About American Financial Group

American Financial Group, Inc. (AFG) operates as an insurance holding company. The company, through the operations of Great American Insurance Group, engages primarily in Property and Casualty Insurance (P&C), focusing on specialized commercial products for businesses. AFG’s in-house team of investment professionals oversees its investment portfolio.

On May 28, 2021, AFG completed the sale of its Annuity business to Massachusetts Mutual Life Insurance Company (MassMutual). MassMutual acquired Great American Life Insurance Company (GALIC) and its two insurance subsidiaries, Annuity Investors Life Insurance Company (AILIC) and Manhattan National Life Insurance Company. In addition to AFG’s annuity operations, these subsidiaries included AFG’s run-off life and long-term care operations.

AFG allows each of its businesses the autonomy to make decisions related to underwriting, claims and policy servicing. This entrepreneurial business model promotes agility, innovative product design, unique applications of pricing segmentation, as well as developing distribution strategies and building relationships in the markets served.

Property and Casualty Insurance segment

AFG’s property and casualty insurance operations provide a wide range of commercial coverages through approximately 35 insurance businesses (as of December 31, 2022) that make up the Great American Insurance Group. AFG’s property and casualty insurance operations ultimately report to a single senior executive and operate under a business model that allows local decision-making for underwriting, claims and policy servicing in each of the niche operations. Each business is managed by experienced professionals in particular lines or customer groups and operates autonomously but with certain central controls and accountability. The decentralized approach allows each unit the autonomy necessary to respond to local and specialty market conditions while capitalizing on the efficiencies of centralized investment and administrative support functions.

Property and Casualty Insurance Products

Property and Transportation

Agricultural-Related: Federally reinsured multi-peril crop (allied lines) insurance covering most perils, as well as crop-hail, equine mortality and other coverages for full-time operating farms/ranches and agribusiness operations on a nationwide basis.

Commercial Automobile: Coverage for vehicles (such as buses and trucks) in a broad range of businesses including the moving and storage and transportation industries, alternative risk transfer programs, a specialized physical damage product for the trucking industry and other specialty transportation niches.

Property, Inland Marine and Ocean Marine: Coverage primarily for commercial properties, builders’ risk, contractors’ equipment, property, motor truck cargo, marine cargo, boat dealers, marina operators/dealers and excursion vessels.

Specialty Casualty

Excess and Surplus: Liability, umbrella and excess coverage for unique, volatile or hard to place risks, using rates and forms that generally do not have to be approved by state insurance regulators.

Executive and Professional Liability: Coverage for directors and officers of businesses and non-profit organizations, errors and omissions, cyber, and mergers and acquisitions.

General Liability: Coverage for contractor-related businesses, energy development and production risks, and environmental liability risks.

Targeted Programs: Coverage (primarily liability and property) for social service agencies, leisure, entertainment and non-profit organizations, customized solutions for other targeted markets and alternative risk programs using agency captives.

Umbrella and Excess Liability: Coverage in excess of primary layers.

Workers’ Compensation: Coverage for prescribed benefits payable to employees who are injured on the job.

Specialty Financial

Fidelity and Surety: Fidelity and crime coverage for government, mercantile and financial institutions and surety coverage for various types of contractors and public and private corporations.

Lease and Loan Services: Coverage for insurance risk management programs for lending and leasing institutions, including equipment leasing and collateral and lender-placed mortgage property insurance.

Trade Credit: Export and domestic trade credit insurance products for global trade and related financing activities.

Marketing

The property and casualty insurance group directs its sales efforts primarily through independent insurance agents and brokers, although small portions are written through employee agents. Independent agents and brokers generally receive a commission on the sale of each policy. Some agents and brokers are eligible for a bonus commission based on the overall profitability of policies or volume of business placed with AFG by the broker or agent in a particular year. The property and casualty insurance group writes insurance through several thousand agents and brokers.

Regulations

Privacy laws, such as the Gramm-Leach-Bliley Act and the Fair Credit Reporting Act, affect AFG’s day-to-day operations. AFG is also subject to other federal laws, such as the Terrorism Risk Insurance Act (TRIA), the Nonadmitted and Reinsurance Reform Act (NRRA), the U.S. Foreign Corrupt Practices Act (FCPA), and the rules and regulations of the Office of Foreign Assets Control (OFAC). AFG operates in limited foreign jurisdictions where its operations are subject to regulation and supervision of the various jurisdictions. These regulations, which vary depending on the jurisdiction, include, among others, solvency and market conduct regulations, including Solvency II; anti-corruption and anti-terrorist financing guidelines, laws and regulations; various privacy, insurance, tax, tariff, trade and sanctions laws and regulations, including the EU and UK General Data Protection Regulation (GDPR); and corporate, employment, intellectual property and investment laws and regulations.

History

American Financial Group, Inc. was founded in 1872. The company was incorporated in 1997.

