About MultiPlan

MultiPlan Corporation provides data analytics and technology-enabled solutions designed to bring affordability, efficiency, and fairness to the U.S. healthcare industry.

The company has evolved both organically and through acquisition into a national organization offering three categories of services:

MultiPlan services target the latter two of these approaches, as illustrated by the schematic below, which shows the value chain for healthcare services from care provision to payment.

MultiPlan sits at the nexus of four constituencies – Payors, employers/plan sponsors, plan members and providers – offering an independent reimbursement solution to reduce healthcare costs in a manner that is systematic, efficient and fair to all parties involved.

MultiPlan offers services to the company’s customers in three categories:

Analytics-Based Services: a suite of data-driven algorithms and insights that detect claims over-charges and either negotiate or recommend fair reimbursement for out-of-network medical costs using a variety of data sources and pricing algorithms. These services are applied prior to the payment of the claim and are often processed within a day of receipt;

Network-Based Services: contracted discounts with healthcare providers to form one of the largest independent preferred provider organizations (PPO) in the United States, as well as outsourced network development and/or management services. These services are applied prior to the payment of the claim and are typically processed within a day of receipt; and

Payment and Revenue Integrity Services: data, technology, and clinical expertise deployed to identify and remove improper and unnecessary charges before or after claims are paid, or to identify and help restore and preserve underpaid premium dollars.

The company’s comprehensive service offerings are often utilized as a suite of solutions to manage medical costs and are often embedded into its customers' technology environments, enabling it to maintain long-term relationships with a number of its customers, including relationships of over 25 years with some of the nation's largest Payors.

MultiPlan Services

Analytics-Based Services

The company’s Analytics-Based Services reduce the per-unit cost of claims using data-driven negotiation and/or reference-based pricing methodologies. These services often are used in a solution hierarchy after MultiPlan's network services to reduce claims with no available network contract, but are also used standalone. All of the services in this category leverage the company’s information technology platform, public data sources, and the billions of claims that it has reviewed and are included in its database reflecting both network and out-of-network priced claims, as well as the results of clinical coding analyses. They feature proprietary algorithms and machine learning/AI to allow claims to be processed quickly and accurately.

Reference-Based Pricing (RBP): RBP provides Payors with a recommended payment amount for out-of-network claims based on a reference point. Most RBP programs in the market uses Medicare as the reference point. The company also offers this option, but most customers elect to use its Data iSight program which uses facility cost as the facility reference point and median reimbursed amounts as the professional reference point. Data iSight delivers provider acceptance of over 90% for facility and 96% for professional claims, and for those claims that are appealed, the company successfully retains about 88% of savings through education and negotiation. The company offers a number of additional choices of reference point, including: median contracted rates (adjusted to the Qualifying Payment Amount for certain surprise bill claims), and usual and customary charges. The company’s Reference-Based Pricing services are used by all types of Payors, most notably large commercial insurers, Blue Cross and Blue Shield plans, provider-sponsored and independent health plans. They are most commonly priced at a percentage of savings identified.

Value-Driven Health Plan Services (VDHP): VDHP is a form of reference-based pricing that bundles member and provider engagement tools to enable employers and other health plan sponsors to offer low-cost health plans. The company’s VDHP service offerings enable a range of VDHP configurations, including a standard form of VDHP which integrates its PPO network for professional and select facility services; a full VDHP which has no network; and a community-based VDHP which features an agreement with a marquee health system in the area to accept the reference-based price in exchange for preferred steerage of the health plan’s members. VDHP services are sold to employers directly using the broker/consultant channel, or through Third-Party Administrators (TPAs). They are most in demand in the small and mid-sized group market. They are most commonly priced per-employee/member-per-month (PEPM).

