About Equitable Holdings

Equitable Holdings, Inc., through its subsidiaries, operates as a financial services company worldwide.

The company has three primary business lines - retirement, asset management and affiliated distribution - that it runs through its two complementary and well-established principal franchises, Equitable and AllianceBernstein. The company provides advice and solutions for helping Americans to set and meet their retirement goals and protect and transfer their wealth across generations; and a wide range of investment management insights, expertise and innovations to drive better investment decisions and outcomes for clients and institutional investors worldwide. The company continues to maintain market-leading positions in Individual Retirement, Group Retirement, Investment Management and Research, and Protection Solutions while its Wealth Management segment continues to grow in prominence.

The company distributes its products through a premier affiliated and third-party distribution platform, consisting of:

Affiliated Distribution:

The company's affiliated retail sales force, Equitable Advisors, which has approximately 4,400 licensed financial professionals who advise on retirement, protection and investment advisory solutions; and

More than 200 Bernstein Financial Advisors, who are responsible for the sale of investment products and solutions to Private Wealth clients.

Third-Party Distribution:

Approximately 1,000 distribution agreements with banks, broker dealers, insurance carriers, brokerage general agencies, independent marketing organizations and wires giving the company access to more than 150,000 financial professionals to market its retirement, protection and investment solutions; and

An AB global distribution team of more than 500 professionals, who engage with more than 5,000 retail distribution partners and more than 700 institutional clients.

Segment Information

The company operates through six segments: Individual Retirement, Group Retirement, Investment Management and Research, Protection Solutions, Wealth Management, and Legacy.

Individual Retirement-This segment is a leading provider of variable annuity products, which primarily meet the needs of individuals saving for retirement or seeking retirement income by allowing them to invest in various markets through underlying investment options.

Group Retirement-This segment offers tax-deferred investment and retirement services or products to plans sponsored by educational entities, municipalities and not-for-profit entities, as well as small and medium-sized businesses.

Investment Management and Research-This segment is a leading provider of diversified investment management, research and related services to a broad range of clients globally.

Protection Solutions-This segment focuses its life insurance products on attractive protection segments, such as VUL insurance and IUL insurance and its employee benefits business on small and medium-sized businesses.

Wealth Management-This segment is an emerging leader in the wealth management space with a differentiated advice value proposition, that offers discretionary and non-discretionary investment advisory accounts, financial planning and advice, insurance, and annuity products.

Legacy-This segment primarily consists of the capital intensive fixed-rate GMxB business written in the Individual Retirement market prior to 2011. This business offered GMDB features in isolation or together with GMLB features. This business also historically offered variable annuities with four types of guaranteed living benefit riders: GMIB, GWBL/GMWB and GMAB.

Individual Retirement

The company's Individual Retirement segment is a leading provider of individual variable annuity products.

Products

The company's products are primarily sold to affluent and high net worth individuals saving for retirement or seeking guaranteed retirement income. The company's product offerings primarily include:

Structured Capital Strategies (SCS): SCS is a registered index-linked variable annuity product which allows the policyholder to invest in various investment options, whose performance is tied to one or more securities indices, commodities indices or ETFs, subject to a performance cap, over a set period of time. The risks associated with such investment options are borne entirely by the policyholder, except the portion of any negative performance that the company absorbs (a buffer) upon investment maturity. In 2021, the company introduced SCS Income, a new version of SCS, offering a GMxB feature. SCS Income is also a registered index-linked annuity that combines lifetime income options with some protection from market volatility in the equities or other financial market or markets to which the annuity is linked.

Retirement Cornerstone (RC): The company's Retirement Cornerstone variable annuity product offers two platforms: RC Performance, which offers access to a broad selection of funds with annuitization benefits based solely on non-guaranteed account investment performance and RC Protection, which offers access to a focused selection of funds and an optional floating-rate GMxB feature providing guaranteed income for life.

Investment Edge: The company's investment-only variable annuity is designed to be a wealth accumulation product that defers current taxes during accumulation and provides tax-efficient distributions on non-qualified assets through scheduled payments over a set period of time with a portion of each payment being a return of cost basis, which is thus excludable from taxes. An optional SIO feature allows a policyholder to invest in various investment options whose performance is tied to one or more securities indices, subject to a performance cap, with some downside protection over a set period of time. This optional SIO feature leverages its innovative SCS offering. Investment Edge does not offer any GMxB feature other than an optional return of premium death benefit.

The company's Individual Retirement segment works with EIMG to identify and include appropriate underlying investment options in its products, as well as to control the costs of these options and increase profitability of the products.