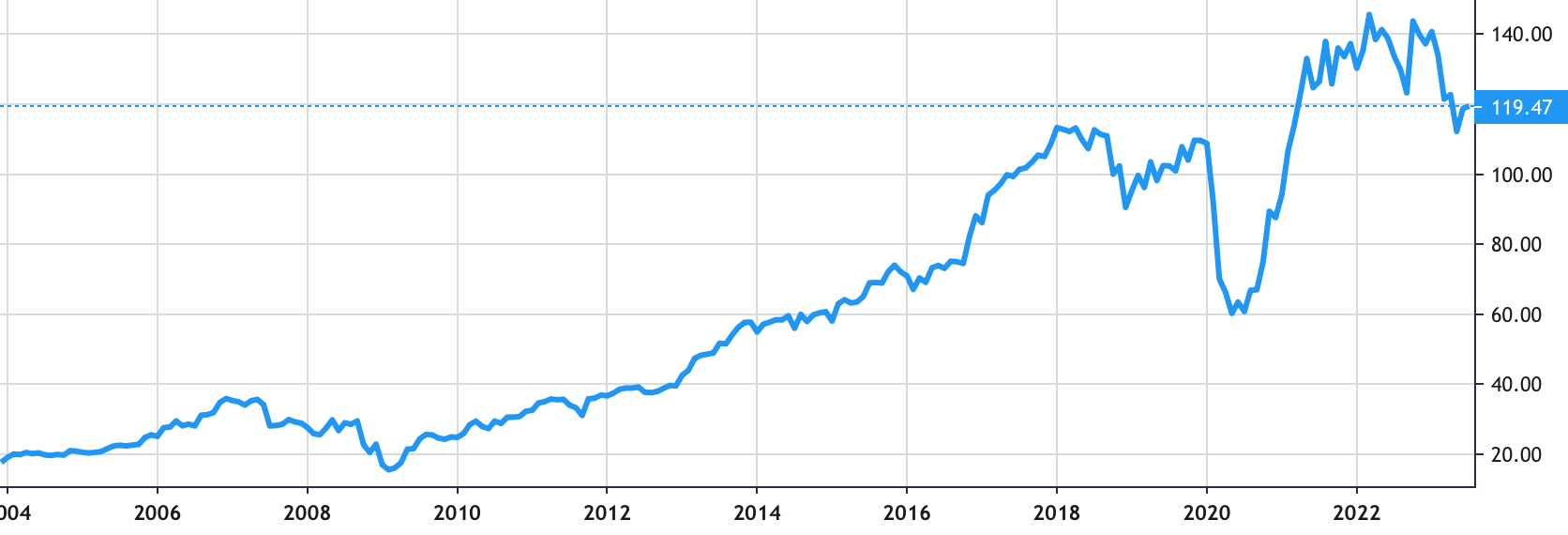

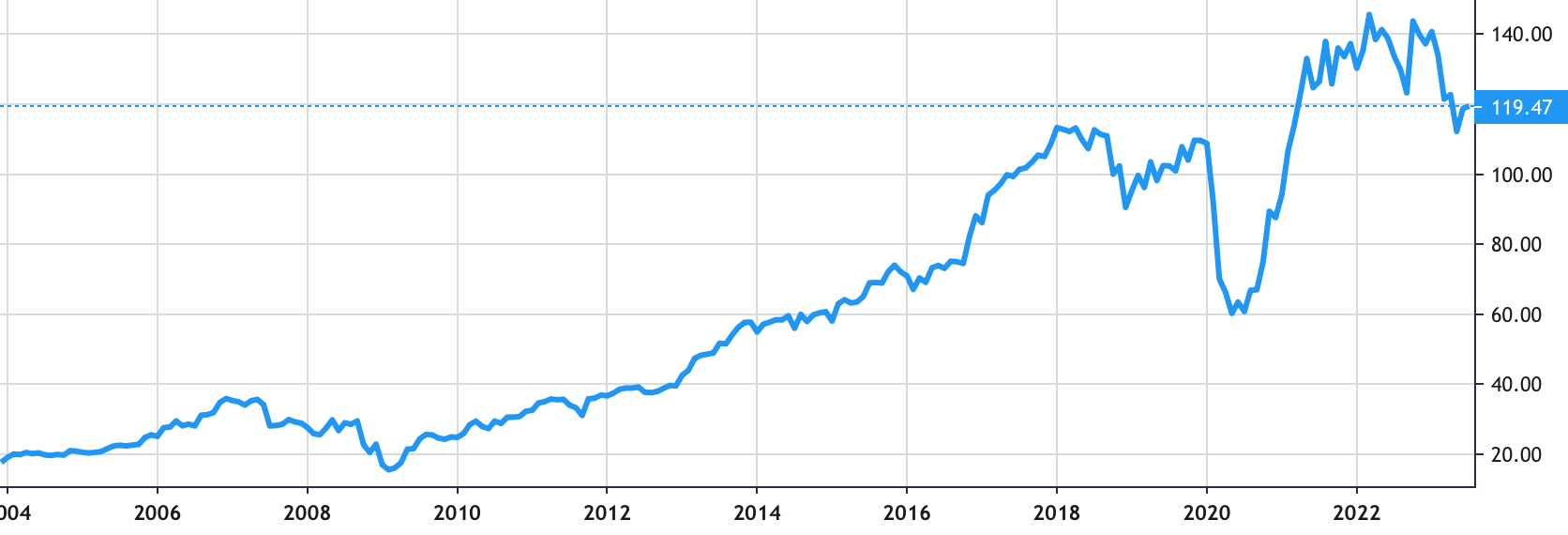

Stock Value

Stock Value