Financial Negotiation: The company’s financial negotiation services assist Payors with pricing out-of-network claims from providers with whom neither the Payor nor MultiPlan have been able to secure a contractual discount. The company handles these claims on an individual basis and attempt to negotiate with the provider an acceptable payment amount for a specific claim that includes member protections from balance billing. Negotiation agreements protect the health plan member from balance billing. Approximately half of the successfully negotiated claims are completed in a fully automated manner. These claims include those in which the proposed negotiated amount is generated by algorithms and automatically transmitted to the provider’s office, and/or that are electronically accepted and signed by the provider. Certain providers also choose to set up an arrangement with MultiPlan for pre-determined levels of discount to be automatically deducted on claims that would otherwise be individually negotiated. For those claims that are not automatically negotiated, MultiPlan works directly with the provider's office through the company’s negotiations staff, which is aided by extensive workflow and benchmarking tools. Financial negotiation services are used by all types of Payors, most notably Blue Cross and Blue Shield plans, provider-sponsored and independent health plans. They are priced at a percentage of savings identified.

Surprise Billing Services. Introduced in 2021, the company’s surprise billing services help Payors comply, or help their employer/plan sponsor customers comply, with the federal No Surprises Act (NSA), which became effective on January 1, 2022. Interim final regulations issued on July 13, 2021 and October 7, 2021 (IFRs) and then final regulations issued on August 26, 2022 (the Final Rules), have provided additional detail on how payors and providers must operate under the NSA. These IFRs and Final Rules implemented portions of the NSA and introduced changes to the reimbursement process of certain types of medical claims, increasing what was typically a one- to two-step reimbursement process to five steps. MultiPlan performs all five steps in an end-to-end service, or makes each step available as components to meet the specific needs of each Payor. The steps require extensive data collection and analysis to identify claims as surprise bills under the law’s definition; calculate the new Qualifying Payment Amount (QPA) introduced by the law and append it to the claim; create an initial payment amount for the claim, typically by using the QPA as the reference point; negotiate a settlement as needed; and take claims through an independent dispute resolution process as needed. In offering these new services, the company leverages existing technology and expertise in data science, claim pricing, and negotiation. The services are used by all types of Payors that must comply with the No Surprises Act (NSA), and are priced either as a percentage of savings for the end-to-end service, or on a per-claim basis for individual components.

Network-Based Services

The company’s Network-Based Services reduce the per-unit cost of claims through contracts with providers and facilities that establish discounts with member protection from balance billing in exchange for patient steerage and other provider-friendly terms and conditions. These services generally are used first in a solution hierarchy with members actively steered to participating providers through online and other directories. The services leverage the company’s extensive network development, credentialing and data management capabilities, as well as a sophisticated transaction engine that matches rendering provider information on the claim to the applicable network contract so the discount can be applied. The company offers a variety of network configurations to support all types and sizes of health plans, generally used as either the primary network, or as a complement to another primary network.

Primary Networks: For Payors without their own direct contractual discount arrangements with providers, the company’s primary networks serve as the network for the Payor’s commercial health plans in a given service area in exchange for a PEPM rate, or as the Payor’s out-of-area extended primary network in exchange for a percentage of the savings identified. The company’s national primary network, branded PHCS Network, has been continuously accredited for credentialing by the National Committee for Quality Assurance (NCQA) since 2001. This provides assurances to employers/plan sponsors and plan members of the quality of providers in the network. Customers mainly include provider-sponsored and independent health plans; Taft-Hartley plans and TPAs, as it is more cost effective for these Payors to outsource this function than to incur the expense of developing and maintaining their own network of thousands of doctors and hospitals.

Complementary Networks: The company’s complementary networks provide Payor customers with access to its national network of healthcare providers that offer discounts under the health plan’s out-of-network benefits, or otherwise can be accessed secondary to another network. Payors use the network to expand provider choice for consumers, and to achieve contracted price reductions with member protections on more claims. The service is priced based on a percentage of savings identified. Customers most commonly include large commercial insurers, property and casualty carriers via their bill review vendors, Taft-Hartley plans, provider-sponsored and independent health plans, and some TPAs.

Other Network Services: The company also offers network build and network management services. Network build services comprise custom development of and/or access to primary network contracts, leveraging the company’s extensive network development team and analytic tools, including a tool combining internal provider data with public sources to enable strategic targeting of providers to be contracted. Customers of this custom build/access service include MA and Medicaid health plans seeking assistance with expansion plans or help maintaining the required network adequacy. Network management services enable health plans to outsource key steps in their claim adjudication. The company loads proprietary or third-party network demographic and rate information and perform claim pricing, as well as optional credentialing and data management services for claims associated to networks that aren’t owned by MultiPlan.