Variable Annuities Policy Feature Overview

Variable annuities allow the policyholder to make deposits into accounts offering variable investment options. For deposits allocated to Separate Accounts, the risks associated with the investment options are borne entirely by the policyholder, except where the policyholder elects GMxB features in certain variable annuities, for which additional fees are charged. Additionally, certain variable annuity products permit policyholders to allocate a portion of their account to investment options backed by the General Account and are credited with interest rates that it determines, subject to certain limitations.

Certain variable annuity products offer one or more GMxB features in addition to the standard return of premium death benefit guarantee. GMxB features (other than the return of premium death benefit guarantee) provide the policyholder a minimum return based on their initial deposit adjusted for withdrawals (i.e., the benefit base), thus guarding against a downturn in the markets. GMxB riders must be chosen by the policyholder no later than at the issuance of the contract.

Markets

For its Individual Retirement segment, the company targets sales of its products to both retirees seeking retirement income and a broader class of investors, including affluent, high net worth individuals and families saving for retirement, registered investment advisers and their clients, as well as younger investors who have maxed out contributions to other retirement accounts but are seeking tax-deferred growth opportunities.

The company's customers can prioritize certain features based on their life-stage and investment needs. In addition, its products offer features designed to serve different market conditions. SCS serves clients with investable assets who want exposure to equity markets but also want to guard against a market correction. SCS Income serves clients who want exposure to equity markets but also want to protect against market correction while seeking guaranteed income. Retirement Cornerstone serves clients who want growth potential and guaranteed income with increases in a rising interest rate environment. Investment Edge serves clients concerned about rising taxes.

Distribution

The company distributes its variable annuity products through Equitable Advisors, its affiliate which is registered both as a broker-dealer and as an investment adviser and whose retail sales force sells both proprietary and third-party variable annuity, life insurance, employee benefits and investment products and services. The company also distributes its variable annuity products through third-party distribution channels, which include banks, broker-dealers and insurance partners. For the year ended December 31, 2023, Equitable Advisors represented 32% of the company's variable annuity FYP in this segment, while its third-party distribution channel represented 67% of its variable annuity FYP in this segment. The company employs over 180 external and internal wholesalers who distribute its variable annuity products across both channels.

Group Retirement

The company's Group Retirement segment offers tax-deferred investment and retirement services or products to plans sponsored by educational entities, municipalities and not-for-profit entities, as well as small and medium-sized businesses. The company operates in the 403(b), 457(b) and 401(k) markets where it sells variable annuity and mutual fund-based products. RBG, a dedicated subset of over 1,000 Equitable Advisors (which include both broker-dealer representatives and investment advisory personnel), is the primary distributor of its products and related solutions to individuals in the K-12 education market.

The tax-exempt 403(b)/457(b) market, which includes the company's 403(b) K-12 education market business, accounted for 74% of gross premiums within the Group Retirement business for the year ended December 31, 2023. The institutional lifetime income market accounts for 3%, the corporate 401(k) market accounts for 19% and the remaining 4% is Other as of December 31, 2023.

Products

The company's products offer educators, municipal employees and corporate employees a savings opportunity that provides tax-deferred wealth accumulation. The company's innovative product offerings address all retirement phases with diverse investment options.

Variable Annuities

The company's variable annuities offer defined contribution plan record-keeping, as well as administrative and participant services combined with a variety of proprietary and non-proprietary investment options. The company's variable annuity investment lineup mostly consists of proprietary variable investment options that are managed by EIMG, which provides discretionary investment management services for these investment options that include developing and executing asset allocation strategies and providing rigorous oversight of sub-advisors for the investment options. This helps to ensure that the company retains high quality managers and that it leverages its scale across both the Individual Retirement and Group Retirement products. In addition, the company's variable annuity products offer the following features:

Guaranteed Investment Option (GIO)-Provides a fixed interest rate and guarantee of principal.

Structured Investment Option (SIO)-Provides upside market participation that tracks certain available indices subject to a performance cap, with some downside protection against losses in the investment over a one, three or five-year period. This option leverages the company's innovative SCS individual annuity offering.

Personal Income Benefit-An optional GMxB feature that enables participants to obtain a guaranteed withdrawal benefit for life for an additional fee.

While GMxB features and Institutional products with guaranteed benefits provide differentiation in the market, this accounts for approximately 1.3% of the company's total AV (other than ROP death benefits) as of December 31, 2023.

