Fixed Income—provides global active asset management services across public fixed income markets.

Jennison Associates—provides active fundamental public equity and fixed income asset management services across an array of growth, value, global and specialty equity strategies, as well as fixed income strategies.

PGIM Quantitative Solutions—provides a range of systematic, customized solutions across equity, multi-asset, and liquid alternative platforms.

PGIM Private Capital—provides private credit solutions across the risk spectrum, including investment grade, high yield, direct lending and mezzanine financing.

PGIM Real Estate—provides a broad range of public and private real estate debt and equity strategies, as well as private equity investments with a focus on secondary transactions in the small and mid-cap market.

PGIM Investments—offers actively managed investment solutions, including mutual funds, listed and unlisted closed-end funds, exchange-traded funds (‘ETFs’) and separately managed accounts to individual investors, defined contribution plans and financial intermediaries in the U.S., as well as Undertakings for the Collective Investment in Transferable Securities (‘UCITS’) and other investment solutions to financial intermediaries in select countries across Europe, Asia and Latin America. Additionally, operates local asset management businesses in Taiwan and India; and has interests in an operating joint venture in China.

PGIM Portfolio Advisory—provides public and private multi-asset class liability-driven investment solutions to institutional clients.

The company holds seed and co-investments in some of its investment products to either seed new products or investment strategies in order to develop a track record prior to obtaining third-party investments; or co-invest alongside clients in PGIM-managed funds to demonstrate that the company’s interests are aligned with theirs.

Marketing and Distribution

The company primarily distributes products through the following channels:

Institutional

Proprietary sales force for each PGIM business with independent marketing and client service teams.

PGIM’s Institutional Relationship Group, which develops relationships with, and introduces PGIM’s broad capabilities to, large institutions globally.

Retail

Third-party intermediaries and product manufacturers/distributors globally who include the company’s investment options in their products and platforms.

Distribution channels associated with other Prudential business segments.

Financial professionals associated with Prudential Advisors, Prudential’s proprietary nationwide sales organization.

General Account

Provide investment management services across a broad array of asset classes for the company’s general account.

Revenues

The company’s revenues primarily come from:

Asset management fees, which are typically calculated based upon a percentage of assets under management. In certain asset management arrangements, the company also receives performance-based incentive fees when the return on the managed assets exceeds certain benchmark returns or other performance targets.

Revenues from commercial mortgage origination and servicing.

Transaction fees earned in connection with the structuring, sale or purchase of assets, primarily related to real estate and private fixed income.

Investment returns from seed and co-investments.

The U.S. Businesses—Retirement Strategies

Serves the retirement needs of both the company’s institutional and individual customers. The company’s Institutional Retirement Strategies business develops and distributes retirement investment and income products and services to retirement plan sponsors in the public, private and not-for-profit sectors, both domestically and internationally, primarily within the United Kingdom. The company’s Individual Retirement Strategies business develops and distributes individual variable and fixed annuity products in the U.S., primarily to mass affluent (households with investable assets or annual income in excess of $100,000) and affluent (households with investable assets in excess of $250,000) customers with a focus on innovative product design and risk management strategies.

Products

The company offers a variety of products and solutions to serve different retirement needs and goals:

Institutional Retirement Strategies

Payout Annuities: products that provide a predictable source of monthly income, generally for the life of the annuitant.

Pension risk transfer—non-participating group annuity insurance and reinsurance contracts issued to pension plan sponsors and intermediaries, under which the company assumes all investment and actuarial risk associated with a group of specified participants within a plan in return for a premium typically paid as a lump-sum at inception.

Pension risk transfer—longevity reinsurance contracts with counterparties from which the company earns a fee for assuming the longevity risk of pension plans that have been insured by third-parties. Premiums for these products are typically paid over the duration of the contract as opposed to a lump-sum at inception.

Stable Value: products where the company’s obligations are backed by its general account, and where the company bears some or all of the investment and asset-liability management risk, depending on the product.