Payment and Revenue Integrity Services

The company’s Payment Integrity Services use data, technology and clinical expertise to assist Payors in identifying improper, unnecessary and excessive charges before or after claims are paid, as well as issues with premiums paid by CMS for government health plans caused by discrepancies with enrollment-related data. Payment Integrity Services can be used before payment, to correct overpayments before they are issued, or after payment to enable the recovery of overpaid dollars. Revenue Integrity Services identify and correct errors in plan enrollment data that lead to underpayment of CMS premium dollars. The services rely heavily on the company’s internal and other data sources, advanced analysis, machine learning and transaction processing technology, as well as clinical expertise to aid in the identification and selection of issues to be addressed with the least provider abrasion.

Clinical Negotiation: This is a specialized pre-payment integrity service targeting claims not reduced through a commercial healthcare Payor’s primary network(s). Eligible claims are taken through payment integrity analytics and a scoring process to identify scenarios where a clinical discussion with the billing provider is warranted. Based on the resulting score, a claim reduction is negotiated with the provider based on clinical findings and a signed agreement is obtained. This service is most commonly used by large commercial Payors, Blue Cross and Blue Shield plans, and provider-sponsored and other independent health plans. Claims are priced based on a percentage of savings identified. Clinical Negotiation also is integrated into MultiPlan's network pricing so the majority of customers benefit from this pre-payment integrity service.

Pre-Payment Clinical Reviews: Pre-payment claims utilize payment integrity analytics, which may include any of the following additional reviews: medical coder, clinician, medical record or itemized bill. Claims are returned with recommended corrections. The services target all claims, including a Payor’s in-network claims, and are most commonly used by large commercial and MA/Medicaid insurers, Blue Cross and Blue Shield plans, and provider-sponsored and other independent health plans. Services are priced based on a percentage of savings identified, where savings is defined as the difference between the allowed amount established by pricing the claim through its normal process and the corrected allowed established based on items/services flagged for removal during the review. Some of the services also are integrated into MultiPlan's network pricing and analytics-based services so the majority of customers benefit from the company’s pre-payment integrity clinical review services.

Coordination of Benefits and Subrogation Services (pre- and post-payment): Coordination of Benefits identifies payments that should have been made by a health plan member's other health insurance coverage (for example, if the member's spouse has coverage through another employer-sponsored plan). Subrogation Services identify payments made related to an accident that are the responsibility of another responsible third party. The services use data, technology and highly experienced staff to identify cases, validate coverage status, report or recover dollars paid in error, and assist with root cause correction to avoid future potential overpayments. Subrogation services are also available in a Software-as-a-Service (SaaS) model. These services are used by commercial, MA and managed Medicaid Payors and depending on the service, are priced based on a percentage of savings identified and/or recovered, per member per year, or per member with primary coverage identified.

Data Mining (post-payment): Data Mining deploys payment integrity analytics combining industry-accepted rules and plan-specific policies to identify overpayments associated with claim adjudication errors, billing errors and contract language, as well as their root causes. Findings are returned to the Payor for action. These services are used by commercial, MA, managed Medicaid and state Medicaid Payors and are priced based on a percentage of savings identified and/or recovered.

Revenue Integrity Services: Targeting issues unique to MA Payors, these services use data, technology, and clinical expertise to identify and restore underpaid premiums, and to improve accuracy of future premiums paid to MA plans by CMS. There are three services offered, typically used in combination: Medicare Secondary Payor interfaces with CMS to confirm member eligibility records for primacy, correct inaccuracies, and help restore and preserve underpaid premium dollars; End Stage Renal Disease (ESRD) analyzes claim data to identify MA plan members with missing ESRD statuses at CMS and works with dialysis providers and CMS to correct the statuses; and Part D Other Health Insurance (OHI) leverages analytics to identify MA plan members where the Part D Pharmacy Coverage on file with CMS is inaccurate and effectuates corrections with CMS. The updated Part D information improves compliance, efficiencies and member satisfaction. These services are priced based on a percentage of the CMS premiums restored to the MA Payor. Part D OHI is priced per validated member with other primary Part D coverage.