Open Architecture Mutual Fund Platform

The company also offers a mutual fund-based product to complement its variable annuity products. This platform provides a similar service offering to its variable annuities. The program allows plan sponsors to select from thousands of proprietary and third party-sponsored mutual funds. The platform also offers a group fixed annuity that operates very similarly to the GIO as an available investment option on this platform.

Services

Both its variable annuity and open architecture mutual fund products offer a suite of tools and services to enable plan participants to obtain education and guidance on their contributions and investment decisions and plan fiduciary services. Education and guidance are available online or in person from a team of plan relationship and enrollment specialists and/or the advisor that sold the product. The company's clients' retirement contributions come through payroll deductions, which contribute significantly to stable and recurring sources of renewals.

Markets

The company primarily operate sin the tax-exempt 403(b)/457(b), corporate 401(k) and other markets.

Tax-exempt 403(b)/457(b)/401(a): The company's core customer base consists of governmental plans of which Public School Districts and their employees make up the majority of its portfolio.

Overall, the 403(b) and 457(b) markets represent 71% of FYP in the Group Retirement segment for the year ended December 31, 2023. The company seeks to grow in these markets by increasing its presence in the school districts where it operates and also by potentially growing its presence in school districts where it does not have access.

Corporate 401(k): The company targets small and medium-sized businesses with 401(k) plans that generally have under $20 million in assets. The company's product offerings accommodate start up plans and plans with accumulated assets. Typically, the company's products appeal to companies with strong contribution flows and a smaller number of participants with relatively high average participant balances.

Institutional 401(k): In 2022, the company expanded its presence in the institutional lifetime income market through its relationship with AllianceBernstein. The company's Institutional business offers GMxB and other annuity guarantees to large institutional retirement plans (>$500M in assets). The products are distributed through asset managers in the defined contribution markets. The company is actively seeking to expand the institutional business.

Other: The company's other business includes an affinity-based direct marketing program where it offers retirement and individual products to employers that are members of industry or trade associations and various other sole proprietor and small business retirement accounts.

Distribution

The company primarily distributes its products and services to this market through Equitable Advisors, primarily using RBG and third-party distribution firms. For the year ended December 31, 2023, these channels represented approximately 76% and 24% of the company's sales, respectively. The company also distributes through direct online sales, which includes engaging existing clients to increase contributions online. The company's direct-to-consumer program uses data analysis combined with digital media to engage educators, teach them about their retirement needs and increase awareness of its products and services. The company employs internal and external wholesalers to exclusively market its products through Equitable Advisors and third-party firms that are licensed to sell its products. Equitable Advisers also accounted for 95% of the company's 403(b) sales in 2023.

Investment Management and Research

The company's Investment Management and Research business provides diversified investment management, research and related services globally to a broad range of clients through AB's three buy-side distribution channels: Institutions, Retail and Private Wealth Management, and AB's sell-side business, Bernstein Research Services. AB Holding is a master limited partnership publicly listed on the NYSE. The company owns an approximate 61% economic interest in AB. As the general partner of AB, it has the authority to manage and control its business. The company is AB's largest client.

Products and Services

Investment Services

AB is fully invested in delivering better outcomes for their clients. Key to this philosophy is developing and integrating research on material ESG issues, as well as AB's approach to engagement, when in the best interest of its clients. AB's global research network, intellectual curiosity and collaborative culture allow AB to advance clients' investment objectives, whether AB's clients are seeking idiosyncratic alpha, total return, downside mitigation, or sustainability and impact-focused outcomes.

AB's investment services include expertise in:

Actively-managed equity strategies across global and regional universes, as well as capitalization ranges, concentration ranges and investment strategies, including value, growth and core equities;

Actively-managed traditional and unconstrained fixed income strategies, including taxable and tax-exempt strategies;

Actively-managed alternative investments, including fundamental and systematically-driven hedge funds, fund of hedge funds and direct assets (e.g., direct lending, real estate debt and private equity);

Portfolios with Purpose, including Sustainable, Impact and Responsible+ (climate-conscious and ESG leaders) equity, fixed income and multi-asset strategies that address AB's clients desire to invest their capital with a dedicated ESG focus, while pursuing strong investment returns;

Multi-asset services and solutions, including dynamic asset allocation, customized target-date funds and target-risk funds; and

Passive management, including index, ESG index and enhanced index strategies.

Markets

AB operates in major markets around the world, including the United States, EMEA (Europe, the Middle East and Africa) and Asia.