Investment-only products—for use in institutional capital markets and qualified plans primarily including fee-based wraps through which customers’ funds are held in a client-owned trust and investment results pass through to the customer. The company earns fee revenue for providing a guaranteed minimum interest rate backed by the general account.

Guaranteed Investment Contracts and Funding Agreements—contain an obligation to pay interest at a specified rate and to repay principal at maturity or following contract termination.

Other products: includes structured settlements and other group annuities.

Individual Retirement Strategies

Indexed Variable Annuities

The Prudential FlexGuard indexed variable annuity, offers the contractholder an opportunity to allocate funds to variable subaccounts and index-based strategies. The strategies provide an interest component linked to, but not an investment in, the selected index, and its performance over the elected term, subject to certain contractual minimums and maximums, and also provides varying levels of downside protection at pre-determined levels and durations. The product also allows for additional deposits and provides a Return of Purchase Payment (‘ROP’) death benefit at no additional charge.

The Prudential FlexGuard Income indexed variable annuity offers similar investment and crediting features as The Prudential FlexGuard product, with a focus on income protection by providing a protected income benefit for an additional fee. Crediting strategies are limited during the income phase.

Traditional Variable Annuities

The Prudential Premier Investment Variable Annuity (‘PPI’) offers tax-deferred asset accumulation, annuitization options and an optional death benefit that guarantees the contractholder’s beneficiary a return of total purchase payments made to the contract, adjusted for any partial withdrawals, upon death.

The Prudential MyRock Advisor Variable Annuity, a fee-based product that offers an optional Dynamic Income Benefit (‘IB’) rider that provides longevity protection through a preset withdrawal percentage applied to a variable income base. In addition, the product offers either a basic death benefit or an ROP death benefit. Both the IB and the ROP are available for an additional fee.

Fixed Annuities

PruSecure, SurePath and SurePath Income, all single premium fixed indexed annuities, offer flexibility to allocate account balances between an index-based strategy and a fixed rate strategy. The index-based strategy provides interest or an interest component linked to, but not an investment in, the selected index, and its performance over the elected term (i.e., 1, 3 or 5 years for PruSecure and 1 or 3 years for SurePath and SurePath Income), subject to certain contractual minimums and maximums. The fixed rate strategy, not associated with an index, offers a guaranteed growth at a set interest rate for one year and can be renewed annually. Additionally, SurePath Income offers a benefit that provides for guaranteed lifetime withdrawal payments.

The Prudential Fixed Annuity with Daily Advantage Income Benefit (‘DAI’), a single premium fixed annuity, provides principal protection, as well as a guaranteed lifetime withdrawal income payment for an additional fee. The lifetime income amount increases daily without exposure to the equity market until the contractholder begins taking withdrawals.

The Prudential WealthGuard Multi-Year Guaranteed Annuity, a single premium fixed rate deferred annuity launched in August 2023, provides tax-deferred growth and guaranteed rate of return over an initial guaranteed rate period (i.e., 3, 5 or 7 years).

The Prudential Immediate Income Annuity (‘PIIA’), a single premium immediate annuity, provides a regular stream of benefit payments. The payments are guaranteed, cannot be changed and are higher than those guaranteed on products that provide liquidity.

Revenues

The company’s revenues primarily come in the form of:

Institutional Retirement Strategies

Premiums associated with insurance and reinsurance contracts and the company’s payout annuities.

Policy charges and fee income based on account values of the company’s fee-based stable value and longevity reinsurance products.

Investment income (which contributes to the net spread over interest credited on the company’s products and related expenses).

Individual Retirement Strategies

Fee income from asset management fees and service fees, which represent administrative service and distribution fees from many of the company’s proprietary and non-proprietary mutual funds. The asset management fees are determined as a percentage of the average assets of the company’s proprietary mutual funds in the company’s variable annuity products (net of sub-advisory expenses related to non-proprietary sub-advisors).

Policy charges and fee income representing mortality, expense and other fees for various insurance-related options and features based on the average daily net asset value of the annuity separate accounts, account value, premium, or guaranteed value, as applicable.

Investment income (which contributes to the net spread over interest credited on certain products and related expenses) and interest income on collateral posted to counterparties.

