About Rentokil Initial

Rentokil Initial plc provides pest control and hygiene and wellbeing services.

The company operates as a world’s leading pest control company. It is a leading operator in North America.

The company serves customers from the largest multinational pharmaceutical industrial and food production companies to local shops, restaurants and homes. The company operates regionally and reports performance across its five global regions: North America, Europe (including Latin America), The U.K. & Sub-Saharan Africa (including Ireland & Baltics), Asia & MENAT(the Middle East, North Africa and Turkey) and Pacific.

In October 2022, the company completed the acquisition of Terminix, the largest pest control brand in the U.S., performing c.50,000 customer visits each day from c.375 locations across 47 states. Terminix is the leading provider in the residential and termite sectors in the U.S.

The company’s products and services are segmented into three business categories: Pest Control, Hygiene & Wellbeing and France Workwear.

Pest Control

The company’s Pest Control business, including Terminix, is the largest operator in both the U.S., the world’s biggest pest control market, and the world. The company is a leading global player in a resilient and non-cyclical industry characterised by strong long-term structural growth drivers. The company operates in 97 of the world’s 100 leading cities by gross domestic product (GDP).

The company offer the highest levels of risk management, reassurance and responsiveness to customers, delivered through its range of innovative products and solutions.

The company’s pest control specialists protect people, enhance lives and preserve the planet by providing pest control solutions across commercial and residential sectors through the use of connected, digitally enabled, energy-efficient and sustainable pest control services. Using both preventative and responsive strategies the company enhances protection for its customers through holistic, integrated connected pest management programmes.

The company’s pest control self-service portal, myRentokil, has 1.2m customer sites supported. The 24/7 customer portal enables scheduling of service visits, responding to audits, and online payment of bills and viewing of documents.

PestConnect, the company’s digital connected pest management system, provides real-time, early warning for effective monitoring and immediate control of rodent pests, reducing the risk of infestation and its technicians’ time on customer premises.

The Command Centre is available in more than 50 countries and provides its teams of experts with more than 200 data dashboards.

Eradico, the company’s new global rodent bait station, has been produced from recycled polymer and can be used with different types of solutions, including its connected products.

The company’s innovative Lumnia LED fly control range continues to offer a more energy-efficient alternative to traditional fluorescent tube systems (by c.62%).

The company also has a range of non-toxic solutions, such as the use of heat treatments, rather than traditional chemicals, for the control of pests.

The company’s Pest Control self-service portal is operational in 50 countries, supporting 1.2m customer sites.

There has been further roll-out of PestConnect, which provides a real-time, early warning digital system for monitoring and controlling rodents. The company has 290,000 units in operation (up 30,000 in the six months to Dec. 2022) across 16,000 sites.

Lumnia, the company’s award-winning range of LED insect light traps, is available in over 60 countries. Partnering with Vodafone and Google, the company has been developing a partner app for Lumnia, to improve the accuracy and efficiency of counting and identifying trends using machine learning.

The company introduced its latest intelligent bird scare device. The device recognizes different bird species and identifies the best scare tool from a broad range to deter each of them.

The company started the global delivery across 20 markets of its expanded Flexi Armour Rodent Proofing Range, which applies impenetrable barriers to reduce the risk of rodent infestations to premises, while lessening the need to use rodenticides.

Working with Vodafone and Google, the company has conducted effective field trials of its connected cameras, which monitors premises and identifies pests with the use of AI technology. 40 individual cameras were trialled on customer sites in the U.K. during 2022, with 28,000 photos taken, transmitted over Vodafone’s network and processed on the company’s platform. The technology supports faster control of pest problems and the reduction of unnecessary visits.

Through its ongoing field trials in the U.K. and its recent acquisition of Eitan Amichai in Israel, the company is developing the use of digital cameras and artificial intelligence (AI) for the automatic identification of pests, providing an early warning system for faster and more effective prevention and control. Eitan Amichai is an advanced user of digital cameras and AI with more than 11,000 remote monitoring devices and c.1,500 cameras installed in c.170 companies and over 1,250 sites. The company has taken this technology into the area of insect control and can identify seven types of insects remotely.

Strategy

The company’s growth strategy has been accelerated by the acquisition of Terminix (Terminix Global Holdings, Inc. and its subsidiary undertakings), but the medium-term focus and strategic themes remain unchanged.

The key elements of the company’s strategy include driving growth in Growth and Emerging Markets organically and through mergers and acquisitions (M&A); increasing focus on non-toxic pest control solutions; using its digital expertise, including web, apps, portals and services to lead digital pest control; continuing to be recognised as the world’s leading brand in pest control; and continuing M&A strategy to expand the city footprint and density.

Competition

Key international competitors of the company include Orkin, Ecolab and Anticimex.

Customers

The company operates across distinct customer segments and a broad range of industries include:

Commercial is the largest segment, accounting for c.50% of the Global pest control market.

Residential representing c.33%, of the Global market, and the largest segment of the U.S. market, accounting for 46% of all revenues.

Termites accounts for c.17% of the Global market and 55% of the global termites market is in the U.S. alone, where Rentokil Terminix is the largest supplier.

Key sectors include food and beverage processing, hospitality, FM, offices and administrative, and logistics and warehousing.