Distribution Channels

AB distributes its products and solutions through three buy-side distribution channels: Institutions, Retail and Private Wealth Management and its sell-side business, Bernstein Research Services.

Institutions

AB offers to its institutional clients, which include private and public pension plans, foundations and endowments, insurance companies, central banks and governments worldwide, and Holdings and its subsidiaries, separately managed accounts, sub-advisory relationships, structured products, collective investment trusts, mutual funds, hedge funds and other investment vehicles (Institutional Services).

AB manages the assets of its institutional clients pursuant to written investment management agreements or other arrangements, which generally are terminable at any time or upon relatively short notice by either party. In general, AB's written investment management agreements may not be assigned without the client's consent.

Retail

AB provides investment management and related services to a wide variety of individual retail investors globally through retail mutual funds AB sponsors, mutual fund sub-advisory relationships, separately-managed account programs and other investment vehicles (Retail Products and Services).

AB distributes its Retail Products and Services through financial intermediaries, including broker-dealers, insurance sales representatives, banks, registered investment advisers and financial planners. These products and services include open-end and closed-end funds that are either registered as investment companies under the Investment Company Act or not registered under the Investment Company Act and generally not offered to U.S. persons. They also include separately-managed account programs, which are sponsored by financial intermediaries and generally charge an all-inclusive fee covering investment management, trade execution, asset allocation, and custodial and administrative services. In addition, AB provides distribution, shareholder servicing, transfer agency services and administrative services for its Retail Products and Services.

Private Wealth Management

AB partners with its clients, embracing innovation and research to address increasingly complex challenges. AB's clients include high net worth individuals and families who have created generational wealth as successful business owners, athletes, entertainers, corporate executives and private practice owners. AB also provides investment and wealth advice to foundations and endowments, family offices and other entities. AB's flexible investment platform offers a range of solutions, including separately-managed accounts, hedge funds, mutual funds and other investment vehicles, tailored to meet each distinct client's needs. AB's investment platform is complimented with a wealth platform that includes complex tax and estate planning, pre-IPO and pre-transaction planning, multi-generational family engagement, and philanthropic advice in addition to tailored approaches to meeting the unique needs of emerging wealth and multi-cultural demographics.

AB manages these accounts pursuant to written investment advisory agreements, which generally are terminable at any time or upon relatively short notice by any authorized party, and may not be assigned without the client's consent.

Bernstein Research Services

AB offers high-quality fundamental and quantitative research and trade execution services in equities and listed options to institutional investors, such as mutual fund and hedge fund managers, pension funds and other institutional investors (Bernstein Research Services). AB serves its clients, which are based in major markets around the world, through its trading professionals, who are primarily based in New York, London and Hong Kong, and research analysts, who provide fundamental company and industry research along with quantitative research into securities valuation and factors affecting stock-price movements.

Additionally, AB occasionally provides equity capital markets services to issuers of publicly-traded securities, such as initial public offerings and follow-on offerings, generally acting as co-manager in such offerings.

In the fourth quarter of 2022, AB and Societe Generale, a leading European bank, announced plans to form a joint venture combining their respective cash equities and research businesses.

Custody

AB's U.S.-based broker-dealer subsidiary acts as custodian for the majority of AB's Private Wealth Management AUM and some of its Institutional AUM. Other custodian arrangements, directed by clients, include banks, trust companies, brokerage firms and other financial institutions.

Protection Solutions

The company's Protection Solutions segment includes its life insurance and employee benefits businesses.

Life Insurance: The company offers a targeted range of life insurance products aimed at serving the financial needs of its clients. The company serves all Equitable client segments, but it specializes in small to medium enterprises and high-income and/or high-net worth clients. The company's product offerings include VUL, IUL and term life products, which represented 91% of its total life insurance annualized premium, respectively, for the year ended December 31, 2023. The company's products are distributed through Equitable Advisors and select third-party firms. Equitable Advisors represented approximately 71% of its total life insurance sales for the year ended December 31, 2023.

Employee Benefits: In the employee benefits market, the company targets its products towards small and medium-sized businesses. The company's core products consist of Group Life Insurance (including Accidental Death & Dismemberment), Supplemental Life, Dental, Vision, Short-Term Disability and Long-Term Disability. In addition, the company offers a full suite of Supplemental Health products including Accident, Critical Illness and Hospital Indemnity. The company's employee benefits' solutions are distributed through Equitable Advisors and select third-party firms, including the traditional broker channel, strategic partnerships (medical partners, professional employer associations (PEOs), and associations), General Agencies, TPAs and Retail Equitable Advisors.