Marketing and Distribution

Institutional Retirement Strategies

The company primarily distribute products through the following channels:

Pension risk transfer through actuarial consultants and third-party brokers.

Structured settlements through third-party specialized brokers.

Voluntary income products and other group annuities directly to plan sponsors.

Stable value products through the company’s proprietary sales force and third-party intermediaries.

Individual Retirement Strategies

The company’s distribution efforts, which are supported by a network of internal and external wholesalers, are executed through a diverse group of distributors, including:

Third-party distribution through:

Broker-dealers;

Banks and wirehouses;

Independent financial planners; and

Independent Marketing Organizations (‘IMO’) (specifically for SurePath and SurePath Income).

Financial professionals associated with Prudential Advisors, Prudential’s proprietary nationwide sales organization.

The company is a leader in providing innovative pension risk management solutions to plan sponsors and in the stable value market.

The U.S. Businesses—Group Insurance

Develops and distributes a full range of group life, long-term and short-term group disability, and group corporate-, bank- and trust-owned life insurance in the U.S. primarily to institutional clients for use in connection with employee and membership benefits plans. Also sells accidental death and dismemberment and other supplemental health solutions and provides plan administration services in connection with its insurance coverages.

Products

The company offers a variety of products, through both non-experience- rated contracts (where the company assumes all mortality/morbidity risk) and experience-rated contracts (where mortality/morbidity experience is shared between the company and the clients), and services through the following businesses:

Group Life Insurance

Employer-paid, employee-paid and member-paid coverages for term life, group universal life and group variable universal life insurance, as well as accidental death and dismemberment insurance. Certain coverages allow employees to retain their coverage when they change employers or retire, and the company offers waiver of premium coverage in the event the insured suffers a qualifying disability.

Group corporate-, bank- and trust-owned life insurance in the form of group variable life insurance contracts utilizing separate accounts. These products are typically used by large corporations to fund deferred compensation plans and benefit plans for retired employees.

Group Disability Insurance

Short-term and long-term group disability insurance, which protect against loss of wages due to illness or injury. Short-term disability generally provides weekly benefits for three to six months while long-term disability benefits are typically paid monthly, following a waiting period, and generally continue until the insured either returns to work or reaches normal retirement age.

Other supplemental health solutions, including accident, hospital indemnity and critical illness insurance.

Plan administration and absence management services.

Marketing and Distribution

The company primarily distributes products through a proprietary sales force organized around market segments in conjunction with employee benefit brokers and consultants. The company defines its market segments as follows:

National Market—employer groups having over 5,000 individuals.

Premier Market—employer groups having between 100 and 5,000 individuals.

Association—affinity groups, regardless of size.

Revenues

The company’s revenues primarily come in the form of:

Premiums and policy charges for the company’s group life, group disability and supplemental health products.

Investment income (which contributes to the net spread over interest credited on the company’s products and related expenses).

The U.S. Businesses—Individual Life

Develops and distributes variable life, universal life and term life insurance products primarily to the U.S. mass middle (households with investable assets in excess of $25,000 or annual income in excess of $50,000), mass affluent (households with investable assets or annual income in excess of $100,000) and affluent (households with investable assets in excess of $250,000) customers with a focus on providing life insurance solutions to protect individuals, families and businesses and to support estate and wealth transfer planning.

Products

The company offers a variety of products, consisting of base contracts and riders (such as the company’s accelerated death benefit rider), that serve different protection needs and goals, including:

Variable Life—permanent coverage for life with potential to accumulate policy cash value based on underlying investment options.

The company’s variable life policies offer flexibility in payment options and the potential to accumulate cash value through a suite of underlying investment options or a fixed rate option.

Indexed variable life policies provide index-linked investment options (index strategies) in addition to a suite of underlying investment options or a fixed rate option. Index strategies credit interest to the cash value that is linked to, but not an investment in, the performance of an external index, subject to certain parameters, such as cap, step, participation, and buffer rates, as well as contractual minimums/maximums.