Hygiene & Wellbeing

The company offers a wide range of hygiene and wellbeing services. Inside the washroom the company provides hand hygiene (soaps and driers), air care, in-cubicle (feminine hygiene units), no-touch products and digital hygiene services. In addition to core washroom hygiene, the company delivers specialist hygiene services, such as clinical waste management. The company is also improving the customer experience through premium scenting, plants, air quality monitoring and green walls. Customer sectors range from public sector (schools, government buildings) and facilities management through to hotels, bars and restaurants, industrials and retail. The company has acquired six hygiene businesses this year.

A new and enhanced version of the company’s myInitial customer portal was launched in 2022 and rolled out to c.20 countries. Total registered users have reached more than 100,000.

The company started the global roll-out of Luna Dry and Luna Mini Dry products, following the H1 launch in Europe. These feature the latest brushless motor technology, a hygienic HEPA 13 filter and long-life performance.

The company continued to invest in its high-quality dispenser ranges to add differentiation and build upsell, significantly increasing usage of its Signature suite of units.

The company sustained its focus on the high-growth air care market, already with a product range that features air purification, air sterilisation and air scenting products.

The company added a new air filtration product, Aeramax Pro 3, which was introduced in Europe. This is a wall-mounted or floor-standing HEPA and carbon filter air purifier with allergy-friendly accreditation.

The company is extending the clean air and wellbeing portfolio into air quality monitoring with data analysis and actionable insights. Pilots have taken place in Asia and Europe to assess and benchmark the quality of air in customer premises and partnership opportunities with third-party solutions were developed.

Trading under the Initial brand, the company offers the widest range of washroom hygiene services and products inside the washroom. The company’s Enhanced Environments businesses improve the occupant experience beyond the washroom and throughout customer premises.

Competition

In-country competitors include PHS Group Inc. (based in the U.K.), Elis (based in France), CWS (based in Germany), Citron Hygiene Canada Limited (based in Canada) and Ecolab Inc. (based in the U.S.) in hygiene services; and Kimberly-Clark Corporation (based in the U.S.) in hygiene consumables and products.

Customers

The company operates in 70 markets across six main customer segments.

Strategy

The company’s strategy is to deliver continued growth through a combination of strong operational focus and targeted M&A to build city density. Central to this is the delivery of excellent customer service, product innovation, service line extensions and improvements to productivity through digital products and applications.

The key elements of the company’s strategy include building margins through postcode and product density; avoiding cross-infection Inside the Washroom; Take its Hygiene services everywhere; developing digital innovations to address customer needs and increase productivity; geographic expansion through organic actions; and geographic expansion through targeted, city-based M&A.

France Workwear

The company’s France Workwear business, operating as a standalone business, specialises primarily in the supply and laundering of workwear, uniforms, cleanroom garments and personal protective wear to customers in hotels, restaurants and catering (HORECA) across France, ensuring that colleagues have the right workwear to support safe and effective working environments.

Strategy

The company’s strategy has focused on creating a business that has a clear market differentiation.

History

Rentokil Initial plc was founded in 1903. The company was incorporated in 2005.

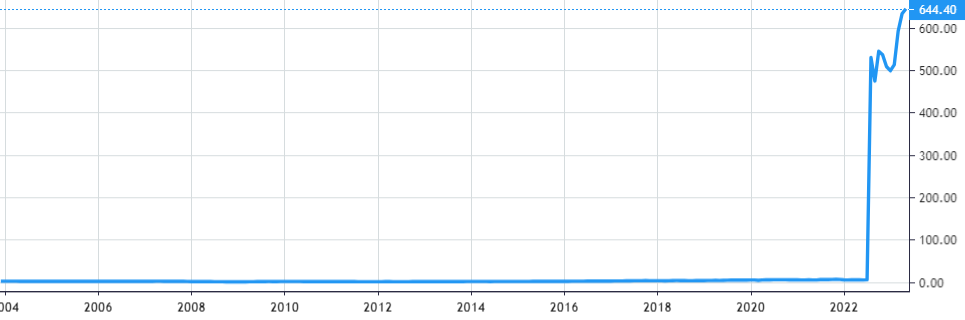

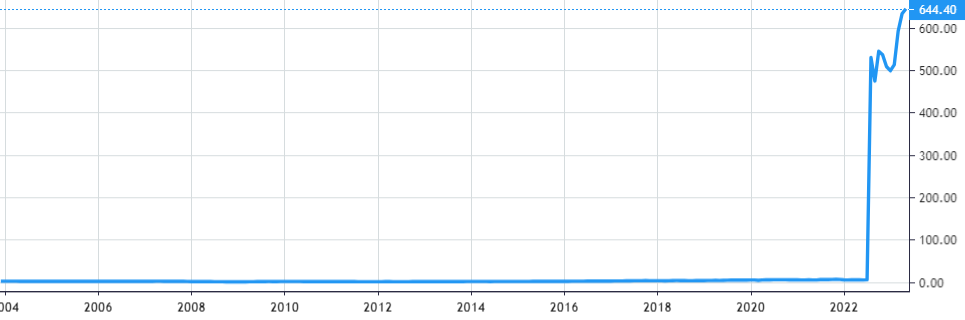

Stock Value

Stock Value