Life Insurance

Products

The company's life insurance products are primarily designed to help individuals and small and medium-sized businesses with protection, wealth accumulation and transfer of wealth at death, as well as corporate planning solutions including non-qualified deferred compensation, succession planning and key person insurance. The company targets select segments of the life insurance market: permanent life insurance, including permanent life insurance, including VUL and IUL products and term insurance. In recent years, the company has refocused its product offering and distribution towards less capital intensive, higher return accumulation and protection products. The company plans to grow its operating earnings over time through earnings generated from sales of its repositioned product portfolio and by proactively managing and optimizing its in-force book.

Permanent Life Insurance: The company has three permanent life insurance offerings built upon a UL insurance framework: VUL, COLI and IUL, targeting individuals and the small and medium-sized business market. UL policies offer flexible premiums, and generally offer one of two death benefit options: a level benefit equal to the policy's original face amount or a variable benefit equal to the original face amount plus any existing policy AV. The company's insurance products include single-life and second-to-die (i.e., survivorship) products.

VUL: VUL uses a series of investment options to generate the investment return allocated to the cash value. The sub-accounts are similar to retail mutual funds: a policyholder can invest policy values in one or more underlying investment options offering varying levels of risk and growth potential. These provide long-term growth opportunities, tax-deferred earnings and the ability to make tax-free transfers among the various sub-accounts. In addition, the policyholder can invest premiums in a guaranteed interest option, as well as an investment option it calls the MSO, which provides downside protection from losses in the index up to a specified percentage. The company's COLI product is a VUL insurance product tailored specifically to support executive benefits in the small business market.

IUL: IUL uses an equity-linked approach for generating policy investment returns. The equity linked options provide upside return based on an external equity-based index (e.g., S&P 500) subject to a cap. In exchange for this cap on investment returns, the policy provides downside protection in that annual investment returns are floored at zero, protecting the policyholder in the event of a market movement down.

The company works with employees of EIMG to identify and include appropriate underlying investment options in its variable life products, as well as to control the costs of these options.

Term Life: Term life provides basic life insurance protection for a specified period of time. Life insurance benefits are paid if death occurs during the term period, as long as required premiums have been paid. The required premiums are guaranteed not to increase during the term period. The company's term products include conversion features that allow the policyholder to convert their term life insurance policy to permanent life insurance within policy limits.

Other Benefits: The company offers a portfolio of riders to enable clients to customize their policies. The company's Long-Term Care Services Rider provides an acceleration of the policy death benefit in the event of a chronic illness. The MSO II rider, referred to above and offered via a policy rider on the company's variable life products, enables policyholders to manage volatility.

The company's in-force book spans three insurance companies, Equitable Financial, Equitable America and Equitable L&A. Equitable L&A is closed for new business. Certain term products and permanent products riders from Equitable America and Equitable Financial have been reinsured to its captive reinsurer EQ AZ Life Re. The company's in-force portfolio is made up of core product offerings, as well as past generation product offerings that include assumption universal life insurance, whole life insurance and other products.

Markets

While the company serves all Equitable client segments, it specializes in small to medium enterprises and high-income/high-net worth clients and their advisers. The company also complements its permanent product suite with term products for clients with simpler needs. The company focuses on creating value for its customers through the differentiated features and benefits it offers on its products. The company distributes these products through retail advisors and third-party firms who demonstrate the value of life insurance in helping clients to accumulate wealth and protect their assets.

Distribution

The company primarily distributes life insurance through two channels: Equitable Advisors and third-party firms, including broker dealers and registered investment advisors that assist clients.

Employee Benefits

The company's employee benefits business focuses on serving small and medium-sized businesses, a priority segment for it, offering these businesses a differentiated technology platform and competitive suite of group insurance products. Leveraging the company's innovative technology platform, it has formed strategic partnerships with large insurance and health carriers as their primary group benefits provider.

Products

The company's product offering includes: a suite of Group Life Insurance (including Accidental Death & Dismemberment), Supplemental Life, Dental, Vision, Short-Term Disability, Long-Term Disability, Critical Illness, Accident and Hospital Indemnity insurance products.

Markets

The company's employee benefit product suite is focused on small and medium-sized businesses seeking simple, technology-driven employee benefits management. The company builds the employee benefits business based on feedback from brokers and employers, ensuring the business' relevance to the market it addresses. The company is committed to continuously evolving its product suite and technology platform to meet market needs.