Universal Life—permanent coverage for life with the potential to accumulate policy cash value.

The company’s universal life policies offer flexibility in payment options and the potential to accumulate cash value in an account that earns interest based on a crediting rate determined by the company, subject to contractual minimums.

Indexed universal life policies provide interest credited to the cash value that is linked to, but not an investment in, the performance of an external index subject to certain cap and participation rates as well as contractual minimums/maximums.

Term Life—coverage for a specified number of years with a guaranteed tax-advantaged death benefit.

Most of the company’s term life policies offer an income tax-free death benefit and guaranteed premiums that will stay the same during the level-premium period.

Most of the company’s term life policies also offer a conversion option that allows the policyholder to convert the policy into a permanent policy that can potentially cover the insured for life.

Other

Final Expense Insurance—a whole life product that provides coverage in smaller face amounts, typically used for funeral expenses.

Marketing and Distribution

The company’s distribution efforts, which are supported by a network of internal and external wholesalers, are executed through a diverse group of distributors, including:

Third-party distribution through:

Independent brokers;

Banks and wirehouses; and

General agencies and producer groups.

Financial professionals associated with Prudential Advisors, Prudential’s proprietary nationwide sales organization.

Assurance IQ, which distributes proprietary simplified products consisting of term life and final expense insurance (as well as other third-party life, health and financial wellness solutions) directly to retail shoppers primarily through its digital and agent channels.

Direct-to-Consumer through:

Prudential.com, a digital platform that provides distribution of the company’s simplified products online.

Personal Advisory Group, Prudential’s sales desk where customers can speak to an agent via phone to fulfill their insurance or investment needs.

Revenues

The company’s revenues primarily come in the form of:

Premiums that are fixed in accordance with the terms of the policies.

Policy charges and fee income consisting of in-force policy- and/or asset-based fees.

Investment income (which contributes to the net spread over interest credited on the company’s products and related expenses).

International Businesses

Develops and distributes life insurance, retirement products, investment products and certain accident and health products with fixed benefits to mass affluent and affluent customers through the company’s Life Planner operations in Japan, Brazil, Argentina and Mexico. The company’s Gibraltar Life and Other operations also provide similar products, as well as advisory and administration services, through multiple distribution channels (including banks, independent agencies and Life Consultants) to broad middle income and mass affluent customers across Japan, through the company’s joint ventures in Chile, China, India and Indonesia; and through the company’s strategic investments in Ghana, Kenya and South Africa.

Products

The company’s products are classified into the following four categories:

Life Insurance Protection Products—include various traditional whole life products that provide either level or increasing coverage, and that offer limited or lifetime premium payment options.

The company also offers increasing, decreasing and level benefit term insurance products that provide coverage for a specified time period, as well as protection-oriented variable life products.

Some of these protection products are denominated in the U.S. dollars and some are sold as bundled products that, in addition to death protection, include health benefits or savings elements.

Retirement Products—include retirement income products that combine insurance protection similar to term life with:

A lifetime income stream that commences at a predefined age;

A savings-oriented variable life product that provides a non-guaranteed return linked to an underlying investment portfolio of equity and fixed income funds selected by the customer; and

Endowments that provide payment of the face amount on the earlier of death or policy maturity.

Investment Products—primarily represented by the U.S. dollar-denominated investment contracts sold by the company’s operations in Japan.

Represents single-pay products where credited interest rates are reset periodically for certain products.

Most of the company’s investment contracts impose a market value adjustment if the contract is not held to maturity.

Accident and Health Products—that provide the following:

Benefits to cover accidental death and dismemberment, hospitalization, surgeries, as well as costs of cancer and other dread diseases often sold as supplementary riders and not as stand-alone products; and

Waiver of premium coverage where required premiums are waived in the event the customer suffers a qualifying disability.

Marketing and Distribution

The company’s marketing and distribution efforts are conducted through the following proprietary agent models and third-party channels:

Proprietary agent models:

Life Planners—focus on selling protection-oriented life insurance products on a needs basis to mass affluent and affluent customers, as well as retirement-oriented products to small businesses. The company’s recruiting and selection process, training programs and compensation packages are key to the Life Planner model; and have helped the company’s Life Planner operations achieve higher levels of agent retention, agent productivity and policy persistency.

