About Schroders

Schroders plc provides fund management services for institutional and retail investors, financial institutions, and high net worth clients in the United Kingdom, America, Europe, and Asia Pacific.

The company, as of December 2007, operated 37 offices in 28 countries. It also started new offices in Mumbai and Dubai in 2007. The company has a network of overseas offices throughout Asia, Continental Europe, and North and South America.

Segments

The company operates through three segments: Asset Management, Private Banking, and Private Equity.

Asset Management

Institutional – The company manages assets, in pooled or segregated form, on behalf of large corporate, local authority, central government and charitable entities, including both defined benefit and defined contribution pension funds.

Retail – The company manages assets on behalf of individuals, via mutual funds and investment trusts, to address their investment needs including defined contribution pension schemes, delivered in a variety of forms. It has relationships with distribution partners worldwide, from local banks and independent financial advisers to global banks and insurance companies, through which the company distributes a range of Schroders branded or sub-advised mutual funds.

Private Banking

The company manages assets on behalf of high net worth individuals and family offices. It provide a range of products including deposit-taking, cash management, custody and execution services, advisory and discretionary asset management and specialized lending.

Private Equity

This segment includes the company's investments in private equity, venture, and buy-out funds and related vehicles.

Significant Events

Acquisitions: In February 2007, the company acquired Aareal Asset Management, a pan-European property asset manager based in Germany, increases its capabilities in European property funds. This business was integrated with its existing UK property business into a single European property business.

Joint Venture: The company entered into a joint venture agreement with the Bank of Communications Schroder Fund Management Co. Ltd., which involves in the management of funds in China.

Dispositions: The company sold its Group business segment, which involved in leasing business.

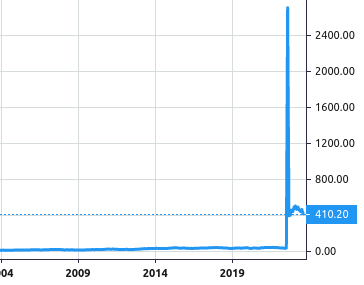

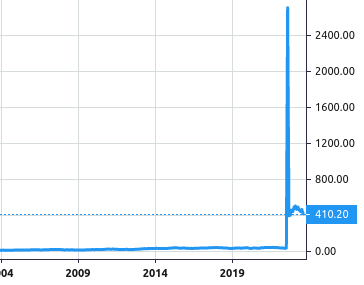

Stock Value

Stock Value