Distribution

The company's Employee Benefits' solutions are distributed through the traditional broker channel, strategic partnerships (medical partners, PEOs, and associations), General Agencies, TPAs and Equitable Advisors.

Wealth Management

The company is an emerging leader in the wealth management space with a differentiated advice value proposition, that offers discretionary and non-discretionary investment advisory accounts, financial planning and advice, life insurance, and annuity products. In 2023, the company began reporting this business separately from its other segments and Corporate and Other.

Equitable Advisors

Equitable Advisors is central to how the company serves its clients. The company's approximately 4,400 financial advisors offer distinctive, financial planning advice with access to a sophisticated suite of products and services designed to address even the most complex financial needs. The company supports its advisors through a national branch footprint with over 80 locations, an integrated digital platform, a robust training program, strong marketing capabilities, and cutting-edge client management tools. The company continuously invests in the development and refinement of capabilities designed to maximize advisor productivity and client satisfaction. The company's differentiated financial advisor support system creates a compelling value proposition and an important driver of recruitment and retention of its financial advisors.

Product and Services

The company offers a broad range of financial solutions that are designed to serve a client through their financial journey in life from asset accumulation to retirement, income, and protection. While market volatility has a significant impact on asset appreciation, the company's advisors have a proven track record of supporting strong growth in advisory net flows resulting in continued asset accumulation and growth. Additional revenues are produced through the distribution of industry leading proprietary and non-proprietary insurance and annuity products to its retail client base. The company offers the following products and services through its Wealth Management segment:

The company offers brokerage products and services for retail clients.

Discretionary and Non-Discretionary Investment Advisory Accounts: The company receives fees based on the assets held in that account, as well as related fees or costs associated with the underlying securities held in that account.

Life Insurance and Annuities Products from the company's Proprietary and Non-Proprietary Suite. The company receives a portion of the revenue generated from the sale of unaffiliated products and certain administrative fees.

Financial Planning and Advice Services: The company provides personalized financial planning and financial solutions for which it may charge fees and may receives sales commissions for selling products that aid in the client's plan.

Legacy

This segment primarily consists of the capital intensive fixed-rate GMxB business written in the Individual Retirement market prior to 2011. The company historically offered a variety of variable annuity benefit features, including GMxB features (ie. GMDBs and GLBs) to the company's policyholders. The remainder of these products either feature only ROP death benefits or do not contain GMxB features. As this business was priced and designed under conditions prior to the 2008 global financial crisis and is materially different from its current product offering, the company has chosen to manage this block and report its results separately from its core Individual Retirement Business.

Corporate and Other

Corporate and Other includes certain of the company's financing and investment expenses. It also includes the Closed Block, run-off group pension business, run-off health business, benefit plans for its employees and certain unallocated items, including capital and related investments, interest expense and corporate expense. AB's results of operations are reflected in the Investment Management and Research segment. Accordingly, Corporate and Other does not include any items applicable to AB.

Equitable Investment Management

EIMG is the investment advisor to the EQ Advisors Trust, the company's proprietary variable funds, and previously served as investment advisor to the 1290 Funds, its retail mutual funds, and as administrator to both EQ Advisors Trust and the 1290 Funds (each, a Trust and collectively, the Trusts). Equitable Investment Management, LLC (EIM LLC) became the investment advisor to the 1290 Funds and the administrator for both Trusts effective January 1, 2023. EIMG and EIM LLC are collectively referred to as Equitable Investment Management.

Equitable Investment Management

Equitable Investment Management supports each of the company's retirement and protection businesses. Accordingly, Equitable Investment Management results are embedded in the Individual Retirement, Group Retirement, Protection Solutions and Legacy segments. EIMG helps add value and marketing appeal to the company's retirement and protection solutions products by bringing investment management expertise and specialized strategies to the underlying investment lineup of each product. In addition, by advising on an attractive array of proprietary investment portfolios (each, a Portfolio, and together, the Portfolios), EIMG brings investment acumen, financial controls and economies of scale to the construction of underlying investment options for the company's products.

EIMG provides investment management services to proprietary investment vehicles sponsored by the company, including investment companies that are underlying investment options for its variable insurance and annuity products, and EIM LLC provides investment management services to its retail mutual funds. Each of EIMG and EIM LLC is registered as an investment adviser under the Investment Advisers Act. EIMG serves as the investment adviser to EQ Advisors Trust and to two private investment trusts established in the Cayman Islands. EQ Advisors Trust and each private investment trust is a series type of trust with multiple Portfolios. EIMG provides discretionary investment management services to the Portfolios, including among other things portfolio management services for the Portfolios; selecting, monitoring and overseeing investment sub-advisers; and developing and executing asset allocation strategies for multi-advised Portfolios and Portfolios structured as funds-of-funds. EIMG is further charged with ensuring that the other parts of the company that interact with the Trusts, such as product management, the distribution system and the financial organization, have a specific point of contact.