Life Consultants—a proprietary distribution force for products offered by the company’s Gibraltar Life operations. Their focus is to provide individual protection products to the broad middle income market, primarily in Japan, particularly through relationships with affinity groups. The company’s Life Consultant operation is based on a variable compensation plan designed to improve productivity and persistency that is similar to compensation plans in the company’s Life Planner operations.

Third-party channels:

Bank Distribution Channel—sells primarily life insurance products intended to provide savings features, premature death protection and estate planning benefits, as well as investment products primarily denominated in the U.S. dollars. The company views this channel as an adjunct to its core Life Planner and Life Consultant distribution channels. The company has relationships with Japan’s major banks, as well as many regional banks, and the company continue to explore opportunities to expand its distribution capabilities through this channel, as appropriate.

Independent Agency Distribution Channel—sells protection products and high cash value products for retirement benefits through the corporate market, and a variety of other products, including protection and investment products through the individual market. The company’s focus is to maintain a diverse mix of independent agency relationships, including corporate agencies and other independent agencies, with a balanced focus on individual and corporate markets.

Revenues

The company’s revenues primarily come in the form of:

Premiums that are fixed or flexible in accordance with the terms of the policies.

Policy charges and fee income consisting of in-force policy- and/or asset-based fees.

Investment income (which contributes to the net spread over interest credited on the company’s products and related expenses).

Corporate and Other

Includes corporate items and initiatives that are not allocated to the company’s business segments, certain businesses whose financial results and operations are not considered significant, and businesses that have been or will be divested or placed in wind-down status, except for the Closed Block. Results of the Closed Block, along with certain related assets and liabilities, are reported separately from the Divested and Run-off Businesses included in Corporate and Other.

Corporate Operations—Consists primarily of: (1) capital that is not deployed in any business segment; (2) investments not allocated to business segments; (3) capital debt; (4) the company’s qualified and non-qualified pension and other employee benefit plans, after allocations to business segments; (5) corporate-level activities, after allocations to business segments, including strategic expenditures, acquisition and disposition costs, corporate governance, corporate advertising, philanthropic activities, deferred compensation, and costs related to certain contingencies and legal matters; (6) expenses associated with the multi-year plan of programs that span across the company’s businesses and the functional areas that support those businesses; (7) certain retained obligations relating to pre-demutualization policyholders; (8) impacts of risk management activities pursuant to the company’s Risk Appetite Framework; (9) the foreign currency income hedging program used to hedge certain non-U.S. dollar denominated earnings in the company’s International Businesses segment; (10) intercompany arrangements with the company’s International Businesses and PGIM segments to translate certain non-U.S. dollar-denominated earnings at fixed currency exchange rates; (11) Assurance IQ, a wholly-owned consumer solutions distribution platform; (12) Prudential Advisors, Prudential’s proprietary nationwide sales organization; (13) the company’s share of earnings in Prismic, as well as the invested assets supporting the contracts reinsured with Prismic Re via coinsurance with funds withheld arrangements and the offsetting funds withheld payable; and (14) transactions with and between other segments, including the elimination of intercompany transactions for consolidation purposes.

Divested and Run-off Businesses—Reflects the results of businesses that have been, or will be, sold or exited, including businesses that have been placed in wind-down status that do not qualify for ‘discontinued operations’ accounting treatment under the U.S. GAAP. The company excludes these results from the company’s adjusted operating income. Divested and Run-off Businesses include:

Long-Term Care—In 2012, the company discontinued sales of its individual and group long-term care insurance products. The company establishes reserves for these products in accordance with U.S. GAAP. The company uses best estimate assumptions when establishing reserves for future policyholder benefits, including assumptions for morbidity, mortality, mortality improvement, persistency, and inflation. The company’s assumptions also include its estimate of the timing and amount of anticipated future premium rate increases and policyholder benefit reductions, including those which may require approval by state regulatory authorities, and a discount rate assumption based on an upper-medium grade fixed-income instrument yield.