Strategy

The company’s growth strategy seeks to amplify this value proposition, and expand beyond it, by leveraging its longstanding customer relationships and extensive proprietary data and algorithms. The strategy has three components: enhancing the performance of the company’s existing service offerings, adding new services or evolving existing service feature/function to meet shifting market requirements, and expanding beyond its three existing service lines within its core and adjacent markets.

The company enhances existing service performance through technology, data and strategic changes aimed at delivering more value on the claim volume it already receives from existing customers. The company has made and continue to make investments in combining proprietary data with third party data, and in advanced technologies, such as artificial intelligence and machine learning to improve service performance.

The company routinely adds services or evolve existing service features and functions within its core service offerings, with initiatives informed by continuously scanning the market and the unique insights its customers share into the market’s unmet needs and changing preferences. An example of this facet of the company’s strategy was the introduction of the 2022 No Surprises Act compliance services combining its pricing and negotiation competencies with new data and logic assets and the addition of a new arbitration service in order to enable its customers to comply with sweeping new regulations. The company is in the process of introducing the next generation of these services, which uses data science to deepen customer value and competitive advantage for MultiPlan. The company has also invested in sales resources to heighten cross-selling activity with existing customers, aided by its extensive ability to bundle discrete service offerings in unique ways.

Finally, the company maintains its focus on introducing new services, either organically or via acquisition, that deliver different value propositions to its customers. The company’s recent focus in this area has been on growing its footprint with in-network commercial claims and MA claims, which significantly increases its total addressable market while leveraging its deep existing customer relationships and existing technology infrastructure. In addition to the 2014 introduction of pre-payment integrity services, recent examples of this strategy component include the acquisitions of HST in 2020 and Discovery Health Partners in 2021. HST added a new service line the company calls Value-Driven Health Plan Services, direct-to-employer services enabling a new type of benefit plan design with reference-based pricing at its core. Discovery Health Partners broadened the company’s pre-payment integrity services to include both post-payment integrity and revenue integrity services.

Markets

The company works with healthcare Payors in the commercial healthcare, government healthcare and property and casualty markets. Substantially all of MultiPlan's services are available in all 50 U.S. states and the District of Columbia. All services are available to all applicable customers regardless of geographic location, company type or size.

Commercial Health

The company works with fully-insured plans directly, including national insurers, Blue Cross and Blue Shield plans, provider-sponsored and independent health plans. The company works with self-insured plans primarily through their plan administrators, which include the same types of companies, as well as TPAs and sometimes the employers/plan sponsors themselves.

Customers

MultiPlan works directly with over 700 Payors to manage medical cost and billing and payment accuracy for their Administrative Services Only (ASO), self-insured employers/plan sponsors and fully-insured health plans where applicable. The company also indirectly services consumers accessing healthcare services through commercial and government health plans or property and casualty policies. In aggregate, the company serves a diverse customer base consisted of national and regional insurance companies, Blue Cross and Blue Shield plans, provider-sponsored and independent health plans, TPAs, self-insured health plans, property and casualty insurers, bill review companies and other companies involved in the claim adjudication process. Through the company’s HST subsidiary it also works with employers directly and through their brokers/consultants.

The company has strong relationships with its customers, which include substantially all of the largest health plans and their ASO platforms. Contract terms with larger customers are often three years and as many as five years, while mid- to small-sized customer contracts are often annual and typically include automatic one-year renewals. The company continues to experience high renewal rates and its top ten customers based on full year 2022 revenues have been customers for an average of 25 years.

The company estimates that in 2022 its Payor customers served over 100,000 employers/plan sponsors actively using its services through the ASO distribution channels, which generated over 85% of its combined Network and Analytics revenues in 2022. Through these plan sponsors, an estimated 60 million consumers have access to its services through their health plans. The company’s three largest Payor customers accounted for approximately 32%, 20% and 10%, respectively, of its revenues for the year ended December 31, 2022.