EIMG has a variety of responsibilities for the management of its investment company clients. One of EIMG's primary responsibilities is to provide clients with portfolio management and investment advisory services, principally by reviewing whether to appoint, dismiss or replace sub-advisers to each Portfolio, and thereafter monitoring and reviewing each sub-adviser's performance through qualitative and quantitative analysis, as well as periodic in-person, telephonic and written consultations with the sub-advisers. EIMG has entered into sub-advisory agreements with more than 40 different sub-advisers, including AB. Another primary responsibility of EIMG is to develop and monitor the investment program of each Portfolio, including Portfolio investment objectives, policies and asset allocations for the Portfolios, select investments for Portfolios (or portions thereof) for which it provides direct investment selection services, and ensure that investments and asset allocations are consistent with the guidelines that have been approved by clients.

EIM LLC is the investment advisor to the company's retail 1290 Funds and provides administrative services to both Trusts. EIM LLC provides or oversees the provision of all investment advisory and portfolio management to the 1290 Funds. EIM LLC has supervisory responsibility for the management and investment of 1290 Fund assets and develops investment objectives and investment policies for the funds. It is also responsible for overseeing sub-advisors and determining whether to appoint, dismiss or replace sub-advisors to each 1290 Fund. Currently, EIM LLC has entered into sub-advisory agreements with six different sub-advisors. The administrative services that EIM LLC provides to the Trusts include, among others, coordination of each Portfolio's audit, financial statements and tax returns; expense management and budgeting; legal administrative services and compliance monitoring; portfolio accounting services, including daily net asset value accounting; risk management; oversight of proxy voting procedures and an anti-money laundering program.

General Account Investment Management

Equitable Financial Investment Management, LLC (EFIM) is the investment manager for Equitable Financial's General Account portfolio. On November 20, 2023, Equitable America entered into an investment management agreement with Equitable Financial Investment Management America, LLC (EFIMA), by which EFIMA became the investment manager for Equitable America's General Account portfolio.

EFIM and EFIMA provide investment management services to the Equitable Financial and Equitable America General Account portfolios, respectively. They each provide investment advisory and asset management services including, but not limited to, providing investment advice on strategic investment management activities, asset strategies through affiliated and unaffiliated asset managers, strategic oversight of the General Account portfolio, portfolio management, yield/duration optimization, asset liability management, asset allocation, liquidity and close alignment to business strategies, as well as advising on other services in accordance with the applicable investment advisory and management agreement. Subject to oversight and supervision, EFIM and EFIMA may each delegate any of their duties with respect to some or all of the assets of the General Account to a sub-adviser.

Regulation

The company's insurance subsidiaries are licensed to transact insurance business and are subject to extensive regulation and supervision by insurance regulators, in all 50 states of the United States, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands.

Equitable Financial is domiciled in New York and is primarily regulated by the Superintendent of the NYDFS.

Equitable America (Equitable Financial Life Insurance Company of America, an Arizona corporation and a wholly-owned indirect subsidiary of Holdings) and EQ AZ Life Re (EQ AZ Life Re Company, an Arizona corporation and a wholly-owned indirect subsidiary of Holdings) are domiciled in Arizona and are primarily regulated by the Director of Insurance of the Arizona Department of Insurance and Financial Institutions. Equitable L&A is domiciled in Colorado and is primarily regulated by the Commissioner of Insurance of the Colorado Division of Insurance.

The company and certain policies and contracts offered by it are subject to regulation under the Federal securities laws administered by the U.S. Securities and Exchange Commission (the 'SEC'), self-regulatory organizations and under certain state securities laws.

Certain of the company's subsidiaries, including Equitable Advisors, (Equitable Distributors, LLC), SCB LLC (Sanford C. Bernstein & Co., LLC, a registered investment adviser and broker-dealer) and AllianceBernstein Investments, Inc., are registered as broker-dealers (collectively, the 'Broker-Dealers') under the Securities Exchange Act of 1934, as amended (Exchange Act). The Broker-Dealers are subject to extensive regulation by the SEC and are members of, and subject to regulation by, the Financial Industry Regulatory Authority, Inc. (FINRA), a self-regulatory organization subject to SEC oversight. Among other regulation, the Broker-Dealers are subject to the capital requirements of the SEC and FINRA, which specify minimum levels of capital ('net capital') that the Broker-Dealers are required to maintain and also limit the amount of leverage that the Broker-Dealers are able to employ in their businesses. The SEC and FINRA also regulate the sales practices of the Broker-Dealers.