Full Service Retirement Business—In the third quarter of 2021, the company entered into a definitive agreement to sell its Full Service Retirement business. The results of this business and the impact of its anticipated sale were transferred from the Retirement segment to Divested and Run-off Businesses at that time. The sale was completed in the second quarter of 2022.

The Prudential Life Insurance Company of Taiwan Inc.—In the third quarter of 2020, the company entered into a Share Purchase Agreement to sell its insurance business in Taiwan. The results of this business and the impact of its anticipated sale were transferred from the International Businesses segment to Divested and Run-off Businesses at that time. The sale was completed in the second quarter of 2021.

Closed Block Division

In connection with the demutualization in 2001, the company ceased offering domestic participating individual life insurance and annuity products under which policyholders are eligible to receive policyholder dividends reflecting experience. The liabilities for the company’s individual in-force participating products were segregated, together with assets to be used exclusively for the payment of benefits and policyholder dividends, expenses and taxes with respect to these products, in the Closed Block. The company selected the amount of assets that were expected to generate sufficient cash flow, together with anticipated revenues from the Closed Block policies, over the life of the Closed Block to fund payments of all policyholder benefits, expenses and taxes, and to provide for the continuation of the policyholder dividend scales that were in effect in 2000, assuming experience underlying such scales continued. No policies sold after demutualization have been added to the Closed Block, and its in-force business is expected to decline as the company pay policyholder benefits in full.

The results of the Closed Block, along with certain related assets and liabilities, comprise the Closed Block division, which is treated as a divested business under the company’s definition of adjusted operating income and reported separately from the other Divested and Run-off Businesses that are included in the company’s Corporate and Other operations.

The company’s strategy is to maintain the Closed Block as required by the company’s Plan of Reorganization over the time period of its gradual diminution as policyholder benefits are paid in full. The company is permitted under the Plan of Reorganization, with the prior consent of the Commissioner of Banking and Insurance for the State of New Jersey, to enter into agreements to transfer all or any part of the risks underlying the Closed Block policies.

Seasonality

The following summarizes the company’s key areas of seasonality in its results of operations:

First Quarter

PGIM: Higher compensation expense (long-term compensation expense for retirement eligible employees is recognized when awards are granted, typically in the first quarter of each year (year ended December 2023)).

Individual Life: Lowest underwriting gains.

International Businesses: Highest premiums.

Corporate & Other: Higher compensation expense (long-term compensation expense for retirement eligible employees is recognized when awards are granted, typically in the first quarter of each year) and lower Assurance IQ revenue.

Second Quarter

International Businesses: Lower premiums.

Corporate & Other: Lower Assurance IQ revenue.

All Businesses: Impact of annual assumption updates (impact of annual reviews and update of assumptions and other refinements. Excludes PGIM).

Third Quarter

Individual Life: Highest underwriting gains.

Corporate & Other: Lower Assurance IQ revenue.

Fourth Quarter

International Businesses: Lowest premiums.

Corporate & Other: Higher Assurance IQ revenue (annual Medicare enrollment).

All Businesses: Higher expenses (expenses are typically higher than the quarterly average in the fourth quarter).

Intangible and Intellectual Property

The company use numerous federal, state, common law and foreign service marks, including in particular ‘Prudential,’ the ‘Prudential logo,’ the company’s ‘Rock’ symbol and ‘PGIM.’

Regulation

The Dodd-Frank Wall Street Reform and Consumer Protection Act (‘Dodd-Frank’) increased the potential for federal regulation of the company’s businesses.

The company’s insurance, investment management and retirement businesses provide services to employee benefit plans subject to the Employee Retirement Income Security Act (ERISA).

The company and its distributors are subject to rules regarding the standard of care applicable to sales of the company’s products and the provision of advice to the company’s customers, including, among others, the U.S. Department of Labor (‘DOL’) fiduciary rule, the Securities and Exchange Commission (‘SEC’) Regulation Best Interest, and the National Association of Insurance Commissioners (‘NAIC’) and Japanese Financial Services Agency (‘FSA’) Standard of Care regulations.