Network

As of December 31, 2022, the company’s network included over 1.3 million healthcare providers. The company’s team of approximately 100 network development professionals manages these network relationships across its Primary and Complementary PPO Networks. The network development team manages a sophisticated program of data mining, profiling, recruiting and ultimately contracting with new providers to increase the value provided to customers.

Sales and Marketing

The company’s largest customers are serviced by a team of national account managers and senior executives responsible for continued growth of the relationship. The account team partners strategically with the company’s customers, leveraging its Healthcare Economics unit to mine the customer's data and proactively present opportunities to the customer to improve performance and competitive position. This team also delivers account service, including daily claims management, RFPs, service inquiries and other marketing and operational support functions. The national account managers are compensated with a base salary plus bonus linked to customer retention.

The majority of the company’s customers are serviced by a dedicated team of account managers and account service professionals organized into three market-focused departments—Health Plans (commercial and government), TPA/Employer, and Property and Casualty. These teams also include sales professionals responsible for new customer acquisition. The market-focused account managers are responsible for relationship management, as well as for growing revenue through expanded use of services. They are compensated with a base salary plus a bonus and commission based on customer retention and revenue from upselling new products. The sales professionals are compensated with a base salary plus commission based on revenue from new customers. Sales and upselling efforts are supported by a marketing team, which generates leads, builds brand awareness, implements and educates customers and develops proposals.

Competition

The company’s competitors vary by service as follows.

Analytics-Based Services: The company competes with 6Degrees; Advanced Medical Pricing Solutions (AMPS); ELAP Services; Payer Compass; Zelis; ClearHealth Strategies; and Naviguard.

Network-Based Services: The company competes with First Health Group Corp., an indirect wholly owned subsidiary of Aetna, Inc.; TRPN; and Zelis.

Payment and Revenue Integrity Services: The company competes with Optum; Conduent; Cotiviti, Inc.; SCIO; and The Rawlings Group.

Government Regulations

The company is subject, either directly or indirectly through its customer relationships, to federal and state laws and regulations governing privacy, security and breaches of patient information and the conduct of certain electronic health care transactions, including for example, HIPAA, which imposes rules protecting individually identifiable health information and setting national standards for the security of electronic Protected Health Information; (PHI). The company is a Business Associate (as defined by HIPAA) of its customers. As such, the company must comply with all applicable provisions of HIPAA (the Health Insurance Portability and Accountability Act and the Health Information Technology for Economic and Clinical Health Act, each as amended, and the regulations that implement such laws), including the HIPAA Security Rule and applicable provisions of the HIPAA Privacy Rule and the Breach Notification Rule.

History

MultiPlan Corporation was founded in 1980.

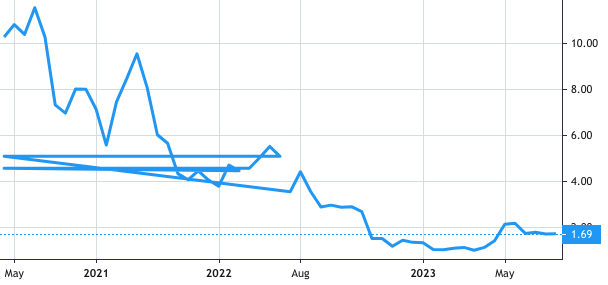

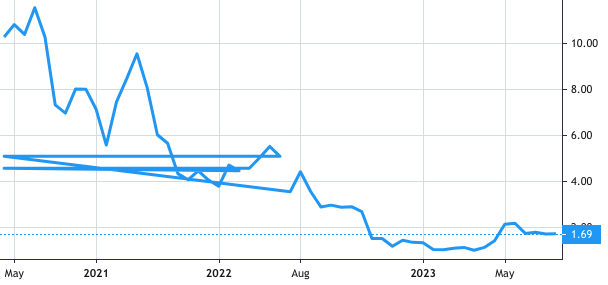

Stock Value

Stock Value