Certain of the company's Separate Accounts are registered as investment companies under the Investment Company Act. Separate Accounts interests under certain annuity contracts and insurance policies issued by the company are also registered under the Securities Act of 1933, as amended (Securities Act). EQAT, EQ Premier VIP Trust and 1290 Funds are registered as investment companies under the Investment Company Act and shares offered by these investment companies are also registered under the Securities Act. Many of the investment companies managed by AB, including a variety of mutual funds and other pooled investment vehicles, are registered with the SEC under the Investment Company Act, and, if appropriate, shares of these entities are registered under the Securities Act.

Certain subsidiaries, including EIMG, Equitable Advisors and AB, and certain of its subsidiaries are registered as investment advisers under the Investment Advisers Act.

EIMG is registered with the U.S. Commodity Futures Trading Commission (CFTC) as a commodity pool operator with respect to certain portfolios and is also a member of the National Futures Association (NFA). AB and certain of its subsidiaries are also separately registered with the CFTC as commodity pool operators and commodity trading advisers; SCB LLC is also registered with the CFTC as a commodity introducing broker. The CFTC is a federal independent agency that is responsible for, among other things, the regulation of commodity interests and enforcement of the Commodity Exchange Act (CEA). The NFA is a self-regulatory organization to which the CFTC has delegated, among other things, the administration and enforcement of commodity regulatory registration requirements and the regulation of its members. As such, EIMG is subject to regulation by the NFA and CFTC and is subject to certain legal requirements and restrictions in the CEA and in the rules and regulations of the CFTC and the rules and by-laws of the NFA on behalf of itself and any commodity pools that it operates, including investor protection requirements and anti-fraud prohibitions, and is subject to periodic inspections and audits by the CFTC and NFA. EIMG is also subject to certain CFTC-mandated disclosure, reporting and record-keeping obligations.

The company and certain of its subsidiaries provide regular financial reporting, as well as, and in certain cases, additional information and documents to the SEC, FINRA, the CFTC, NFA, state securities regulators and attorneys general, the NYDFS and other state insurance regulators, and other regulators regarding the company's compliance with insurance, securities and other laws and regulations regarding the conduct of the company's businesses.

The company provides certain products and services to employee benefit plans that are subject to Employee Retirement Income Security Act of 1974 (ERISA) and certain provisions of the Internal Revenue Code of 1986, as amended (the 'Code').

Many of AB's subsidiaries are subject to the oversight of regulatory authorities in jurisdictions outside of the United States in which they operate, including the Ontario Securities Commission, the Investment Industry Regulatory Organization of Canada, the European Securities and Markets Authority, the Financial Conduct Authority in the U.K., the CSSF in Luxembourg, the Financial Services Agency in Japan, the Securities & Futures Commission in Hong Kong, the Monetary Authority of Singapore, the Financial Services Commission in South Korea, the Financial Supervisory Commission in Taiwan and the Securities and Exchange Board of India.

The company is subject to the rules and regulations of the New York State Department of Financial Services (NYDFS), which in 2017 adopted the Cybersecurity Requirements for Financial Services Companies (the 'NY Cybersecurity Regulation'), a regulation applicable to banking and insurance entities under its jurisdiction.

History

The company was founded in 1859. The company was incorporated in Delaware in 2003. It was formerly known as AXA Equitable Holdings, Inc. and changed its name to Equitable Holdings, Inc. in 2020.

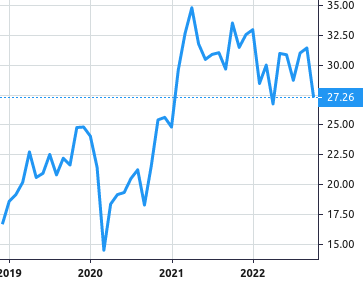

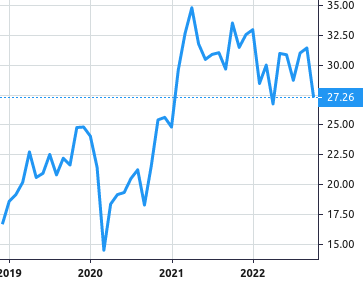

Stock Value

Stock Value