The New Jersey Department of Banking and Insurance (‘NJDOBI’) acts as the group-wide supervisor of Prudential Financial pursuant to New Jersey legislation that authorizes group-wide supervision of internationally active insurance groups (‘IAIGs’). The law, among other provisions, authorizes NJDOBI to examine Prudential Financial and its subsidiaries, including by ascertaining the financial condition of the insurance companies for purposes of assessing enterprise risk. In accordance with this authority, NJDOBI receives information about the company’s operations beyond those of its New Jersey domiciled insurance subsidiaries.

State insurance departments in the fifty states, the District of Columbia and various U.S. territories and possessions monitor the company’s insurance operations. PICA is domiciled in New Jersey and its principal insurance regulatory authority is the NJDOBI.

The company’s variable life insurance, variable annuity and mutual fund products generally are ‘securities’ within the meaning of federal securities laws and may be required to be registered under the federal securities laws and subject to regulation by the SEC and the Financial Industry Regulatory Authority (‘FINRA’). Certain of the company’s insurance subsidiaries are subject to SEC public reporting and disclosure requirements based on offerings of these products.

The company’s international insurance operations are principally supervised by regulatory authorities in the jurisdictions in which they operate, including the FSA, the financial services regulator in Japan.

Prudential’s subsidiaries Gibraltar Reinsurance Company Ltd. and Lotus Reinsurance Company Ltd., as well as Prismic, in which Prudential has a significant equity interest, are Bermuda exempted companies with liability limited by shares and each is registered as a Class E (re)insurer under the Bermuda Insurance Act 1978, and related regulations as amended from time to time (‘Bermuda Insurance Act’). By virtue of their registration under the Bermuda Insurance Act, these companies are supervised by the Bermuda financial services regulator, the Bermuda Monetary Authority (‘BMA’).

The company’s retirement and investment products and services are subject to federal and state securities and fiduciary laws, ERISA, and other laws and regulations. The SEC, FINRA, the Commodity Futures Trading Commission (‘CFTC’), National Futures Association (‘NFA’), state securities commissions, state banking and insurance departments, DOL and the Department of the Treasury are the principal U.S. regulators that regulate the company’s retirement and investment management operations. In some cases, the company’s domestic U.S. investment operations are also subject to non-U.S. securities laws and regulations.

Some of the separate account, registered fund and other pooled investment products offered by the company’s businesses, in addition to being registered under the Securities Act, are registered as investment companies under the Investment Company Act of 1940, as amended, and the shares of certain of these entities are qualified for sale in some states and the District of Columbia. Separate account investment products are also subject to state insurance regulation as described above. The company also has several subsidiaries that are registered as broker-dealers under the Securities Exchange Act of 1934 (‘Exchange Act’), as amended, and are subject to federal and state regulation. In addition, the company has subsidiaries that are investment advisers registered under the Investment Advisers Act of 1940, as amended. The company’s third-party advisors and licensed sales professionals within Prudential Advisors and other employees, insofar as they sell products that are securities, are subject to the Exchange Act and to examination requirements and regulation by the SEC, FINRA and state securities commissioners. Regulation and examination requirements also extend to various Prudential entities that employ or control those individuals.

The company has subsidiaries that are broker-dealers or investment advisers. The SEC, the CFTC, state securities authorities, FINRA, the NFA, the Municipal Securities Rulemaking Board, and similar authorities are, as applicable, the principal regulators of these subsidiaries.

The company’s broker-dealer and commodities affiliates are members of, and are subject to regulation by, ‘self-regulatory organizations,’ including FINRA and the NFA, as applicable. Self-regulatory organizations conduct examinations of, and have adopted rules governing, their members.

The company is also subject to various laws and regulations relating to corrupt and illegal payments to government officials and others, including the U.S. Foreign Corrupt Practices Act and the U.K.’s Anti-Bribery Law.

History

Prudential Financial, Inc. was founded in 1875. The company was incorporated in 1999.

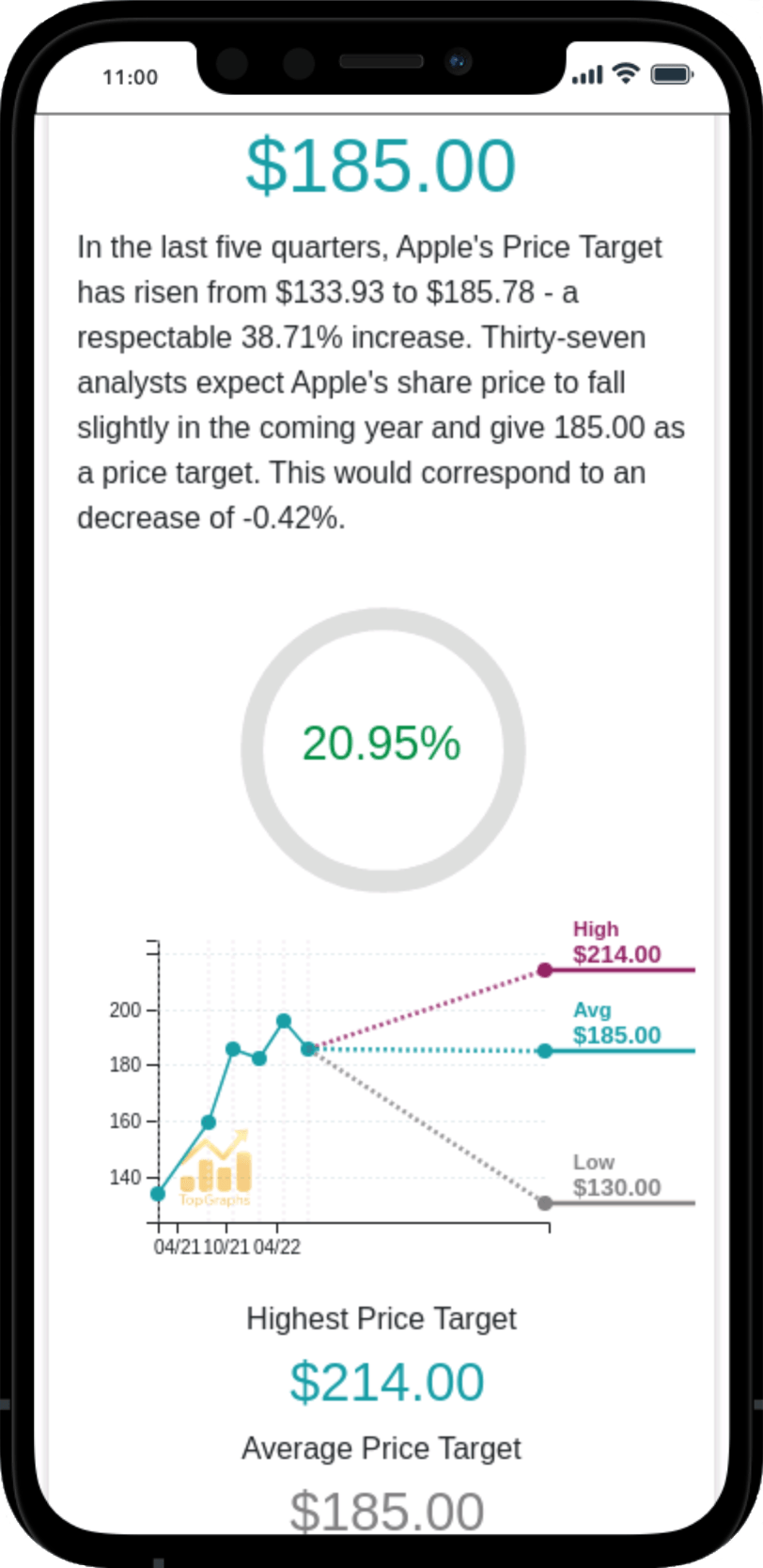

Stock Value

Stock Value